IT WAS just about 5.30 pm but it was turning dark and freezing cold (around zero degrees celcius!) when we arrived recently at our destination.

This was a fertilizer factory somewhere in Jiangyin, which was a 2-hour drive from Shanghai - a trip we made after visiting XinRen Aluminum.

With us was Ms Su Min, chairwoman of Guangzhao Industrial Forest Biotechnology, which is listed on the Singapore Exchange and has a market capitalisation of about S$54 million currently.

She was brimming with enthusiasm as we all hopped out of her MPV and followed her to a jetty by a river.

I didn’t know until then that this was the historic Yangtze River, and I let out a whistle.

The river offered a convenient and inexpensive way to ship organic fertilizer produced by the factory.

After several minutes taking in the sights of the wide river, and struggling to cope with the cold of winter, we hurried back into the MPV and drove about 100 m to the factory.

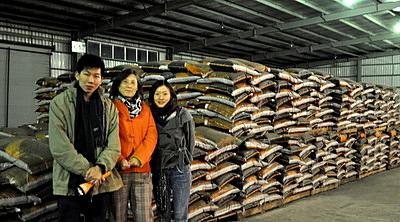

Work had stopped and silence filled the place, which Ms Su showed us around, pointing out where the key production processes took place. Then we headed next door to a warehouse where bags of organic fertilizer were stored.

New business: Distributing organic agricultural products

The organic fertilizer is used in farms to produce organic agricultural products that Guangzhao Industrial Forest Biotech is seeking to distribute to international markets.

The fertilizer, produced through a patented method involving fermentation, contains microbes, explained Ms Su.

They are key: they will rapidly multiply in the natural environment where there is sufficient warmth and moisture. They will help break down organic matter and release trapped nutrients for agricultural crops to thrive on.

It is a virtuous cycle, and forms a natural ecosystem – which is very unlike the use of chemical fertilizers that does not promote the cultivation of microbes in the soil and, worse, kill them off, explained Ms Su. In addition, excess chemical fertilizers leach into the soil and pollute water ways.

As is evident to those who know her, and going by her involvement in her various businesses, Ms Su is a passionate advocate of a sustainable environment.

The organic fertilizer production business is not going to be injected into Guangzhao, but the company has proposed to enter the new business of distributing organic agricultural products to generate stable cash flow.

For that Guangzhao announced on Dec 29 that it has entered into a sales and marketing agency agreement with Shanghai Shi Hua Organic Agricultural Product Development Co.

The latter company was incorporated in China in 1999, making it one of the pioneers of organic business in China.

Shi Hua has 26 agricultural products including rice, soybeans, and vegetables planted in duly certified organic fields of over 33,000 hectares, which are certified by the EU, USA and Japan.

Its established list of clients includes Walmart, the largest supermarket chain in the U.S.

Shi Hua is wholly-owned by Ms Su and Guangzhao CEO Song Xuemeng, so the agreement is an interested person transaction.

Guangzhao has said that the aggregate transaction value in the current financial year is anticipated to be less than 5% of the Group’s latest audited net tangible assets, and thus it will not be subject to the approval of shareholders.

Guangzhao is in transition: It was listed on the Singapore Exchange in 2004, with its core business being tissue culture and propagation of plantlets and saplings for its main product, the Guangzhao Fast-Growing Poplar.

Guangzhao recognised the relatively long cultivation and maturity periods for the trees, and frequently unpredictable harvests as a result of factors beyond the control of the Company, such as poor weather and fluctuating timber prices.

As a result, it has identified the organic foods industry, which has potential for growth due to the increasing awareness of the health benefits of organic foods and the rise in popularity and demand for organic food sources.

Future of its forestry assets

Guangzhao announced last November that it had signed a Letter of Intent with GreenWood Resources China, a subsidiary of GreenWood Resources, Inc.

The parties entered into a non-binding Letter of Intent to share information in relation to the proposed sale of a portion or all of the approximately 15,000 hectares of forestry assets owned by the Group, including the timber ownership rights, timber use rights and land use rights, in Jiangxi, Anhui, Shandong and other locations in China.

The parties will work diligently to: share information, visit key sites, confirm price and other key terms, implement due diligence activities, and, if successful, develop key transaction documents and transfer assets. GWR China and the Group have not signed a purchase and sales agreement and have not entered into substantive negotiations regarding the transfer of Group’s forestry assets.

Guangzhao plans to sell the forestry assets in stages over 2 to 3 years. Their carrying amount (or book value) is about RMB560million (about S$110 million), or twice the market value of Guangzhao currently.

This could be a key attractive feature of Guangzhao shares, which seasoned investor Bobby Lim and seven others bought into in Sept 2010 via a 45-million new share placement at 8.01 Singapore cents a share.

Recent story: LORENZO, GUANGZHAO Surge As Punters Follow Smart Money