Overseas Union Enterprise: This big-cap company (market cap: about S$2.1 billion) that has demonstrated for the past 7 successive trading days its determination to buy back its fallen shares.

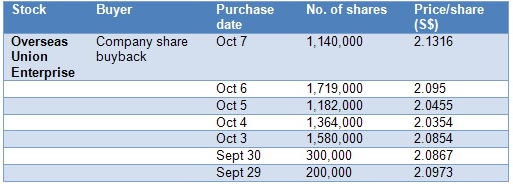

Between Sept 29 and Oct 7, it bought back 7,485,000 shares at a total cost of more than $15 million. The stock price closed last Friday at $2.14, a little higher than the price of the shares bought back (see table) and at a sharp discount to its Net Asset Value of $3.09 as at June 30 this year.

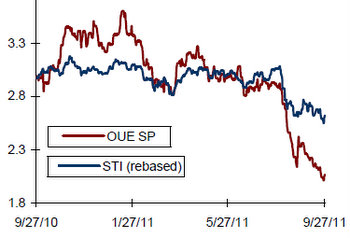

The stock is down about 34% in the year to date.

Phillip Securities in a report dated Sept 28 said it had lowered OUE’s RNAV from $4.13 to $4.06.

The analyst, Bryan Go, said he ascribed a 30% (previously 0%) discount to the RNAV to reflect the current slowdown in economy and weaker office leasing market.

The stock’s fair value is thus lowered to $2.84. “We maintain our Buy recommendation given the current attractive valuation.”

Its price-to-book ratio at the recent price of $2.06 stood at a historical low of 0.67x (close to -2sd), compared to 0.75x seen in previous trough.

Bryan Go highlighted that OUE has more office properties in its book now (whose values are marked to market on an annual basis) compared to the previous cycle, when the property group held predominantly hotel assets.

“Downside risk could arise from downward revaluation of office assets in the event of a recession, when demand for new office space falls drastically,” said Bryan.

NextInsight file photo

DMX Technologies: It has not bought back its shares in at least the past five years, according to SGX data, but started doing so in May this year as the stock market spiraled down.

Starting at 34 cents, DMX has bought its shares at they slid to as low as 21 cents during the turmoil triggered by the European debt crisis and the US economic slowdown.

DMX, whose revenue is largely derived from China and other Asian markets, has bought back 5.1 million shares to date.

Year to date, the stock price, which closed at 23 cents last Friday, is down 45%.

DMX is an Internet network infrastructure and digital media solutions and services provider, and is 51.14% owned by KDDI, a leading telecommunication service provider in Japan.

For 2Q ended June this year, DMX reported a 46.2% surge in net profits attributable to shareholders of US$4.2 million.

Revenue surged 37.4% to US$80.5 million on broad-based growth across all its business segments.

Recent story: DMX: 2Q11 Net Profit Up 46.2% at US$4.2 million

Yanlord Land Group: Are you gloomy about the property market in China? Well, not Aberdeen Asset Management PLC and its subsidiaries.

They have collectively become a substantial shareholder of Yanlord, holding 99,547,000 shares or a 5.1% stake.

A director, Ng Ser Miang, have also accumulated Yanlord stock, raising his holding from 405,000 to 705,000 shares in 2 transactions from Aug through to Sept.

Yanlord has developed a number of large-scale residential property developments in Shanghai and Nanjing with international communities of residents – such as Yanlord Garden, Yanlord Riverside Gardens and Yanlord Riverside City in Shanghai.

Then there are Orchid Mansion, Bamboo Garden and Yanlord International Apartments in Nanjing.

As of Oct 3, Yanlord stock had fallen to 71 cents, which was 42% down in just two months, prompting Kim Eng Research analyst Wilson Liew to comment: "The stock currently trades at an all‐time low P/B of 0.51x. We think the market has priced in an overly bearish scenario with respect to China’s property market, as well as Yanlord’s fundamentals."

Recent story: PRC Developers' Financial Health; Auto Sector Rating Kept ‘Underweight’

Comments