AFTER a 13.1% increase in its net profit for 3Q suggested a slowdown, World Precision Machinery has entered the final quarter of the year with positive guidance that:

* 4Q will be stronger year-on-year;

* the orderbook is RMB287 million, which is higher than the RMB254 m of 3 months ago; and

* the dividend to be proposed for the full-year will be maintained at 30-40% of net profit.

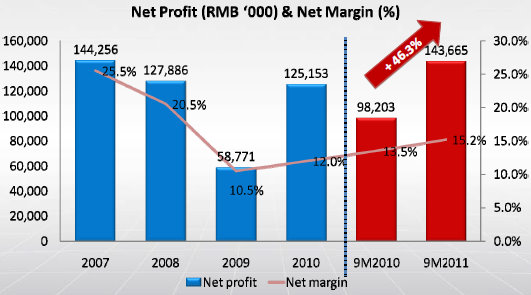

To start with, profit growth for FY11 is all but a certainty since for Jan-Sept, World Precision had clocked 45.8% growth in net profit.

Its 9M2011 net earnings of RMB143.1 million had, in fact, exceeded FY2010 full-year earnings of RMB125.2 million.

Given the likely profit growth, the final dividend to be proposed for FY2011 can be expected to, in absolute terms, exceed last year’s 11.9 RMB cents a share.

World Precision Machinery’s stock price has been resilient, closing recently at 51 cents, virtually unchanged from the 50.5 cents it started 2011 at.

The trailing dividend yield is 4.5%.

World Precision Machinery (market cap: S$204 million) is one of the 3 largest integrated manufacturers of precision metal stamping machines in China.

Among its products, those categorized as “high-performance and high-tonnage” are contributing more in sales.

This category grew 22.1% year-on-year in 3Q, and boosted the group’s gross profit margins from 26.2% to 28.4%.

On the other hand, the ‘conventional stamping machines’ declined in sales and gross margins.

Riding on boom in China’s auto parts and home appliance sectors

Between 60% and 70% of World Precision’s sales already are to the auto parts and home appliance sectors, which are growing fast.

In particular, China’s replacement market for auto parts is in its infancy since its auto population only started to grow exponentially in 2005.

As for the home appliance sector, retail sales rose 19.5% year-on-year in Sept 2011 as the country urbanises and rural residents enjoy higher incomes, according to official statistics.

A high barrier to entry into this business is the two years of qualification process for automotive sector and high end machining equipment.

Yet another barrier: The current replacement cost of World Precision Machinery's plants is about RMB1.5 billion.

Here are some highlights of the Q&A session last Thursday:

Q: Why did margins and sales of conventional machines go down?

CFO Samuel Ng: We are putting more resources into the high-performance category. The customers for conventional machines are small and medium-enteprises which have been affected by credit controls in China.

Q: Your orderbook of RMB287 m as at Nov 7 -- how long will it take to be fulfilled?

Non-executive director Cheng Hong: About 3 months -- in this 4th quarter and next 1st quarter.

Q: In the orderbook, what is the split between the conventional and high-performance machines?

Samuel: It's a third for conventional and two-thirds high-performance. The mix was the same in the orderbook as at August 5.

Q: Your press release highlights the potential of the auto parts replacement market and home appliance sector. Currently, how much of your sales go to these 2 sectors?

Samuel: It's 60-70% altogether. The machines are both high-performance and conventional stamping machines. But for the auto parts, it's mostly high-performance/high tonnag machines.

Q: When will your Shenyang plant be completed?

Cheng Hong: The first phase will be ready in the second half of 2012. Based on last year's figure, we have about 300 customers in Dongbei area and revenue is about RMB127 m. This year, we expect 20-30% growth for Dongbei area.

Gradually we will use the new factory in Shenyang, instead of our Danyang factory, to serve the Dongbei customers as we can enjoy 5-10% savings in transportation cost and reduce raw material cost by another 5%.

Recent stories:

WORLD PRECISION MACHINERY, FORELAND, OUE: Latest happenings

WORLD PRECISION MACHINERY is a growth stock, says CEO

BRIGHT WORLD: Stellar growth, continued dividend payout expected this year