Reproduced with permission of Financial Alliance from its November market outlook which was sent to its clients recently. In November 2008, Financial Alliance (www.fa.com.sg) became the first and only Financial Adviser Firm in Singapore to achieve both the Singapore Quality Class and the People Developer status.

Q. Has the strong rebound in October changed your views in any way?

FA: No. Just to recap, our view is that markets are still in a transition stage where it will head lower. At this point, we expect markets to revisit the lows of late September/early October and even potentially exceed these lows in the months ahead.

We sense that markets have still yet to come to terms with the potential slowdown that is on the horizon. Similar to the 2006‐2007 period when markets underestimated the strength of global growth (at over 5% during this period), there is a high likelihood it will again do so, albeit underestimating the slowdown instead.

Our view on corporate earnings remains the same: we believe it will be difficult for corporations to maintain their good earning performances seen in the first three quarters of this year. While the revisions to future earnings have started, these will probably have to be revised sharply lower as the overall economic slowdown becomes apparent.

We will only be comfortable when we feel markets have fully discounted the extent of the global slowdown and its accompanying risks. A tell‐tale sign would be bad sentiment all around, laden with the air of gloom & doom. This scenario could happen somewhere in the first half of 2012 as we expect the world to grasp the full extent of the global slowdown during that period (this is especially so from the statistical viewpoint as the first half of 2011 saw relatively strong growth).

Q. Can you update us on what the latest Leading Economic Indicators are saying?

FA: In the latest press release dated November 14 for its September Economic Leading Indicators, the OECD said: ”Composite leading indicators (CLIs) for September 2011… continue pointing to a slowdown in economic activity in most OECD countries and major non‐member economies. Compared to last month's assessment, the CLIs point more strongly to slowdowns in all major economies.”

Turning points of CLIs tend to precede turning points in economic activity relative to long‐term trend by approximately six months. Note that this also means that in all likelihood we will see October and November’s data continue to point southwards given present circumstances to suggest that the first half of 2012 will be one of slower below trend growth.

It should be reminded too that the OECD publishes CLIs for over 13 major economies and ALL these are pointing to the ongoing slowdown continuing into the near future. Collectively, we estimate that these 13 economies represent in excess of 90% of global nominal GDP.

To date, we have seen more monthly/quarterly data move in tandem with these leading indicators. For example, the European Union economy is clearly stalling as it grew a paltry 0.2 percent in the third quarter of 2011 versus the previous quarter. And going forward, the fourth quarter data can only get worse as the debt crisis has worsened.

A recession in Europe, which looks inevitable, would be bad news for the U.S., which sells 20 percent of its exports to Europe, and also for Asia. Europe is after all the largest economy in the world, producing $16.2 trillion in goods and services last year. In comparison, the United States produced $14.5 trillion last year and China $5.9 trillion. By the first half of 2012, it will be clear that the world is undergoing a synchronized slowdown, one which is likely to surprise to the downside. The high base in the first half of 2011 will not help data that are not seasonally adjusted.

Q. So you don’t think Europe’s recent financial sector plan signals a turning point in the markets?

FA: No. Historically, the introduction of major schemes or initiatives during crises have seldom signaled turning points in the markets. Such schemes or initiatives are essential in helping to rebuild market confidence but market bottoms are not normally found at times when such measures are introduced.

The following highlights some recent crises, the various key schemes/initiatives that were introduced and the respective market reactions:

1. Indonesia 1998. The introduction of four IMF packages failed to reverse the Jakarta Stock Exchange, which continued its slide in August & September 1998 as the crisis spread to Russia and Brazil. This was coupled with the collapse of Long Term Capital Management, one of the largest US hedge funds at that time.

While it can be argued that the JKSE was dragged down by external factors (the crisis which spread to Russia and Latin America after Asia), one can imagine that the crisis in Europe will similarly not be confined to one or just a small group of countries. The restructuring and deleveraging that Indonesia and many other Asian economies saw after the 1998 crisis is happening in Europe e.g. defaults, retrenchments, etc.

2. United States 2008. The case of the U.S. helps us to understand just how complex it is when it comes to fighting a crisis. In 2008, the Federal Reserve, U.S. Treasury and U.S. government had gone all out to implement a series of measures from the top of the market to the bottom, but with little success. The most significant of these was the $700 billion Troubled Asset Relief Program(TARP) introduced in October 2008. Nonetheless, despite this program, the S&P 500 continued to lose ground until March 2009.

3. Europe 2011. When it comes to the European crisis, it is hard to imagine how the recent European Stability package could signal the turning point for the markets. In our view, the situation in Europe is even more complex than that of the U.S. given the involvement of various countries, a single currency and monetary policy, and increasing political pressure as major countries like Germany & France head to the polls in the months ahead.

In fact, Italy has recently come under scrutiny, with yields on its borrowings rising sharply and PM Berlusconi being forced to step down. The question remains on which is the next country to come under attack from the market after Italy and Greece. This is reminiscent of what happened during the Asian crisis when Thailand was the first to fall, followed by other countries.

On this point, even after the EU package and government changes in Greece and Italy, credit markets remain stressed. Yields on Spanish debt rose above 6 percent in a mid‐November auction, Italian bond yields climbed back towards 7 percent and even non‐German triple‐A rated issuers saw new highs on premiums over safe‐haven Bunds. For example, Austrian 10‐year bond yields touched euro‐era highs versus Bunds, while the equivalent Dutch spread was at its most since early 2009, which one analyst quoted by CNBC called “a worrying development." All eyes are on French bonds now with yields rising in mid‐November to over 30 basis points in 10‐year yields in the last week, pushing the spread over Bunds to new euro‐era highs above 170 basis points.

Q. Is there anything else we can learn from the above examples?

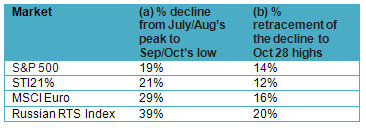

FA: Firstly, one should continue to expect a slew of measures to be introduced and potentially sharp rebounds in markets preceding such measures. However, these are likely to be counter‐trends within a primary downtrend. Secondly, despite all the measures being introduced in the 1998 and 2008 crises, markets basically carried on southwards until they “burnt out” by themselves. We could say that in those instances, markets only bottomed after suffering a considerable period of gloom and doom. In technical terms, one could argue that markets reached a point where there was just no more sellers left (metaphorically speaking). Whether coincidental or not, in both examples, above the JKSE & S&P500 only bottomed some 14 & 17 months after their respective peaks. We are now into the 9th month in Europe’s case if we are to use February’s peak in the Euro Stoxx 50 Index.

Q. Presumably you will be keeping to the present asset allocation?

FA: Yes. We remain cautious and are comfortable maintaining the status quo on our portfolios. We believe the markets are not a place to be for many investors given the volatility. Even for aggressive investors, a significantly reduced exposure to equities is warranted. Many have asked us whether it is prudent to remain in such a defensive position and in cash‐like instruments given the almost non‐existent return. Our reply to that is we feel the present situation is one where we are happy to keep our investments intact versus taking on risk and losing part of it.

However, our present position is not permanent. We are patiently waiting for the right time to re‐position ourselves back into the equity markets. Presently, that period looks likely (although this may change) to occur in the first half of 2012, a point we believe markets will be at their darkest in terms of pessimism and sentiment. Right now, there remains a disconnect between what we see as clear signs of a deteriorating fundamental situation globally and continued stress in the credit markets vis‐à‐vis equity markets which are still fairly optimistic and buoyed by liquidity. One party has to “revert back to reality” and we believe it will be the latter.

Recent stories:

SANI HAMID: 'No turning point in crisis yet, market bottom not in sight yet'

BRIAN R. TAN: The 5 stocks I like most are .....

It is best to stay defensive, either stick to high grade bonds or highly defensive dividend stocks to ride through the current turmoil.

http://www.investinpassiveincome.com

The politicans are having us on the roller coaster ...... guess their private bankers are having the first hand news on what is happening before anyone.

STI corrected about 7% since hitting 2905 on 28 OCT and is now trending towards 2500 or possibly lower in the coming months. The price of GOLD is back to US$1,700 and the US 10 year Bond yield is 1.92% . DOW closed at 11257 last night. European Bonds are unstable and the political situation in the Middle East is very fluid. The current protest in Egypt and Syria can escalate into a civil war and the whole region will be engulfed into a turmoil.

The Chinese Premier has warned that there shall be anaemic growth in the world economy for a fairly long time. China's exports to Europe and US will be badly hurt in this circumstance. I have also read recently about the severe property price correction in many Chinese cities.

My personal view is that there is little upside potential for Singapore properties from here. At worst,it can fall as much as 30% in the next 3 years when the current building construction is

completed and the over-supply is not matched by strong economic growth.