Vivien Ho is a former analyst, and currently contributes stock analysis to a HK magazine, Capital Weekly, on a regular basis.

Translated by Andrew Vanburen from 中线看好内银股,重农行潜力大 (请查看下面)

THE PEOPLE’S REPUBLIC of China had amassed a staggering 51.4 trln yuan in foreign currency loan balances by the end of January, up an eyebrow-raising 18.3% year-on-year.

For the month, yuan loans increased by 1.04 trln yuan, which is actually 318.2 bln less than the year-earlier period.

January yuan loan growth was down significantly due in large part to the ongoing tightening measures by the central bank.ff

The market has naturally been anxious about the People’s Bank of China’s interest rate hikes and increases in the reserve requirement ratio, and therefore PRC banks may take a slight earnings hit this year and likely lag behind listed firms in other sectors.

As interest rates have already risen thrice in four months – and twice already this year – and measures meant to curb over-fast growth in the property sector have already been implemented and largely digested by the market, domestic banks should take cheer from the fact that they should also benefit from the recent rally in the stock markets, with Chongqing Rural Commercial Bank Co Ltd (CRCB) (HK: 3618) likely to stand out from its peers.

In terms of assets, CRCB is tops in the Chongqing market, with the lender raising some 1.4 bln hkd in a December IPO. The bank is also sure to benefit from continuous central government support for both the agricultural sector as well as economic growth in the municipality.

Chongqing is the largest in terms of both area and population of China’s four municipalities, and the only one of the four (the other three being Beijing, Tianjin and Shanghai) located in the country’s less-developed west, and will also benefit from central authorities’ ongoing efforts to spur economic growth in the hinterlands.

As an example of this policy, Chongqing municipality’s compound annualized economic growth rose 18.2% from 2007-2009, a full five percentage points above average national growth over the corresponding period.

As loan demand in the less-developed western regions of the country is relatively higher than in other areas, it is likely that the central bank will permit CRCB to operate with a slightly lower reserve requirement ratio than the country’s “Big Four” lenders in order to achieve greater flexibility in meeting business development capital needs in the fast-growing region.

In addition, urbanization in the western municipality is accelerating rapidly, financing penetration rates are still relatively low with loans growing steadily, and as the bank’s asset quality continues to improve, we believe CRCB is worthy of positive expectations and attention.

CRCB is western China’s first provincial level rural commercial bank. It began as a credit union in the former “city” of Chongqing linking up with 39 county-level credit unions to form the basis of its modern-day incarnation as the country’s third largest rural commercial lender. Overall, it is currently China’s No.20 lender by total assets.

As of end-June 2010, CRCB had total assets of 261.6 bln yuan. Total deposits were at 185.4 bln yuan which accounted for 14.6% of all Chongqing-area lenders. Loans stood at 114.5 bln yuan, or 11.6% of the Chongqing area’s total. CRCB has 1,457 outlets in the municipality covering some 1,244 townships which translates into a municipal penetration rate of 98.8%.

For the first half of 2010, the bank’s top line rose 49% year-on-year to 3.6 bln yuan, with interest income up 46.6% at 3.4 bln. Administrative and commission net income shot up 128.8% to 123 mln yuan while net profit rose 80.4% to 1.66 bln.

One of the major drivers of the better performance was that the callback on asset impairment losses during the period was 142 mln yuan versus 112 mln in the year-earlier period. According to the company’s recent prospectus, CRCB is forecasting full-year 2010 net profit of 2.85 bln yuan, up 51% from 2009. This would give the lender a forward P/E of 13.4 times, higher than the average for its domestic peers.

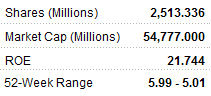

After its Hong Kong listing in December of last year, CRCB’s net asset value per share was 2.72 hkd with a P/E ratio of just 1.87 times, comparable to its peers. Since then, the counter’s valuation once slipped below its offer price of 5.25 hkd, hitting a low of 5.06 while hitting a high of 5.9 in January (Friday, Feb 25 closing price: 5.89 hkd).

Although CRCB has the smallest market capitalization of all the H-share banks, with its Hong Kong-listed shares worth some 12.8 bln hkd at present, and its valuation hasn’t exactly wowed investors so far, this hasn’t stopped high profile funds from paying the lender quite a bit of attention.

On February 14, Edmond de Rothschild Asset Management boosted its long position in the H shares of CRCB to 5.06% from 4.97% by acquiring 2.13 mln shares at 5.247 hkd per share on average. Value Partners and Capital Research also hold over 5%.

Recent story by Vivien Ho:

TEXHONG TEXTILE: High Returns, Low PE

中线看好内银股,重农行潜力大

Written by 何慧韻

中国大陆1月底的外币贷款余额为51.4万亿元人民币,同比增长18.3%;当月人民币贷款增加1.04万亿元人民币,增长较去年同期少3182亿元。

1月份人民币贷款增长显著减少,反映中央收紧银根的措施开始见效。

由于巿场忧虑中央为压抑通胀,持续推出紧缩措施,会影响内地银行股今年的业绩表现,内地银行股一直落后大巿。

不过,人民银行今年内已第二度宣布加息,加上各地均有针对房贷的措施出台,有关负面因素应已在内地银行股现价中反映,随着内地股市转好,内地银行股应可反弹,不妨留意重庆农村商业银行(3618)。

以总资产及存款计,重农行为重庆最大的银行,可受惠于中央不断推出的扶农政策及重庆经济急速增长,所受政策调控压力亦较轻。

重庆为中国四大直辖市之一,是中国面积最大、人口最多,也是西部唯一的直辖市,被列为西部大开发战略的重点地区。

重农行以重庆为发展据点,该区正处于经济高速增长。

以重庆直辖市为例,2007至2009年的年复合经济增长高达18.2%,较同期内地经济增长高5个百分点。

由于西部地区的贷款需求较大,预计人行会相对要求重农行比四大银行稍低的存款准备金,令银行在发展贷款业务上有更大弹性。

加上重庆地区的城市化率快速提升,金融渗透率低,贷款增长力亦较强,而且重农行资产质素持续有改善,值得看好。

重农行是中国西部首家省级农村商业银行,在原重庆市信用联社、39个区县信用社和农村合作银行的基础上组建,为第三大农村商业银行。在中国所有银行中则名列第二十大。

截至2010年6月底,重农行总资产为2,616亿元人民币。存款总额为1,854亿元人民币,约占重庆所有银行机构存款总额的14.6%;总贷款1,145亿元人民币,占重庆所有银行机构总额的11.6%。

该 行在重庆有1,457个网点,覆盖1,244个乡镇,占总数的98.8%。2010 年上半年, 收入35.97亿元人民币,上升49%,净利息收入增46.6%至34.4亿元人民币,手续费及佣收入净额急增128.8%至1.23亿元人民币,纯利增 80.4%至16.6亿元人民币。

业绩大增的主因之一,是期内资产减值损失回拨1.42亿元人民币,上年度同期则减值损失1.12亿元人民币。

据其招股文件预测,2010年全年盈利28.5亿元人民币,较09年上升51%。

重农行现价预测巿盈率13.4倍,在一众内地银行股中最高。

上市后,重农行每股账面资产净值 2.72元,巿帐率 1.87倍,与同业平均相若。

该股自去年12月中挂牌后,曾一度跌穿招股价5.25元,低见5.06元,1月初配售旧股后回稳,最高曾见过5.9元。

虽然重农行是内银股中巿值最小,H股市值128亿元,而且上巿以来表现一般,但仍无碍基金对其的兴趣。

除Edmond de Rothschild外,惠理及Capital Research均持有重农行逾5%权益。

趁大市回调,建议待5.4元买入,目标价6元,5.3元止损。

何慧韻目前的稿子: 天虹紡織高息低PE