This article by 'financiallyfreenow' and the follow-up comment by reader 'Deo' were posted recently on a blog, http://financiallyfreenow.wordpress.com/, and are reproduced with permission.

Artivision became a 4-bagger stock in less than a month!

Artivision became a 4-bagger stock in less than a month!

Many who have been following the stock market closely since May would know about Artivision.

On 15th May, it said it had made a Facebook application called Advision which is a revenue-sharing application that displays advertisement on videos and still photographs uploaded by users of Facebook.

Artivision's share price has been volatile for some time and rose by a whopping 69.2% to close at 22 cents on June 3!

However, if we were to look at the fundamentals of the company, it’s nowhere near a company that value investors will invest in.

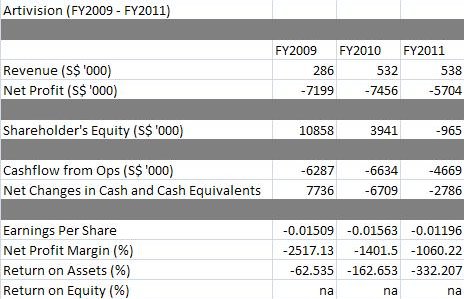

Take a close look at the table:

It can be seen that Artivision had net losses, dwindling shareholders’ equity, negative cashflow, dwindling cash balances, negative margins, negative ROE and ROA for the past three years.

But the share price has been going up like crazy on pure speculation and not due to the fundamentals of the company.

We should all remember that behind every stock price, there’s an underlying business.

If the underlying business is not sound, one should stay away from the business. Buying such businesses will only cause an emotional roller-coaster (based on fear and greed).

Unless you have lots of money to spare and can stomach huge risks, you should stick to investing in fundamentally strong companies with good free cash flow. Such prudent investing will ensure that you can have a good night’s sleep and can also pave way for a worry-free retirement.

Comment by 'Deo':

More trouble ahead for Artivision my friends: the evil demon of all startups – CASH FLOW.

Artivision floated 75m shares out of nearly 500m shares at $0.20 at IPO in Aug 2008, raising $13.2m nett.

Operating revenue was $500k for 2010 vs burn rate for the company of about $8m, making a nett loss of $7.45m – similar to 2009 loss of $7.1m.

They already parted ways with CEO Leong Kwek Choon in Sept 2009, cutting expenses by $250K a year and COO David Yim on 31 May 2010 (also $250K a year).

Chairman Philip Soh (who is also a full time employee of UOB Kay Hian) took over his role & is working for free (according to remuneration tables of ann report).

Despite this huge hole, Ofer Miller is taking $250K-$500K a year.

So after nearly 2 years and with no CEO or COO in sight – it looks like a two-man company.

On top of that, look at the Annual Report closely – they already burned $13m of the $13.2m nett proceeds of IPO.

Now its has a pte placement of 14.7m shares at $0.17 to Quek Yang Hang raising how much …?$2.5m??

~ By way of comparision:

Both Philip Soh & Ofer Miller have 330K and 240K options at conversion price of $0.17 from 16/1/2010 – 2014 and 3,686,268 at conversion price of $0.1189 expiring 28/11/2012

But that's really small change cos each of them owns 175,866,000 (175+ million) shares already.

Long and short, the placement is only enough to cover operating expenses for an additional 4 months the company is in serious cash flow problem.

No doubt the annual report addressed the issue of a going concern and they have secured

1) interest free, unsecured loan of $2m and

2) a letter of financial support to continue to provide or procure financial support for the Group for up to 15 months from 31 March 2010″

…….. both from ALGOTECH

Hello ?? Algotech is Philip Soh & Ofer Millers’ BVI incorporated vehicle for the listing. (Maybe someone should do due diligence to make sure Algotech hasn't pledged Artivision shares to a 3rd party to raise its $2m injection.

So it's left hand clapping right hand and the only two people dancing are Philip Soh & Ofer Miller.

In a nutshell this company is burning money at a phenomenal rate and cannot cut back anymore since R&D / marketing costs for a tech company are essential for life.

If they turn to a VC for help, VCs will makan them – hence a nice private investor like Quek Yang Hang. I guarantee you they will be back for series B funding at a lower placement price within 6 months – or face delisting.

If Brother Loh say go, it will fly!