Excerpts from latest analyst reports...

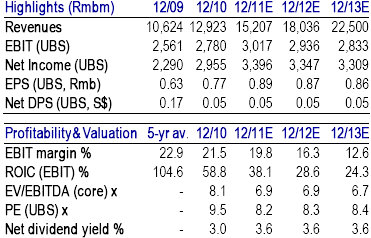

UBS: ‘Proactive’ YZJ initiated BUY

UBS said it is initiating coverage of Yangzijiang Shipbuilding (SGX: YZJ) with a BUY rating.

“YZJ is impressively proactive in tackling the challenges faced by shipbuilders. The company recognizes that high margins from orders secured prior to the 2008 financial crisis will inevitably be squeezed, due to lower-margin incoming contracts. In response, YZJ is executing plans to ensure net profits are maintained, and critically, the company emerges from the soft patch a stronger industry player,” the brokerage said.

Strategic moves: Breaking new markets, driving efficiency

YZJ recently secured Seaspan as its first client for seven large 10,000 TEU containerships, breaking into a market dominated by Korean and a handful of PRC shipyards.

“Even though YZJ will incur learning curve costs on the first few vessels, the contracts are of strategic importance, while YZJ remains focused on improving productivity. Quicker turnaround time lowers per-vessel costs, and allows the company to deliver more vessels per year, increase market share and help fend off cost headwinds,” UBS added.

Capital management – interest income sustainable

The company believes active capital management is important and will continue to invest excess cash in financial products to enhance its yield over deposit rates.

“We think YZJ’s interest income is sustainable 2011-13E. Cash flow is healthy, interest rates have risen, and reinvestment opportunities exist on funds maturing this year,” UBS said.

YZJ’s 1.67 sgd price target is based on a sum of the parts methodology.

“We value shipbuilding on DCF assuming COE=9.9%. We value the investment portfolio on the yield earned over two years. This translates into about 20% of its carrying value,” UBS said.

See also: YANGZIJIANG, PRC INTERNET STOCKS, CHINA FLOORING: What Analysts Now Say...

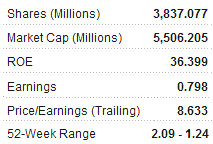

IIFL: DAIRY FARM started ADD on ‘robust sales’

IIFL said it is initiating coverage on Dairy Farm International (SGX: DFI), the second-largest retailer in Asia with 5,386 outlets in ten countries, with an ADD recommendation thanks to strong sales.

“DFI owns some of the most popular retailing brands (such as Giants, Cold Storage, Guardian and 7-Eleven) across various retailing formats like supermarkets, hypermarkets, convenience stores, and healthy & beauty stores. With robust sales in China, Hong Kong, Indonesia and India, DFI is a direct play on the Asian consumption story,” IIFL said.

15% net profit CAGR expected over 2010-2013

IIFL said Dairy Farm has a “strong presence” in all retailing platforms (supermarkets, hypermarkets, health & beauty stores, convenience stores and home furnishing stores).

“The company’s brands are industry leaders in their respective local markets (Hong Kong, Taiwan, Malaysia, Singapore and Indonesia). The group’s revenue is well diversified across geographies and retail formats. North Asia, comprising Hong Kong, Taiwan and China, accounted for 40% of operating profit in 2010, and supermarkets/hypermarkets accounted for 55% of operating profit in 2010.”

Asian retailing – secular growth Modern retail store sales registered 4-5% CAGR during 2007-10 in Asia; this is expected to accelerate to 6-6.5% CAGR during 2010-14.

“We expect retail sales in DFI’s main markets (China, Hong Kong, Singapore, Malaysia, Indonesia and India) to register a faster 5-15% CAGR during 2010-2014. Hypermarkets and supermarkets (accounting for 60% of DFI’s sales) have been the fastest-growing formats in Asia,” IIFL added.

Steady growth, superior profitability During 2007-10, DFI’s sales, EBITDA and net profit increased in spite of the financial crisis.

“Thanks to the resilience of its business and the secular growth in Asian retailing, DFI delivered 10% sales CAGR, 16% EBITDA CAGR and 17% net profit CAGR during 2007-10. DFI’s ROE, RoA and net profit margin have been consistently superior to other Asian retailers,” IIFL said.

See also: GALAXY ENTERTAINMENT: Bingo! Up 1,700% In 2.5 Years

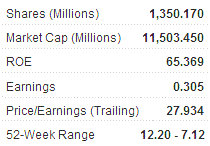

GOUCO: BUY on GCL-POLY after positive profit alert

Guoco Capital said it is reaffirming its BUY call on GCL-Poly Energy (HK: 3800), one of the leading green energy suppliers in the PRC including power and heat via cogeneration, incineration, solar and wind, after the Hong Kong-listed firm issued a positive profit alert.

“GCL-Poly announced that net profit for the first half of 2011 will increase by approximately 300% yoy. This implies interim EPS of 0.20 hkd that is in line with our forecast but higher than market consensus of 0.18. We expect analysts to upgrade full year earnings forecast after interim results announcement in late August,” Guoco said.

Developed countries such as Germany, Japan and Italy have announced they will abandon nuclear power while these countries do not have abundant natural resource such as coal, nature gas or crude oil.

“Alternative energy -- especially solar -- is a promising option. Use of solar energy in China and the U.S., the two major power-consuming countries, is still at relatively low levels. We believe they will pull the photovoltaic industry to another level once the demand is released,” Guoco said.

After massive price declines across the whole photovoltaic value chain during the last two months, Guoco says its checks suggest the spot price of wafers has stabilized in July.

“Based on our channel check with PRC local factories, we see the actual deal price even increased a bit for a profit self-amendment. Meanwhile, major polysilicon producers are concentrating on negotiating long-term contract orders with key clients to lock-in a stable ASP,” Guoco said.

It estimates the bottom-line for polysilicon ASP is above US$50/kg, which will improve earnings visibility of major players with low cost structures such as GCL-Poly.

GCL-Poly on track to expand polysilicon and wafer capacity “The newly added 10K-level production line in Jiangsu Zhongneng manufacturing plant will become operational this month. We believe GCL-Poly will fulfill its plan to expand polysilicon capacity to 46,000 MT and wafer capacity to 6.5GW before schedule,” Guoco said.

“We maintain our 2011/2012 EPS forecast at $0.54/$0.69 implying GCL-Poly is presently trading at 2011 PER of 8.0x. Assuming the spot ASP of polysilicon drops as low as US$50/kg in 2H11 in the worst scenario, company’s EPS in 2011 will be more than $0.40.”

The brokerage added that it recommends investors to build their positions before the sharp recovery of the solar sector and “enjoy the sunshine after the dawn.”

“We stick to our BUY rating on GCL-Poly with 12-month target price at 5.40 hkd based on 10x 2011 PER, implying an upside potential of 25%.”

See also: COMTEC SOLAR: HK Wafer Listco Gets 1.2 Bln Hkd From TPG Capital