Photo: SIAS Research

Excerpts from SIAS Research report...

SIAS Research expects strong orderbook for ERATAT LIFESTYLE

Analyst: Liu Jinshu

We left Eratat Lifestyle Limited’s trade fair feeling optimistic about its order book for the 2011 Autumn/Winter season, which will be finalized about a month from now. The visit also showed us that Eratat is on track in executing its articulated strategy to raise brand value. During the visit, we felt positive investor interest in this counter, which is a confidence booster. Maintain Increase Exposure view based on an intrinsic value of S$0.480.

Key Developments:

Trade Fair Garnered Positive Response: Feedback we obtained suggested that the trade fair was more impressive than that last year. Consequentially, we felt that Eratat’s Autumn/Winter 2011 order book (when finalized) may place upward pressure on our forecasts.

ERATAT PREMIUM: In fact, we have already seen the financial success of the PREMIUM label, whose average orders per store was 56% higher than the CLASSIC series for 1H FY11, despite a late mid-season launch for the former.

We see this as a much more astute move to grow sales and profits compared to pushing distributors to open more outlets than they can manage.

Allaying Concerns: With its Annual Report due to be out over the next two weeks, Eratat’s audit should be nearing formal completion. With no announcements thus far over any audit issues, we see little cause for concern over Eratat’s cash balances at the moment.

Investor Interest: Eratat offers an attractive mix of strong growth prospects and undemanding valuation at the moment. As the company continues to reach out to more investors, including institutions, we see increased participation by investors as a potential share price catalyst.

Recent story: ERATAT: 97% surge in latest quarterly net profit - and why it wants to place out shares

Credit Suisse says COSCO is 'most expensive shipbuilder globally'

FOLLOWING ON COSCO’s letter of intent to build two semisubmersible rigs for Sevan Drilling, Credit Suisse has now raised questions on the attractiveness of the deal for the shipbuilder.

Credit Suisse said that based on Sevan Drilling’s investor presentation published on 3 April, the cost of hull and equipment of US$459 mn for two semisubmersible rigs is 20% lower than the Sevan Brasil rig under construction.

Hence, the profitability of this project for Cosco would be even lower than current contracts despite improved execution from the repeat order.

Furthermore, the back-end loaded payment structure of 20% payable on signing of firm contract and 80% at delivery means that the financing cost would be borne by Cosco, noted Credit Suisse.

There is a further unattractive feature: The signing of final contracts is subject to the listing of Sevan Drilling, and is expected by the end of May 2011.

The two newbuild rigs ordered are speculative and do not have contract coverage upon delivery. Options for two additional drilling units expiring in 1Q12 and 3Q12 have a similar price and payment structure, leaving little margin upside even if exercised.

Credit Suisse said it maintained its UNDERPERFORM rating and target price of S$1.60 for Cosco.

Another unfavourable comment from Credit Suisse was: “On 2011E P/E of 20x, Cosco remains the most expensive shipbuilder globally despite its poor execution track record.”

Excerpts from DBS Vickers report...

DBS Vickers says EZRA’s earnings bottomed in FY10, expects growth of 8% in FY11F and 53% in FY12F

Ezra’s progression up the value chain is expedited with AMC’s capabilities and track record. We estimate that the subsea unit alone, with a combined fleet of 10 vessels, coupled with AMC’s capabilities, would be able to support annual revenue and earnings of US$1bn and US$80-120m respectively, boosting group earnings up to 170% from current levels.

Positive near term catalysts include 1) the impending deliveries of its delayed newbuild vessels, likely with back-to-back contracts; 2) the potential work relating to Ezion’s 6th liftboat; and 3) more subsea contract wins as work under tender doubles to US$3bn.

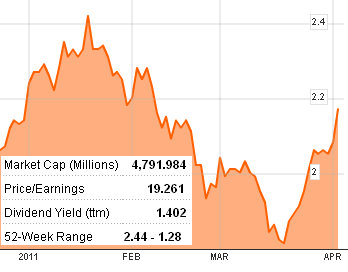

We believe earnings bottomed in FY10, and expect growth of 8% in FY11F and 53% in FY12F. Maintain BUY, TP raised to S$2.20 (from S$2.05 post-rights).

Excerpts from OCBC Investment Research report ...

OCBC checks out ISDN’s new agri business, notes stock trading at 3.8X PE

Analyst: Carey Wong

ISDN Holdings Limited invited us to visit its new hydroponics farm in Subang, Malaysia, recently. Using patented Boxsell elliptical channels hydroponics, ISDN is able to grow “temperate” vegetables and premium “micro-greens” on low-land farm in a tropical country.

The one-acre farm, which cost about S$400k to build but has very low running cost as it uses 60% less water and fertilizer, can produce up to 23k crops every harvest, or nearly 100k tonnes of fresh produce annually.

Meanwhile, ISDN is also in the process of constructing its second farm in Suzhou, China, and expects to start the initial planting in 2Q11.

While management is encouraged by the positive feedback from numerous parties (including those who were initially very skeptical over ability, pricing and delivery), it remains quite realistic about the earnings contribution in the early years.

As such, management reassures us that it is still focused on growing its core motion-control engineering business. Based on its FY10 EPS of S$0.0413, ISDN is trading at a historical PER of 3.8x; but we note that manufacturing peers typically command a PER of 6-8x. We do not have a rating on the stock.