Chan Wai Chee, head of research at Phillip Securities Research, is a seasoned analyst and his reports are often like no other in their depth of analysis -- and especially passion. Here are excerpts from his recent report on Sunpower Group, which designs and manufactures energy saving and environmental protection products with heat transfer technologies. The company, which is listed on the Singapore Exchange, serves customers in the petrochemical, steel, and transportation industries.

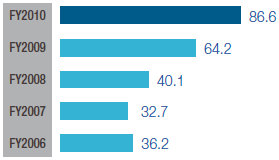

DESPITE ITS good performance since IPO: PATMI of RMB19m (’05), RMB36m (’06), RMB33m (’07), RMB40m (’08), RMB64m (’09), RMB86m (’10), and RMB95m

forecast (’11); its share price has gone nowhere.

IPOed at 22¢ on 16 Mar 2005 it is only 23¢ today.

The dividend it paid out might have covered your brokerage.

Meanwhile, the STI has moved from 2,169 to 2,778, a gain of 28%.

If you had put $1000 in a riskless savings account that is now paying 0.22% p.a., your $1000 has become $1020. It certainly outperformed investing in Sunpower, counting risk.

In the stock market, sometimes, the good reputation of its management, the reputation of its products, the reputation of its customers, and the continuous (almost always, increasing) profits - count for nothing – as is the case of Sunpower.

So, why should I continue to tell you its fundamentals?

Its management team, which owns more than 60% of the company, must be very patient people.

They still believe in doing their job and letting the market do the voting. We give them credit for an excellent job done all these years after IPO.

However, apart from its first dividend pay-out following last year’s result, management has not done more to enhance shareholder value. Its price is 4.0 X trailing earnings. If Sunpower were listed in Shanghai, it would be trading at 40 X P/E. Why not consider a delisting and re-listing somewhere else with a higher P/E?

At 0.80 X book, certainly it is below intrinsic value. If it is below intrinsic value, the company could and should buy back its shares. If the company is not doing anything to enhance shareholder value, then perhaps minority shareholders can do something.

Taking charge of the Share Price

Share Buy-back: Our 2012F shows a ROE of 17.4%. Assume the company borrows an additional RMB10m at 7% p.a. for 2012.

It will earn a net 10.4% return or increase the EPS to RMB30.2f.

But if it borrows the additional RMB10m and buys back its shares at SG23c (assume forex of 5:1) and cancelling these, it will reduce ths outstanding shares by 9m to 320m. EPS, after netting off interest expense, would come to RMB30.6f.

It is a better return for shareholders. Therefore shareholders at the next AGM should query why management did not do share buy-back.

Professionals at Play: We have gone through TWO major rounds of mark-down/accumulation/mark-up/distribution. In cruder terms, pump-and-dump.

There must be many shareholders out there that bought Sunpower shares at above 22¢. Maybe 44¢ or 33¢. Now, sitting on losses of 50% or 33% respectively. Because they are not professionals.

With still 27% free-float, it is difficult to stop the professionals totally but we can reduce their activities. We can STOP lending out shares. This should hinder their operations on the way down. Make sure when applying to open a trading account, you do not tick a box that permits the broker to lend out all your shares. If it is an exception box, make sure you put Sunpower amongst the exceptions.

We can buy without leveage so that there is no panic to cut loss when the price is falling. We can buy when it is near intrinsic value. There are many definitions of intrinsic value but a conservative interpretation is the example given above for share buy-back. One can never tell if the next rise is real or just another pump-and-dump. But the length of the accumulation and the magnitude of the rise should give some indication.

Be an Activist: Get yourself a book to find out how these professionals operate. You may want to split your investment into two lots. Part is for holding. And, part is for trading Sunpower like the professionals. When they have to share the gains with you, they may feel crowded out and go play some other stock.

Be an Advocate: If you have friends, who are long-only buy-and-hold type of fund managers, tell them about Sunpower’s fundamentals. When they buy, they will help cripple the professionals’ ability. Attend the next AGM and keep asking management to enhance shareholder value. Ask for dividends, dividends, and more dividends. Put more pressure when the RMB400m loan is being paid down. Ask why listing elsewhere is not a good move. All the best!

Recent story: SUNPOWER: Orderbook is a record RMB1 billion, up 59%

We have to ask ourselves, does the business gain anything by giving more dividends to shareholders? The simple answer is No. In fact, the business may face the problems of cash shortage and weak working capital by giving out more dividends at a time when the global economy is going downhill.

As long as the Company can deliver a ROE higher than the dividend yield that it is giving shareholders, I believe it is a fair deal.

Does Mr Chan know that Berkshire Hathaway does not give out dividends? Do you see shareholders making complains during the AGM?

Disappointing to see the Head of Research making these un-justificable comments.

Don't say the cash is not there as they have been audited by top tier external auditor for several yrs and have been boasting abt their cash balance held in China/S'pore in every quarterly report.