SERIAL SYSTEM, whose stock has proven to be resilient in the recent market fall, is set to list its shares as TDRs on the Taiwan bourse – a pleasantly surprising achievement as several Singapore-listed companies (such as Osim International) have announced they were withdrawing their TDR plans owing to the bearish market.

Serial announced two days ago, Wednesday (28 September), another piece of good news.

The issue price of its TDR has been fixed, through bookbuilding, at the equivalent of S$0.1726, representing a premium of 13.7% over the weighted average price for trades of Serial shares on the SGX-ST on the full market day of 28 Sept.

SIAS Research, in a report today, said the premium means that existing shareholders suffer from minimal dilution as a result of the TDR issue.

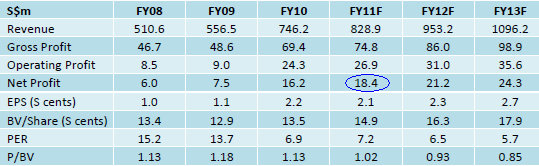

The additional funds will better position Serial to pursue growth, a prospect that has contributed to SIAS Research analyst Liu Jinshu maintaining his recommendation that investors ‘increase exposure” to the stock.

Its intrinsic value is estimated at S$0.200, he said.

Serial will be issuing 28 million TDRs, with each TDR representing 3 ordinary shares of the company.

Net proceeds will come up to approximately S$14.5 million, which will be used to finance the increased working capital requirements of the Group's electronic components distribution business, in particular, to support the growth of the Group's new product lines in markets in Greater China, Taiwan, and South Korea.

The equity capital raised via the TDR issue will also strengthen the financial structure of the Group, improving the Group’s gearing and current ratios.

Here are excerpts from the SIAS Research report:

Our Thoughts: The fact that Serial managed to issue its TDRs at a premium came as somewhat of a surprise given current market conditions. That said, Serial’s share price did close at a high of S$0.169 on 19 September 2011 – three days before the start of the book building exercise. Nonetheless, strong demand gives promise that the TDRs may be well received upon listing.

The business impact is that Serial has through this exercise raised its profile in Taiwan – a market that the company wants to grow in. Despite Serial being one of the largest distributors in Asia and Taiwan being one of the largest electronic components market in the region, Taiwan only accounted for 6% of Serial’s sales in 1H 2011.

Other than the publicity, the funds from the listing will provide Serial with more working capital, thus making it easier for the company to extend more generous credit terms to compete with local firms.

Recent stories:

SERIAL SYSTEM: Chairman wins Ernst & Young award, stock in last lap to TDR listing

Buying during market panic: ARA ASSET, SERIAL SYSTEM, SAMKO TIMBER