SERIAL SYSTEM has surprised with its announcement of a one-off interim dividend following its 3Q results.

The amount is 0.16 cent a share, which comes on top of the 0.3-cent paid out for the first half of this year.

Investors can expect a final dividend to be paid also, as in past years, according to Serial chairman Derek Goh during a briefing for analysts and the media on Thursday evening.

He guided for a payout ratio of 40-50% of the net earnings for FY11, which is unchanged from the past few years.

Serial has regularly held out that one of its key investment merits is its dividend payout.

It is in a stronger position with the infusion of net proceeds of S$14.5 million from its TDR listing early this month, most of which will be used to finance the increased working capital requirements of the Group's electronic components distribution business, in particular, to support the growth of the Group's new product lines in markets in Greater China, Taiwan, and South Korea.

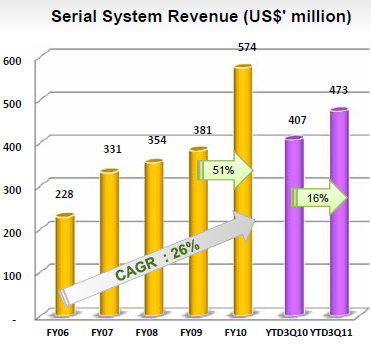

The growth story is set to continue, said Derek, who highlighted that Serial has a track record of outperforming the industry.

Serial’s latest set of results extends that track record, with its revenue growing 16% year on year in the first nine months of this year to US$473 million. In Singapore dollars, the revenue growth was 4% to S$586.7 million, owing to the depreciation of the USD.

The Asia-Pacific semiconductor market grew 5% in the same period.

Serial’s gross profit was almost unchanged at S$54.1 million for the first nine months, while its gross margin dipped from 9.6% to 9.2%.

Overall, the net profit dipped 8% to S$9.6 million, partly due to higher expenses from a bigger headcount and the opening of new offices in places like China and South Korea.

A negative is the cash conversion cycle, which went up from 51 days in FY10 to 66 days in the year-to-date. This is in line with market trends where Serial’s competitors are giving longer credit terms to customers, according to Derek.

Serial’s revenue growth is being driven by:

a. Expansion of its already extensive distribution network in the Asia Pacific. It added 6 offices in Asia-Pacific, bringing the total to 54 – one of the largest Asian presence in geographic spread. It has 680 employees.

b. Expansion of its product lines and extending existing lines.

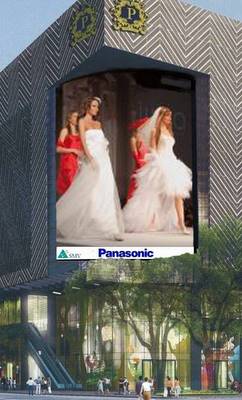

c. Acquisitions of high-margin businesses. Recent acquisitions include the businesses of Digital Out-of-Home advertising, multimedia solutions and venue management services. These come under its 65%-owned subsidiary, Serial Multivision, which was set up in early 2010.

Another acquisition: Contract Sterilisation Services, which produces customized heart-lung packs used in heart bypass surgeries. Annual revenue is S$3-4 million with a relatively high profit margin (compared to electronics distribution).

In the past few months, Serial Multivision has secured high-profile clients for its LED advertising wall, one of Asia's largest, at Grand Park Orchard@Knightsbridge. They include Gucci, Hugo Boss, Cartier, Vertu, D&G, Fedex and Nikon.

Serial Multivision, whose COO Simon Choo holds the other 35% of the company, owns also the the Northpoint LED and billboard (clients include UOB) and the to-be-launched Verge LED.

In its other business, Serial Multivision is working on securing, among other things, a contract from Khoo Teck Puat Hospital for an eMOS (electronic Meal Order System) whereby patients can order their meals via iPads.

Serial Multivision is also providing digital signage solutions for Hard Rock Café, a longtime client, which has an outlet in Malacca.

In yet another area, Serial System has a 34.8%-owned subsidiary in Taiwan, Bull Will Co., which is in the midst of aggressive expansion of its manufacturing capacity.

It produces automotive and customised magnetic, passive, electro-mechanical and discrete components. Its customers include Honda and Toyota as well as those in the industrial and consumer electronics industries.

Look out for meaningful growth in revenue from Bull Will by end of next year, says Derek.

Recent story: SERIAL SYSTEM's Surprise: To List TDRs in early Oct - at premium price!

The powerpoint presentation to analysts can be accessed at the Singapore Exchange website by clicking here.