LEADING EXPERTS on China’s steel industry met in Hong Kong last Wednesday-Thursday to discuss the country’s efforts to invest overseas in major mining assets to ease upstream costs and boost profits.

And several listed firms including Baosteel Group (SHA: 600019), Wuhan Iron & Steel Co Ltd (SHA: 600005) and Beijing Shougang Company Ltd (SZA: 959) are leading the charge.

Speakers from mining and steel firms, as well as Chinese government officials, took to the stage at the CBI-sponsored Iron Ore Trading and Investment Conference to offer guidance on where PRC-based steelmakers might be headed in the current year.

Most agreed that the Chinese steel sector needs more discipline to prevent rampant overproduction and blind capacity expansion, both of which severely strain margins for the big players and the mini-mills alike.

But more importantly, the entrenched fragmentation of China’s steel industry makes it extremely difficult for the sector to speak with one voice when meeting with “The Big Three” global mining firms (Australia’s BHP and Rio Tinto as well as Brazil’s Vale) to hammer out contract prices for iron ore, the key upstream input used in the production of finished steel.

They pointed out that PRC steel sector fragmentation and lack of unity come contract talk time resulted in the annual negotiations between Chinese steelmakers and overseas iron ore exporters being shelved, with quarterly prices now negotiated – a situation that almost always favors the miners and allows more regular price increases.

But barring an overnight consolidation of China’s steel sector, another way to reduce raw material costs and improve profit margins is to simply buy out the suppliers – whether by incremental stakes or outright takeovers.

“My job is very straightforward. China has money and needs resources. Latin America needs money and has rich resources,” said Erik Bethel, managing director of SinoLatin Capital, a firm which assists Chinese firms facilitate investments in Central and South American mining assets.

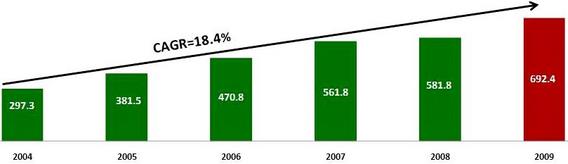

He said that while China has under a fifth of the planet’s population, the country consumed over two-fifths of the world’s steel last year, and this made China more reliant than ever on long-term, stable and affordable iron ore.

But sector fragmentation along with rising input costs result in “paltry profits” for PRC-based mills.

“The problem for Chinese steelmakers is not necessarily getting iron ore, as the Big Three are mining ample supplies. The problem is cost control, because China’s steel sector is very fragmented and therefore it has little leverage in price negotiations,” Mr. Bethel said.

The “Big Three” supply 60% of China’s iron ore imports and control 80% of the seaborne trade in the mined commodity, so the PRC simply cannot shop elsewhere.

“Therefore, China must either except overreliance on the ‘Big Three’ or else find ways to go outbound with iron ore investment.”

But bringing the product to the mills was easier said than done, and “proximity was a factor.”

“While Australia is not close, it is ‘closer’ to the PRC than Brazil, so this helps minimize shipping rates and time. Also, Australia enjoys common law and uses English which helps in negotiating sessions,” Mr. Bethel added.

This has helped Australia grow to become the supplier of 42% of China’s imported iron ore needs, while more geographically-distant Brazil stands at 23% and India – whose own mining sector is as fragmented as is China’s steel sector – is in third place at 17%.

Consistently high demand for high quality iron ore in China coupled with a recognized need to reduce reliance on the “Big Three” has spurred on Chinese firms in their overseas investment campaign.

Mr. Bethel said that in the past five years alone, 25 PRC-based metals and mining firms – some listed in Hong Kong – have pumped 12.3 bln usd into the biggest of the 32 largest deals.

“They have been characterized by half of the Chinese suitors seeking outright control, 53% of the transactions involved Chinese buying stakes in publicly-listed resource firms and 34% ending in full acquisitions.”

Australia has been the preferred target, with 13 investments closed totaling 3.2 bln usd.

But making up for lost ground has been Latin America, in second place with 2.5 bln usd involving three deals.

Major examples include China’s top listed steelmaker – Baosteel – forming a 50:50 JV in 2001 with Brazil’s Vale to secure eight mln tons of iron ore annually from Baovale Mineracao.

Following two failed projects in Brazil for Baosteel in 2007 and 2009, the Shanghai-based steelmaker successfully bought a 15% stake in Australia’s Aquila Resources for 265 mln usd, with Mr. Bethel explained that Brazil’s foreign investment environment can sometimes be “challenging.”

“There is a growing sentiment in Brazil that while foreign investment in natural resources is welcome, the investors should also put some of their money into improving things in Brazil, rather than just mining and moving product out.”

However, he said this has not stopped Baosteel’s domestic peers from trying their luck in Latin America, as iron ore was simply too critical a commodity.

Wuhan Steel signed a deal in 2009 with Venezuelan miner CVG for iron ore supply, bought a 22% stake in Brazil’s MMX in 2009 and formed a JV with Argentina’s EBX for a 5 mln ton/year steel mill.

Shagang Group Co Ltd, Shandong Steel, Shougang Group and Valin were also increasingly playing the overseas investment game to lock up iron ore, with Shougang especially active in Latin America.

Beijing-based Shougang first invested in a 671 square kilometer iron ore mining project in Peru in 1992.

“The Shougang project was a disaster at the time, but since then it has gotten much better,” Mr. Bethel said.

He predicted that Latin America would be an increasingly important destination for China steelmaking investment capital as the country continues to have a great hunger for steel.

“As for emerging markets, Africa is seen as an ‘easier’ place to invest, and Brazil in particular is seen as ‘complicated’ with excessive regulations and environmental concerns. But there is growing optimism about Latin America with substantial iron ore reserves in the region, logistics systems constantly being upgraded and shipping prices coming down to earth.”

And with no sign of a slowdown in demand for steel demand in China, Mr. Bethel predicted that his office would be even busier setting up deals between PRC mills and foreign miners.

“It all starts with urbanization in China, and steel is the backbone of the country’s growth. China created 16 billion square meters of urban floor space in 2010, a massive amount... and it aims to have 10 cities with 30 million people within 15 years.”

And as the world’s biggest producer (by far) and consumer (also by far) of steel, PRC steelmakers would increasingly be training their collective gaze on overseas mining assets, with iron ore in the crosshairs.

See also: SAPPHIRE CORP: Strong Growth To Come From 2013 On Jump In Vanadium Production