The content below was published recently on www.asiapacfinance.com and is reproduced with permission

WE TUNED to CNBC and Bloomberg today, and realized how depressing it can be absorbing all the bad news of sovereign debt defaults, political agendas and increasing job cuts.

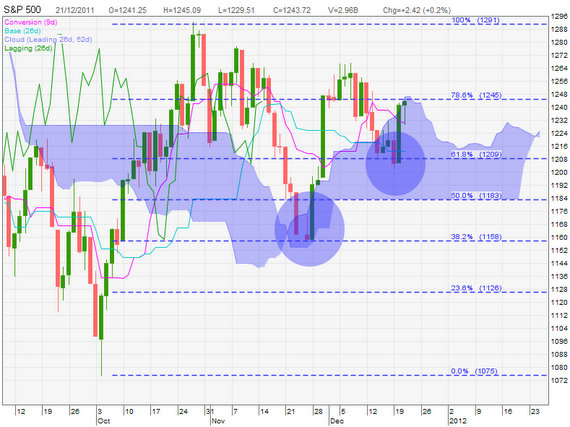

But we analyzed the S&P chart using Ichimoku analysis and it's not that bad - in fact we may even see a short rally in January 2012.

The January effect is a calendar-related anomaly in the financial market where financial security prices increase in the month of January. This creates an opportunity for investors to buy stock for lower prices before January and sell them after their value increases.

Therefore, the main characteristics of the January Effect are an increase in buying securities before the end of the year for a lower price, and selling them in January to generate profit from the price differences.

While the January effect has been less pronounced in recent years, we combined Ichimoku and Fibonacci Lines in analysing the price action of the S&P 500 into 2012:

As you can see, price has been well supported by the thick Ichimoku cloud since November 2011. Price has also been supported by the 38.2% retracement line in late November, and also this past week by the 61.8% retracement line.

Tenkan Sen (pink line) is still above Kijun Sen (turquoise line), with price looking to break out of the kumo cloud to the upside.

We conclude significant downside protection unless the S&P breaks below 1183. If not, we could see a short rally in January 2012.

Related stories:

SANI HAMID: "Equity markets will head lower...but possibly bottom in 1H2012"

KEVIN SCULLY: What to make of the US and EU debt problems?

"The European crisis isn't as deep and terrible as people think," Mobius was quoted as saying by Valor. "Nations there are in a process of negotiations and that takes time."

http://www.cnbc.com/id/45749292/