Translated by Andrew Vanburen from: 港股氣氛走勢轉弱,或再下試23500點 (中文翻譯, 請閱讀下面)

HONG KONG shares have been losing some momentum of late, fallling nearly 2% last week due to chronic anxiety in both the Special Administrative Region as well in the People’s Republic of China over a series of rate hikes and other credit-tightening measures taken by Beijing.

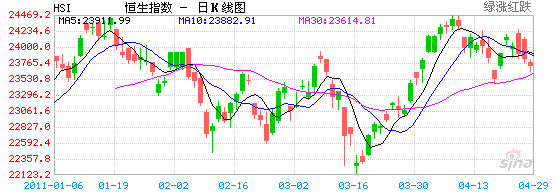

Therefore, 23,500 may be the new base level of support for Hong Kong's benchmark Hang Seng Index going forward.

Investors have been conducting most of their market-watching activities from the relative safety of the sidelines rather than in the trenches due to the People’s Bank of China rate action as well as the budget standoff in the US and ongoing debt crises in the European Union.

And now with the death of Al-Qaeda leader Osama bin Laden, there is another round of wait-and-see as the world digests news of the demise of the planet’s most wanted terrorist.

But a glimmer of better things to come also recently emerged with still relatively low interest rates in key markets, an apparent end to quantitative easing (QE) measures from Washington (for now...) and generally better than expected financial reports from heavyweight firms listed in the US.

3M, Ford, UPS, General Electric and Boeing were among some of the US-listed blue chips surprising on the upside with their results announcements, which helps sell the idea that the US may have finally turned the corner and is ready to enjoy a sustained recovery.

This all helped give a slight boost to the Hang Seng Index on Thursday and Friday of last week, especially after the Dow Jones average and the S&P both touched two-and-a-half year highs, while the Nasdaq is in even more impressive 10-year high territory.

However, the Development Research Center of the State Council (DRC), a leading policy research and consulting institution directly under the PRC Cabinet, pointed out in a recent statement that rapidly rising resource, energy and property prices continue to take their toll, displaying all the hallmarks of a potentially high-inflation environment.

Therefore, the bulk of the capital market investors currently keeping a close eye on proceedings from the sidelines will continue to stay put until either consumer price index growth stabilizes, or a long-term and sustainable raft of credit control policies is in place.

And with less trading activity and daily turnover in the markets on a day in and day out basis, the general take-away sentiment amid such a phenomenon is that people are either nervous about near-term prospects... or they simply don’t see much value in current listcos.

Therefore, there is a strong likelihood that this dampening effect on market sentiment and the ability of the Hang Seng to make a sustained go at 25,000 is quite minimal.

I see the 10-day moving average breaking down through the 20-day moving average level soon on the above-mentioned anxieties, with 23,500 being the newest lower-limit level to offer support and possibly be tested.

Although stock markets in both Hong Kong and the PRC are showing slight downtrends of late with daily turnover on the HKSE registering a decided decline, there is fortunately no near-term evidence that capital is flowing outward in any significant degree and investors should take some cheer from that.

In fact, the recent slight uptick in the value of the Hong Kong dollar suggests that just the opposite might be occurring, although in no significantly appreciable way.

As for individual counters, China's Internet chat king Tencent Holdings Ltd (HK: 700) has exhausted its recent run and there are no apparent upside drivers on the near-term horizon for this largest social network firm in the PRC to hang its hat on.

Recent pronouncements by the National Energy Administration that Mainland China is enduring a chronic domestic coal supply shortage, particularly stockpiles used to fuel coal-fired power plants, have boosted sector players like Yanzhou Coal Mining Company Ltd (HK: 1171) and China Coal Energy Co Ltd (HK: 1898).

And with continued strong global oil prices and ongoing coal shortfalls, these two counters are worthy of close attention.

See also: HK WEEKLY WRAP: Index Slides 1.7% On Week On Rate Worries

港股氣氛走勢轉弱,或再下試23500點

(文: 涂國彬, 永豐金融集團研究部主管)

本周港股氣氛明顯轉淡靜,成交對比4月初的平均800多億元下跌逾10%,亦於24000點關口徘徊,觀望氣氛濃厚,主要原因為市場關注聯儲局於周四(28日)凌晨宣布的議息結果,畢竟2010年下半年的升市還是由QE2所帶動。

結果一如市場預期,低利率環境持續,QE2如期完成,令美股周三(27日)造好,亦帶動港股於周四高開。

美股造好的另一原因,為美國企業的首季業績普遍理想,3M、福特汽車、UPS、通用電氣及波音等多間企業業績均優於市場預期,反映美國經濟復甦的步伐理想,道指及標普創兩年半高位,而納指更創十年新高,令周三、周四港股均能高開。

不過,中國國務院發展研究中心的一份報告指出,國內物價上漲的峰值和拐點還未出現,通脹壓力依然存在,市場擔心人行將更長時間維持緊縮政策,令內地股市本周持續向下,亦拖累港股表現,令至本文落筆時(周四),本周恆指每天要不就是下跌,要不就是陰燭,走勢明顯偏弱。

觀乎恆指目前的技術走勢,10天線將跌穿20天線,出現死亡交叉;MACD指標亦呈向下趨勢。因此,若恆指跌穿周三的低位23825點,或會再次下試4月低位23500點。

雖然恆指及內地股市走勢偏弱,而港股成交額亦縮小,但資金未見有流出的跡象;本周港匯轉強,亦進一步下試4月多番觸及的支持位7.766水平,資金似是流入而非流出,情況非一面倒看淡。

至於行業方面,以資訊科技板塊、金融及資源板塊的表現最為突出。資訊科技板塊的升勢主要受騰訊(700)所帶動,而騰訊於本周亦再創新高;不過在缺乏利好因素的催化下,該板塊的升勢未必能持續。至於金融板塊方面,主要因市場憧憬即將公布的內銀業績,使內銀普遍造好所帶動。

然而,資源板塊的升勢則受煤炭股所帶動。國家能源局表示,內地部分地區煤電油供應出現趨緊的狀況,反應煤炭供不應求的情況已引起政府關注,令煤炭股受惠,兗州煤(1171)及中煤能源(1898)紛紛造好。預期短期內煤炭供不應求的情況將會持續,而油價仍繼續高企的情況下,煤炭股值得留意。

請閱讀: HK WEEKLY WRAP: Index Slides 1.7% On Week On Rate Worries