INTEGRATED NETWORK infrastructure and digital media solutions provider DMX has posted a 46.2% surge in net profits attributable to shareholders of US$4.2 million for 2Q2011.

Revenues surged 37.4% to US$80.5 million on broad-based growth across all its business segments.

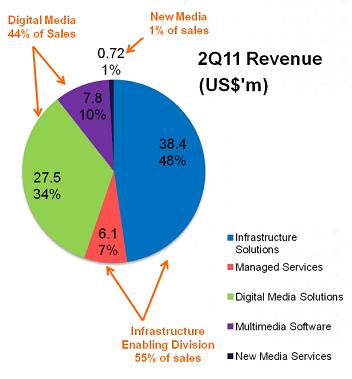

IT infrastructure spending was healthy across its operating regions, and its mainstay Infrastructure Enabling division grew 24.6% to US$44.5 million, representing 55.3% of overall sales.

Under this division, both the Infrastructure Solutions and Managed Services segments registered strong growth of 20.8% and 55.1% respectively.

Revenue growth was driven by the migration from analog to digital cable TV in China and the growing IPTV market in South Korea. This gave rise to a 54.4% surge in segment revenues for Digital Media Solutions to US$27.5 million and a 52.9% surge in revenues for Multi-media Software to US$7.8 million.

The group’s new division, New Media, which focuses on providing content and applications to telecom, cable and mobile operators, contributed revenue of US$700,000, or 0.9% of group revenues.

"New Media is a segment that will help transform DMX from hardware-based player to the higher margin services business model," said Ms Jismyl Teo, DMX's CEO at an analyst briefing yesterday.

On 1 Jul, DMX launched its D-Smart platform, a cloud-based platform where applications are offered as software as a service (Saas) through major mobile operators in China.

Enterprise customers pay a monthly charge instead of high initial investments in hardware or software, allowing DMX to generate recurring income streams under this New Media service.

The major contract wins from major enterprises and telecom operators in South Korea and Indonesia led to an 81.0% surge to US$27.4 million for revenue from outside of China. Revenue outside of China made up 34.0% of total sales for the quarter.

Gross margins were 22.0%, two percentage points lower than in 2Q2010 due to aggressive marketing of hardware based Digital Media and Infrastructure Enabling solutions in China, Korea and Indonesia.

Hardware-based projects provide lower margins but there is opportunity for DMX to ride on customers’ expansion and potentially cross-sell higher margin, service-based offerings from the Managed Services and Multimedia Software segments in the future.

Net margins were 5.5%, while order books were US$72.1 million as at 30 Jun.

Another secular trend benefiting DMX is the mandated move towards fixed, mobile and broadcast (“FMBC”) network convergence by TV and telecom operators.

FMBC allows for the simultaneous sharing of dcontent across television, Internet and mobile phones.

DMX has already launched its FMBC product, the Vision CEP software platform, which incorporates proprietary technologies developed by its parent, KDDI Corporation, one of the largest telecom operators in Japan.

The Vision CEP software platform is currently being marketing in 5 out of the 12 cities earmarked for trial FMBC network over the next 2 years.

Below is a summary of questions raised at the briefing and Ms Teo’s replies.

Q: What's your competitive advantage?

There aren't many players in our space. We need to service ICT customers, including providing network security services. Not many players have our expertise of helping customers design the whole network and integrating the equipment. Lower-end system integrators don't have the skill set to integrate the latest equipment.

A lot of telco operators have a small system integration arm but these only serve the parent operator, are for equipment purchasing rather than system design and integration.

Q: Who are your competitors?

Digital China, Datacraft, Dimension Data

Q: Why is your margin so low then?

Our margins are higher than the competition. ROE is low because capital base is big. Our capital base is big because KDDI injected more than US$100m to expand our business when we sold 51% to KDDI in 2009.

Q: Why are your accounts receivables so large?

This is due to our revenue recognition policy of doing business in China. We collect in phases when we do implementation. All our customers are telco operators and cable operators. Active collection usually happens in the 3rd and 4th quarters.

Q: Why aren't your accounts payables just as large?

We are buying from the large manufacturers like CISCO and Juniper. They don't give such long credit terms because they have bargaining power.

Q: How many days do auditors give you for provisions?

We have no bad debt records, so we don't need to have provisions.

Related story: Hot Stocks: DMX TECHNOLOGIES, WORLD PRECISION MACHINERY