THE FERTILIZER business has been around a long time and nobody expects anything radically different to emerge, but here comes Guangzhao Industrial Forest Biotechnology with what it says is a world first.

Guangzhao has just signed a MOU to buy a 49% stake in a company that has pioneered a type of organic fertilizer which has received a patent in the US.

The fertilizer, known as TLB, contains microbes which break down organic matter into nutrients for crops. This averts the release of harmful chemicals such as heavy metals into the soil by traditional chemical fertilizers, which then kill off existing soil microbes and leach into the soil and pollute water bodies nearby.

Another harmful consequence -- the inorganic salts of chemical fertilizers accumulate in the soil, and disrupt the microbiological ecosystem, leading to soil crust and salinization.

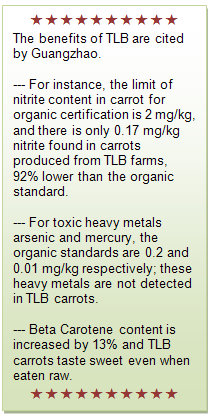

According to Guangzhao’s chairwoman, Su Min, TLB fertilizer has been introduced to farms in several provinces in China, and the results have been positive – ranging from higher beta carotene content in carrots to higher antioxidants in potatoes.

The use of TLB transforms the quality of farmland, she said. The soil becomes loosened, and its organic content increased.

TLB is 70% made up of coal stone (otherwise useless material available in abundance at coal mines), 20% phosphorous and 10% flour.

Yeast is added in a fermentation process involving 10 grammes of microbes per tonne of fertilizer produced. The microbes multiply rapidly during the fermentation.

The TLB business that Guangzhao is seeking to buy is 49% owned by Su Min and the CEO of Guangzhao, Song Xuemeng - an interested party transction that is subject to shareholder approval.

The target company is Asia Technology Investment Limited (ATIL), which is incorporated in Hongkong, and its wholly-owned subsidiary, Suzhou Sanan Shihua Bio-fertilizer is incorporated in Suzhou.

The acquisition covers a 30-year exclusive use right in Southeast Asia for the unique technology of producing TLB which Guangzhao says will address the three big problems hindering sustainable development of agriculture - namely, food contamination, soil degradation and water pollution.

As the main raw mateial is coal stone, TLB sells for a lower price than chemical fertilizers, which are subject to pressures of rising prices of crude oil from which they are made.

The TLB business is profitable, but no financial figures were announced by Guangzhao -- neither has the acquisition consideration been announced.

The TLB plant is located next to the Yangtze River in Taicang Jiangsu (which we visited early this year, see story link below), and has an annual production capacity of 100,000 tonnes.

It was commissioned for mass production in Aug 2005.

The fertilizer business has generated strong cashflow, according to Guangzhao, which will enable Guangzhao to become a larger business, especially when it expands the production capacity.

The value of the Company’s current biological assets, comprising 15,000 hectares of poplar, pine, and other breeds of industrial forest is around S$100 million, about twice as much as the company’s market capitalization currently.

Its forest business can generate continuous and stable cashflow with annual planting of new trees and harvest of mature trees.

However, trading of Guangzhao shares was suspended in 2008 before the company could establish its business model. The one year and nine months’ suspension slowed down the pace of forestation and development of the company. Hence, the Company now needs to inject a new business to enhance its financial performance.

According to Guangzhao, the key benefits of TLB for consumers and Guangzaho shareholders lies in the fact that agriculture will become the hot spot for governments and investors, with their focus on new technological agriculture projects promoting agriculture development and addressing the 3 big problems.

As TLB is the solution, it will bring tremendous economic benefit to the Company and its shareholders.

The potential use of TLB is immense: there are 66 million ha of arable land in South East Asia, with annual consumption of chemical fertilizer at around 11 million tons, and a market value of around S$10 billion.

Recent story: GUANGZHAO IND FOREST: Seeking stable cashflow from organic agri products business