IN THIS AGE of high speed connectivity, the Internet allows us constant, 24-7 exposure to countless media outlets... that is, if we willingly choose to expose ourselves. Many of us find it hard to tear our gaze from our TV sets and news portals these days.

Last week’s massive earthquake in northern Japan, the killer tsunami that followed and now the intense anxiety over a growing threat from a destabilized nuclear power plant just 225 km from the 13 mln residents in Tokyo, has had an immediate impact on global asset prices.

But looking back over the past seven decades, no natural disaster has made the top 10 in terms of market impact.

This, however, understandably cannot assuage the anxieties of the Japanese living in and around the danger zone, as Mother Nature may be done with her shaking and deluging for now, but mankind’s modern marvel – the nuclear power plant – is now the chief concern in the densely-populated Kanto Plain, home to Tokyo and the heart of the country’s political, financial and industrial zones.

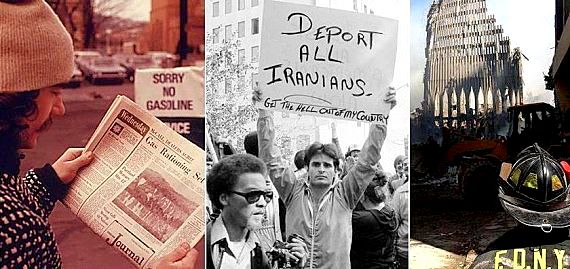

While these concerns for the people of Japan and our investments in that country are completely understandable, those of us worried about the long-term market impact from this horrific natural (and man-made) series of disasters can take some solace from the fact that since the beginning of World War II, when the tyrannical Nazi regime invaded Poland on September 30, 1939, the 10 most market-moving calamities have all been intentionally committed by the hand of man, with Mother Nature having nothing to do with it.

In James Altucher’s book Trade Like Warren Buffett, the author provides a very valuable study into what 10 earthshaking events since the hellish Third Reich’s unleashing of genocide on an entire continent have most impacted global stock markets, using the S&P 500 Index as a barometer, and giving one-month and half-year follow-up levels for the index to determine how long-lasting the cataclysms were to market performance.

As can be seen from the table below, all 10 epochal events were man-made, and all but one (the 1973 OPEC oil embargo) involved mankind committing violence against his fellow man.

What we investors need to do now most of all (in addition to praying for the Japanese victims) is to calmly pick up the remote control, click off our television sets, and soberly assess the situation with a rational frame of mind.

Ask yourself: “The Japanese disasters... do they directly impact my portfolio? Are my physical investments there at risk? If so, will the impact be short-term or long-term? Am I falling victim to panic, and losing my head among all the media hype and fear-mongering? If I sell off my holdings now, will I accept far too low a price due to the heightened anxiety, only to possibly watch the markets fully recover next week when the Japanese government issues an ‘all clear’ signal?”

These are valid questions, and only a sober-minded rational mind is able to answer them without letting fear and emotion rule the roost.

Not making the top 10 list are the two worst nuclear accidents this past quarter century: Chernobyl in 1986, and Three Mile Island in 1979.

Their stories are detailed, too long for the space I have been given here, and readers might wish to click on the two Wikipedia links below to know what happened and how the markets reacted to the two meltdowns.

This will better equip us with information, including historical precendents, on just how peacetime nuclear "events" might shake the markets.

Chernobyl (1986):

http://zh.wikipedia.org/wiki/%E5%88%87%E5%B0%94%E8%AF%BA%E8%B4%9D%E5%88%

Three Mile Island (1979):

http://zh.wikipedia.org/wiki/%E4%B8%89%E5%93%A9%E5%B2%9B%E6%A0%B8%E6%B3%

84%E6%BC%8F%E4%BA%8B%E6%95%85

See also:

INVESTORS Wowed By ‘Hot Stocks’ Reveal Blind Spot