Photos: SIAS Research

Excerpts from latest analyst reports....

SIAS Research raises Eratat's target price from 32 cents to 45 cents

Analyst: Liu Jinshu

Eratat Lifestyle’s 2Q FYE10 results for the period ended 30 Sep 2010 were better than expected. PATMI grew by 62.8% QoQ and 108.0% YoY, mainly as a result of higher ASPs, and hence gross margin, for Eratat’s apparel products. We expect the company to launch more sophisticated products to penetrate the 1st tier cities.

Maintain Increase Exposure view based on an intrinsic value of S$0.450.

Key Developments:

Eratat’s strategy of providing quality products and raising prices is now bearing fruit in terms of higher profitability. The strong set of results for 2Q FYE10 suggests similar top-line performance for 3Q FYE10, driven by yet to be filled orders and mid season restocking demand.

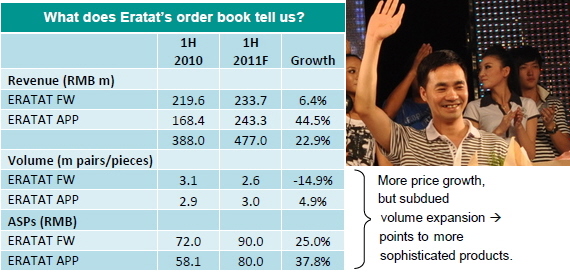

Eratat has also finalized its order book for the Spring/Summer 2011 season. 1H FY11F sales of ERATAT branded products are now expected to grow by at least 23% YoY.

Going forward, we expect Eratat to continue developing more sophisticated products to justify its price hikes. In the pipeline is a premium product series targeted at consumers in the 1st tier cities.

Over time, Eratat intends to develop itself into a leading fashion wear brand. The company’s objective is to increase contribution of apparel products to its sales. As apparel items have higher margins, this may lead to upside surprise in profitability.

Forecasts and Valuation: We now project Eratat to enjoy net margin of 13.5% to 13.9% from FYE10F to FY14F. We had earlier expected net margin to range from 12.5% to 13.0% over the same period. 6M net margin from Apr to Sep 2010 was 13.9% (Jul to Sep: 16.0%). Accordingly, we raise our intrinsic value of Eratat to S$0.450 per share (8.8x 9M FYE10F PER / 6.4x 12M FY11F PER) from S$0.320 previously.

Key risks. Eratat’s business model requires significant working capital. Eratat’s apparel suppliers are mainly Tier 1 manufacturers with foreign brand names as their clientele. To ensure timely delivery of goods, Eratat has to make significant prepayments to these vendors. Concurrently, it is extending credit to deserving distributors to encourage them to open more specialty stores. This has led cash conversion days to increase to 126 days in 2Q FYE10 from 117 days in 1Q FYE10.

Furthermore, Eratat faces execution risks in the roll-out of its strategy. In a bid to raise prices and to create perceived value, Eratat does risk pricing itself out of the market. The company will have to monitor sales and inventory levels carefully to ensure that timely promotional activities are implemented to sustain growth.

For the full 10-page SIAS Research report, click here.

Recent story: ERATAT LIFESTYLE: 108% net profit growth in 2Q, best quarter ever

OCBC maintains 'hold' rating on Raffles Education, target price 28 cents

Analyst: Carey Wong

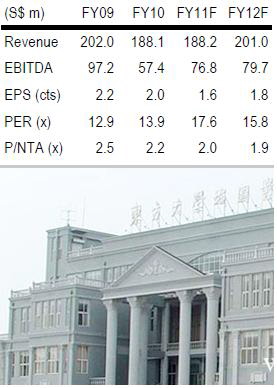

Poor start to FY11. Raffles Education Corp (REC) released its 1QFY11 results last Thursday, with revenue falling 18.2% YoY and 5.5% QoQ to S$42.2m, or around 19.7% of our original FY11 forecast, as it continues to feel the impact of lower student enrolments arising from a reduction in the allocation of National Education School students; this as a result of a decline in the number of students seeking entry into institutions of higher learning in the PRC.

REC added that the weaker RMB to the SGD also resulted in translation loss on its China derived revenue. And coupled with higher operating expenses from its enlarged operations, net profit saw a huge 58.3% YoY and 73.9% QoQ tumble to S$5.9m, or just 11.6% of our full year estimate.

While core net profit (excluding forex and exceptionals) has also tumbled 68.3% YoY to S$5.2m, we note that it was a turnaround from the estimated S$2.6m net loss recorded in 4QFY10.

Cutting fair value to S$0.285. The fall in student enrolments appears to be much larger than expected and we think that the numbers are unlikely to recover significantly in the near term; as a result, we are paring our FY11 revenue forecast by 12.2% (FY12 by 11.4%) and earnings estimate by 17.7% (FY12 by 13.3%). In turn, our fair value drops from S$0.33 to S$0.285 (still based on 18x FY11F EPS).

However, we still believe that the worst is likely over for REC, and we should see meaningful earnings contribution coming in from the 14 new colleges REC has established over the last two years. Hence we maintain our HOLD rating.