Chicken Rice Lover contributed this article to NextInsight

Background: (http://www.cosmosteel.com)

|

Cosmosteel |

B9S / COSM.SI |

|

Share price |

14.4 c |

|

No of shares in Issue |

283.1 m |

|

Market Cap |

$40.8m |

Headquartered in Singapore, CosmoSteel is a leading supplier and distributor of piping system components to the Energy, Marine and Other industries in Southeast Asia and other regions.

Positives for Cosmosteel

- Its share price (14.4c) is trading at 0.5x its NAV per share of 28.37c as of 31 Sept 2021.

My estimate of the NAV is similar, at 28.4 cents, but I arrive at it differently.

Let’s start with 4 selected balance sheet items which comprise my NAV estimate, as shown below.

Conservatively, I have excluded other balance sheet items such as trade receivables.

I then ascribe a 50% discount to the Property, Plant & Equipment (PPE) value but keep the rest unchanged.

|

Selected items from balance sheet |

Company's valuation as at 30 Sep 21 |

Per share* |

Value ascribed by author |

Remarks |

|

1. PPE |

22.3m |

7.9c |

3.9c |

50% discount |

|

2. Inventories |

34.3m |

12.1c |

12c |

Rising commodity / steel prices |

|

3. Cash & Equivalent |

32.5m |

11.5c |

11.5c |

|

|

4. Total Loans & Borrowings Non Current: |

11.3m

|

(4c) |

(4 c) |

|

|

5. Inventory written off earlier |

44.3 – 16.3 = 28m |

10c |

5.0 |

50% discount |

|

*based on 283.1m shares issued TOTAL |

28.4c |

|||

I add in “inventory written off earlier” – which is of course not a formal balance sheet item but it’s relevant given that the written-off inventory has recovered substantially in value.

In a reply to shareholder’s questions posted on SGX website on 22 Jan 2022, Cosmosteel said:

"The cumulative inventories written down of the Group was approximately $44.3 million as at 30 September 2018 (“FY2018”). Out of $44.3 million, approximately $16.3 million was reversed over the subsequent three financial years. The reversal of the allowance for goods was mainly due to inventories sold and an estimated increase in net realisable value as a result of increase in steel prices."

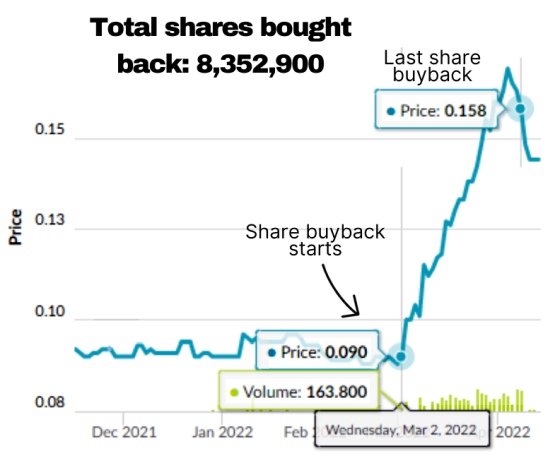

- Company bought back its shares from 9c to 16.5c

Since the release of its FY results on 25 Nov 2021, and holding its AGM on 28 Jan 2022, the company had embarked on a share buyback (SBB), starting on 2 Mar at 9c until 16.5c (8 Apr). Chart: SGX

Chart: SGX

- The last SBB was on 8 Apr 2022 - the pause in buying is likely due to the blackout period, which is 1 month, before the release of its 1H 2022 results in May

- Since Cosmosteel stopped its share buyback, its share price has corrected to 14.4c

- Note that SBB is accretive to Cosmosteel’s NAV since it is buying shares at a discount to its NAV

- Other possible catalysts

- Commodities price increases (inventory worth more)

- Recovery of O&G sector (more business opportunities)

- Privatisation possibility (since it is trading at a nice discount to NAV)

Negative for Cosmosteel

On 5 June 2018, it was placed on the SGX watchlist due to 3 consecutive annual pre-tax losses and an average daily market capitalisation of less than S$40 million over the last 6 months prior to 1 June 2018.

It was given three years to meet the exit criteria. Subsequently, it applied for and was granted a one-year extension to 4 June 2022. Recently it applied for a further extension to 4 June 2023.

Cosmosteel’s share buyback and an apparent recovery in investor sentiment have pushed the stock price up in recent weeks, resulting in a market capitalisation of just over S$40 million.

Coupled with its profitability in the past 3 years (see table below), Cosmosteel looks positioned to exit the SGX watchlist.

|

Y/E Sept, SGD (mn) |

FY19 |

FY20 |

FY21 |

|

Revenue |

91.6 |

86.8 |

39.4 |

|

Gross profit |

18.7 |

16.7 |

7.0 |

|

Net profit after tax |

2.8 |

5.3 |

2.4 |

|

Dividend |

0.25 c |

0.5 c |

0.5 c |

|

Source: Company |

|||

But what if it decides to privatise, following in the footsteps of fellow steel stockists Hupsteel (2019) and Sin Ghee Huat (2021)?

Here are 3 delisting price scenarios and the corresponding upside for the stock price:

|

Privatisation at ... |

Upside (in cents) |

Upside (in %) |

|

20c |

20-14.4 = 5.6c |

5.6 / 14.4 = 39% |

|

28c |

28-14.4 = 13.6c |

13.6 / 14.4 = 94% |

|

Full RNAV * = NAV + inventory written off earlier = 28.4 + 10 = 38.4c |

38.4-14.4 = 24c |

24/1.4 = 166% |

* excluding further inventory revaluation upside due to rising steel prices