Excerpts from latest analyst reports...

GOLDMAN SACHS: China A shares waiting for 'warmer winter'

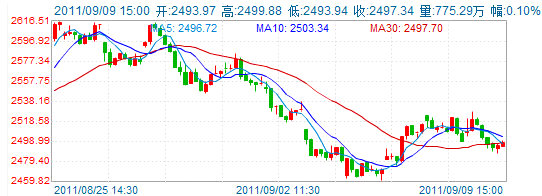

Goldman Sachs said that Mainland China-listed A shares are awaiting a “warmer winter” as they still faced near-term downside drivers.

“Sentiment remains lackluster and we see few positive catalysts for the market in the near term although the risk/reward profile is becoming appealing. The 2,600 level could be a near-term support for CSI300 as the heavily weighted large cap sector, now at exceptionally low valuation, should provide some support to the overall market,” the investment bank said.

It added that market sentiment may improve towards 4Q2011 as there should be further evidence of abating inflation and moderate improvements in market liquidity, barring further global de-risking.

However, there is a possible shift from outperformers to laggards within consumer/defensive sectors.

“We see a likely short-term shift from outperformers (food & beverage) to underperforming/lagging sectors (media, tourism & hotel, health care, etc) within the consumer related/defensive sectors.”

Goldman Sachs said this is because (1) ‘buy consumer’ remains a good means of achieving possible growth while remaining defensive in current market conditions, (2) food & beverage has outperformed the market for a while and has become crowded, and Goldman suggests investors be selective in those relatively laggard sectors mentioned above.

“We also upgrade the capital goods sector from ‘underweight’ (UW) to ‘neutral’, downgrade non-ferrous metals from ‘overweight’ (OW) to ‘neutral’, and reshuffle our basket of small-mid caps based on recent market developments."

Focus on China’s internal growth trends Amid the ongoing global deleveraging, Goldman Sachs suggests investors focus on two internal fundamental trends in China for sector and stock selection in the mid to long term – consumption upgrades and industrial upgrades.

“Overall, we maintain our preference for domestic demand-driven sectors.”

See also: HAIER, SHANGHAI PHARMA Among Stocks On Cusp Of Comeback?

UBS: Prices down, inventories up in SOLAR SECTOR

UBS said that for the global solar panel manufacturing sector, in which China plays a major role, prices are down and inventories are up.

“Our third day at (solar trade show) PVSEC confirmed the bad data points heard during the first two days of the show. It appears that most of the players ramped up utilization rates back in June anticipating good September sales which have not materialized yet.

“As a result we believe there is 4GW+ of modules in transit or in warehouses in Europe,” UBS said.

What could go right? UBS said that stronger-than-expected September sales would be the quickest way out of the current difficulties.

“After this show where expectations have been reset, the September sales could possibly pick-up on short notice as people are just back from holidays. However our meetings with downstream companies suggest that visibility is low and does not even cover September sales.”

It said to watch out for volumes and net working capital issues in the current quarter.

“In this environment and in case a pick-up in volumes does not materialize in the next 2 weeks, we expect volumes to be at risk for Q3. Also, as inventories seem to increase and clients ask for advantageous payment terms, net working capital could deteriorate further at the end of Q3.”

Stock implication: still bad, remain as selective as possible

UBS said the solar trade show is clearly disappointing on all fronts including for its entire stock universe.

“We reiterate our relative preference for downstream stocks (Phoenix Solar and SMA, both German-based) and low cost producers First Solar (Nasdaq: FSLR), Trina (NYSE: TSL) and Yingli (NYSE: YGE) over high cost producers (Q-Cells, Conergy, Solarworld, SunPower) or companies in the middle of the value chain including JA Solar (Nasdaq: JASO) and Taiwan-based Motech.”

See also: COMTEC SOLAR: HK-Listco's 1H Profit Soars 48.1% On Vibrant Wafer Sales