Positive on POS: Pax Global Chairman Tiger Nie (second from right), and Financial Controller Chris Lee (right) met with investors in Hong Kong on Friday. Photo: Andrew Vanburen

Positive on POS: Pax Global Chairman Tiger Nie (second from right), and Financial Controller Chris Lee (right) met with investors in Hong Kong on Friday. Photo: Andrew Vanburen

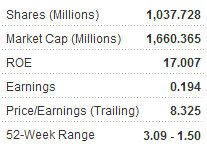

PAX GLOBAL Technology Ltd (HK: 327), which controls more than 30% of the PRC’s electronic fund transfer point-of-sale (EFT-POS) terminal market, is cashing in on the rapid global move to a cashless society.

Hong Kong-listed Pax Global is definitely onto something as first half revenue soared 69% to over 451 mln hkd, generating a net profit of 67.2 mln compared to 50.2 mln a year earlier.

Speaking Friday at an Aries Consulting-sponsored Company of the Month event in Hong Kong, Pax Global Chairman Tiger Nie said the company was very bullish on growth, especially in the world’s most populous country.

“We currently sell to over 60 countries around the world, but we can’t ignore the tremendous growth potential of Mainland China’s PCI (payment card industry) potential,” he told investors.

PAX Global 's customers include UMS, Bank of China, Agricultural Bank of China, Bank of Communications and China Mobile.

“Our business can be likened to the development of the bank card business, and we have solid contracts with all of China’s Big Four lenders so far, save with ICBC. And each bank has different standards and requirements that must be met.

PAX’s countertop and mobile EFT-POS terminals are able to process a wide range of electronic payment types including signature and PIN-based debit cards, credit cards, contactless/radio frequency identification cards, RF-enabled mobile phones, IC cards, pre-paid gift and other stored-value cards. Photo: PAX

PAX’s countertop and mobile EFT-POS terminals are able to process a wide range of electronic payment types including signature and PIN-based debit cards, credit cards, contactless/radio frequency identification cards, RF-enabled mobile phones, IC cards, pre-paid gift and other stored-value cards. Photo: PAX

“And given the size and resources of our clients, they demand very rigid security specifications for their EFT-POS, and we are able to comply. This all translates into very high entry barriers for the industry which helps us immeasurably,” Mr. Nie said.

Major products created and designed by PAX include POS terminals like those you might find at a hotel’s checkout counter or the beside the cashier at a restaurant.

First half revenue from sales of POS terminals alone rose 61% year-on-year to 388.9 mln hkd.

PAX also designs personal identification number (PIN) pads such as those a bank teller might ask you to use to confirm you are indeed the holder of the account.

“Revenue growth over the period has been greatly driven by an increase in overseas sales, mainly attributable to increased sales to Europe, the Middle East, Africa, Latin America and the Commonwealth of Independent States.

“In China, with the improvement of a bank card acceptance environment and the increased consumer spending by bank cards, the demand for POS terminals increased constantly, especially by the major merchant service providers and financial institutions in China,” Mr. Nie said.

And one of the most exciting but still fledgling product categories is contactless readers, which can be found in places like buses and subways, as well as non-contact card POS venues such as convenience stores.

In Hong Kong, a pilot program will be implemented beginning in December for the Special Administrative Region’s (SAR) Octopus payment service system.

The Octopus reader, which is PAX’s own S90 series POS terminal, will be integrated with the taxi’s meter, rendering payment fast, convenient and cashless.

And if the idea takes off, PAX is poised to see a flood of new orders coming in for its products, as there are over 18,000 cabs plying the streets of the SAR at present.

“Yes, we are excited about this opportunity and we do have the technology to make it all happen. But one current hurdle is the drivers themselves, many of whom are quite unwilling to give up the idea of cash transactions as that is all they have known all their lives.

“So this proposal will require promotional work,” Mr. Nie said.

He said that the realization of a cashless society is not a matter of if, but of when.

Pax Global Chairman Tiger Nie (left) explaining his company's potential to investors in Hong Kong. Photo: Andrew Vanburen

Pax Global Chairman Tiger Nie (left) explaining his company's potential to investors in Hong Kong. Photo: Andrew Vanburen

Governments around the world are promoting it as it helps both consumers and service providers with verifiable record-keeping and may ultimately prevent some cases of fraud, corruption and the circulation (and demand for) counterfeit currency.

Chairman Nie, who got his professional start in the IT department of China Merchant’s Bank, also dismissed any anxiety over potential competition from smart phones and their increasing utilization and functionality as “bank cards” in their own right.

“In fact, the development of mobile handsets as ‘payment cards’ is a net positive for us. These smart phones will develop along this trajectory which will need even more ‘readers’, and that can only mean more sales for us,” he said.

PAX benefitted from product loyalty from its customers.

“Our clients are likely to use our products for a long time. We are unlike a cell phone or laptop designer, whose products are typically used for a year or two until the consumer either loses them or longs for an upgrade or new style,” Mr. Nie added.

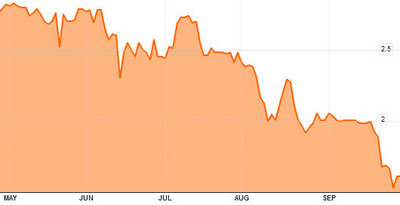

PAX's Hong Kong-listed shares are currently near 52-week lows despite a standout first half

PAX's Hong Kong-listed shares are currently near 52-week lows despite a standout first half

And PAX was managing to get a much more diverse body of customers to jump on the loyalty bandwagon.

The firm recently named a major distributor as a strategic partner to help it market its products in Iran, a move which no doubt helped PAX land its first order in the Middle Eastern country with the first order of over 100,000 units to be delivered within one year.

PAX also received its first order for 5,000 units from Knet, a national firm providing E-banking services to all lenders in Kuwait.

Additionally, PAX saw a “significant” growth in sales of POS terminals and PIN pads in New Zealand in the first half.

“We place a tremendous emphasis on R&D. Our clients have extremely high technical and security demands and we must prioritize R&D in order to meet their requirements,” Mr. Nie said.

In fact, PAX’s 452 workers included no traditional factory laborers as the company did not own plants of its own.

Instead, PAX focuses all its efforts almost entirely on conceptualizing new products and bringing them to production, with all manufacturing eventually outsourced to third-party producers.

PAX designs and develops its products and manufacturing procedures, carries out R&D, sources raw materials and components, implements quality control in-house and finally sells and distributes its products, while also providing after-sales services.

Mr. Nie said 40% of the company’s expenses – or around 5% of revenue – is dedicated to R&D.

PAX Global listed in Hong Kong in December 2010, raising 806 mln hkd, 40% of which was immediately earmarked for R&D.

As of August 2011, 42.8% of PAX Global’s shares were held by Hi Sun Tech (HK: 818), 23.7% by Digital Investment Ltd and 6.9% by FIL Ltd.

PAX’s countertop and mobile EFT-POS terminals are able to process a wide range of electronic payment types including signature and PIN-based debit cards, credit cards, contactless/radio frequency identification cards, RF-enabled mobile phones, IC cards, pre-paid gift and other stored-value cards.

PAX also develops and sells consumer activated devices, contactless devices and EFT-POS software, which is installed in its EFT-POS products and not sold independently.

See also:

BULL RUN: HK Shares To Rise 25% Over Next 12 Months, Says CLSA

'CHINA’S LADY BUFFETT' Dumps 12 Stocks... Sign Of The Times?