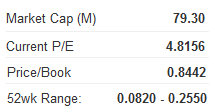

CHINA ENVIRONMENT 3Q Revenue Jumps 21%

CHINA ENVIRONMENT LTD (SGX: CENV) saw its July-September revenue rise 21% year-on-year to 126.2 mln yuan.

However, the Fujian Province-based producer of pollution control equipment experienced a slight decrease in its third quarter net profit to 11.9 mln yuan, from 12.7 mln a year earlier.

The Singapore-listed firm saw the completion of 18 dust collector projects in the July-September period compared to 14 such projects in the third quarter of 2010.

China Environment's gross profit increased slightly to 28.7 mln yuan, with gross profit margins at 23%.

Profit before tax in the just-completed quarter stood at 16.46 mln yuan compared to 18.23 mln a year ago.

For the nine months ended September 30, 2011, the company reported revenue of 457.0 mln yuan, an increase of 5% from the year-earlier period.

January-September profit after tax attributable to equity holders was 59.8 mln yuan.

Corresponding to the lower profits, earnings per share for the first nine months ended September 30, 2011 was at 9.5 RMB cents compared to 10.7 RMB cents in the year-earlier period.

Profit before tax for the January-September period was 83.88 mln yuan compared to 94.38 mln.

Net profit for the period stood at 60.83 mln yuan compared to 68.47 mln a year ago.

As of September 30, 2011, net cash used in operating activities stood at 38.34 mln yuan.

Purchase of property, plant and equipment totaled 0.058 mln yuan compared to 3.971 mln a year ago.

“The decreases in net profit over the three-month and nine-month periods were mainly due to decreases in gross profit and an increase in total operating expenses,” China Environment said.

See also:

SIJIA: Thai Flood Orders Top One Mln Units

TYCOON CHENG: Fundraising In Fretful Times

Photo: CCB

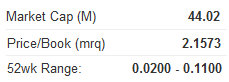

ARMARDA 3Q Top Line Surges 80%

ARMARDA GROUP LTD (SGX: AMDA) saw its third quarter revenue surge ahead 80% year-on-year to 6.35 mln hkd.

However, the Singapore-based provider of IT services to Mainland China’s financial institutions reported a third quarter net loss of 11.0 mln hkd, albeit much improved from the 61.1 mln hkd loss a year earlier.

Total comprehensive loss attributable to equity shareholders of Armarda was 10.4 mln hkd compared to 60.5 mln a year ago.

Net cash used in operating activities was 2.7 mln hkd compared to 26.6 mln a year ago.

“This is primarily due to cash used in operating activities before changes in working capital of approximately 8.9 mln hkd, which has been offset by the decrease in trade and other receivables of approximately 4.1 mln in the third quarter of 2011, and the increase in other payables and accruals of approximately 2.1 mln,” Armarda said.

Third quarter loss per basic share was 0.98 HK cents compared to 10.12 HK cents a year ago.

The increase of revenue from trading of IT equipment was mainly contributed by sales of RFID chips as well as other IT equipment.

Despite the increase in revenue of approximately 2.8 mln hkd, the loss was mainly attributable to (i) the increase in other expenses of approximately 4.0 mln hkd, and (ii) an increase in the cost of goods sold of approximately 2.4 mln hkd.

This was partially offset by (a) the decrease in amortization costs of intangible assets of approximately 1.5 mln hkd, and (b) no impairment of goodwill during the period.

See also:

TENFU: Tea For Two? Or Two Billion?

Natural Selection At Play In PRC PROPERTY SECTOR, Overweight Sector