Excerpts from latest analyst reports…

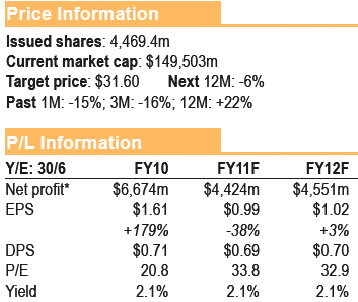

HAITONG believes Hang Lung Properties (HK: 101) is “overvalued” (target: 31.60 hkd, current: 31.95)

Analyst: Katie Chan

HLP reported a 74% and 77% yoy slump in turnover and underlying net profit (after excluding the revaluation gain from investment properties) to 2.52 bln hkd and 1.28 bln in 1H FY11, respectively. The plunges were largely attributed to the absence of property sales in Hong Kong; only six car parking spaces amounted to 3 mln hkd were sold in contrast to the property sales of 7.5 bln during 1H FY10.

HLP maintained a strong financial position as at end-1H FY11 with net cash of 12.5 bln hkd after the 10.9 bln share placement in early November 2010; the potential sales of the completed development properties in Hong Kong will add around 15 bln.

Nevertheless, the company will need to invest over 20 bln in the mainland for its ongoing projects. HLP is averse to debt financing and would consider equity financing at any opportune time.

The stock is trading at a premium to NAV, thus the chance of further equity financing should not be ruled out.

We are upgrading our valuation in view of HLP’s increasing rental income from the mainland, however, we maintain our view that the stock is overvalued as our estimated end-FY11 NAV is 31.60 hkd/share.

See recent: ISAAC CHIN: $5 M In REITS, $2 M In Properties....And More

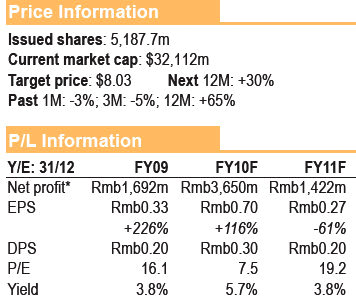

HAITONG is “buy” on SOHO China (HK: 410) amid strong Shanghai showing (target: 8.03 hkd, current: 5.86)

Analyst: Hugo Hou

In FY10, SOHO China’s share price was one of the best performers among mainland developers, up 40% yoy, at a time when most peers suffered from the endless unfavorable policies affecting the sector.

The Beijing developer’s Shanghai expansion proved to be a success and contract sales reached a record Rmb23.8b with an ASP of nearly Rmb60,000/m2.

Though our FY11 earnings forecast has been revised down due to a major delivery schedule adjustment, we have slightly lifted our target price to 8.03 hkd, representing a 20% discount to our newly assessed NAV of Rmb8.53/share.

SOHO China’s shining sales performance may be contributed by the growing domestic wealth and the anti-speculation policies in the residential sector.

In terms of quality office space, both rental demand from local SMEs and investment interest from affluent individuals boomed in China’s two biggest cities.

The largest sales contributor in FY10 was Beijing’s eye-catching Galaxy SOHO.

In six months, the developing project achieved a disposal rate of 81% and fetched Rmb14.6b, the largest annual sales from a single project ever in China and even greater than many listed developers’ total sales last year.

As most of the sales from the two completed projects were instantly recognized, we revised upward our earnings forecast for FY10 due to the better-than-expected disposal.

However, a nosedive in revenue seems unavoidable in FY11, as Guanghualu SOHO II was withdrawn from the built-and-sell list.

We had originally assumed that the 167,000 m2 high-end office project would be completed in 4Q11 and contribute most of FY11’s property sales revenue.

With a fine-tuned policy, SOHO China now prefers to hold more prime properties for recurrent income.

We believe this makes sense for sustainable growth, though the change in policy left limited sales revenue for FY11.

However, abundant inventory will be available in FY12 and FY13 and a significant bounce-back is expected.

See recent: PROPERTY INVESTMENT: 'It's Not A Great Risk/Reward Profile Currently'