During the Cultural Revolution of the 1960s and 70s, he had stuck to state ideals of rapid industrialization by working as a lumberjack to support the timber industry. Each day meant meeting the target set-out by the central government – to cover an area of 100 cubic metres, which amounted to about 30 to 50 being chopped trees per day.

“In winter in the north, the temperature was -30 degrees and it was a two-man team. We used an electric saw and took 10 minutes to topple down a big tree. But when it toppled, it also destroyed other trees in its path and we would trim off the branches and they would be towed away. For me, I felt sad each time we cleared the land but those days, our objective was to meet the target,” recalls Mr Song in Mandarin.

Life has come a full circle for Mr Song who has since moved on to become the chief executive officer of Guangzhao Industrial Forest Biotechnology Group (GIFB), a company engaged in tissue culture and the propagation of plantlets, of which its main product is the Guangzhao Fast-Growing Poplar trees. Not surprisingly, the motivation behind the setting up of the business was the sense of moral obligation which Mr Song felt he had to fulfill.

“For the past 100 years, we have de-forested much of China and I thought that it takes so long for the trees to be replaced again. That inspired me to think of how to develop new technologies to grow trees faster and grow certain trees in arid types of land,” he says.

Based on its tissue-culture technology, the Group is known for propagating poplars which grow at double the rate of other species. GIFB’s “fast-growing” poplars, which reach maturity at a height of about 15 metres over a four- to five-year period, are cultivated in 18,600 hectares of forests across eight provinces in China.

As China continues to experience a shortfall in its domestic timber supply, GIFB’s biological assets consisting of pine and poplar trees have seen gains in fair value. The trees are periodically harvested for timber upon reaching maturity, but during “lull” periods when no harvesting takes place, revenue is reflected from gains in fair value which is ultimately a non-cash item.

While the Group expects to continue its harvesting this year, recent developments reflects huge potential for the company to effectively move away from over-dependence on its biological assets – that is, its trees. By leveraging on its biotechnology expertise, GIFB is looking at developing its other related businesses that will provide recurring revenue and thus improve its earnings visibility moving forward.

BIOFUEL CROP

One such initiative that the company has undertaken is the development of superior strains of a biofuel crop known as “jatropha curcus”. As biofuel production grows in prominence, questions have been raised about sustainability as using food crops for biofuel production would only exacerbate the current shortage in food supply.

Hence, non-edible fruits such as jatrophas are fast gaining acceptance in the industry.

“Compared to oil palm, jatropha is more viable as it is non-edible. Planting oil palm also requires more fertile land, rainfall and so on, whereas jatropha needs less rainfall per year, less fertilizer and you can use more marginal land,” explains Mr Song.

Utilising its strength in biotechnology and tissue culture in particular, GIFB has propagated a species of jatropha curcus that yields more oil. In simplified terms, tissue culture breeding technique involves exposing a plant tissue to a specific regimen of nutrients, hormones, and light to produce many new plants, each a clone of the original mother plant.

“Tissue culture ensures the quality and yield of a particular species. If you use seeds to propagate and you planted 100 seeds, they would all grow differently. But we identify the characteristic of fruit that we want and clone it so when I sell you 100 plantlets, they’re all from this top-grade quality,” remarks Mr Song.

Significantly, through rapid tissue culture technology, GIFB has developed techniques to cultivate this special species of jatropha on a commercial scale. The Group is backed by a team of forty in-house and external researchers in Singapore and China along with a host of forestry and research institutes. It is also worth noting that the China National Space Administration grants GIFB exclusive rights to send plant specimens for experiments on board its space missions.

DEMAND FOR JATROPHA

Biodiesel facilities are being built all over Asia and with five plants totaling 1.5m tonnes capacity under construction, Singapore is poised to become one of the largest biodiesel production bases in the region.

“I’m confident about demand as major players have put in the money to construct the plants so they’ll definitely need the raw material,” says Mr Song.

Supporting his bullish stance, he adds, “The big oil companies in China such as Sinopec and PetroChina have approached me and said ‘If you can show us some area where you have successfully planted that (i.e jatrophas), we’ll sign an agreement with you and even pay you deposit to secure a five or ten-year supply.’ So after speaking to these people, I felt that this is the area that I should pursue.”

As part of its pilot cultivation project, GIFB secured a 40-hectare plot of land in Cambodia last March, citing the country’s excellent weather and environmental conditions as ideal for growing jatropha curcus. In the pipeline, the Group is looking at starting up its jatropha plantation, which is arguably a capital intensive project.

“In the first few years, you really won’t see profit as it normally takes five years to achieve a five-kilo fruit. But for us, we use cloning techniques so it takes us only three years. So if we go into plantations, we’ll break even in three years but we’ll need additional financing to support us,” says Mr Song. He however adds that subsequent fundraising to develop this would not be done on GIFB’s books, but under a subsidiary that will focus on biodiesel crop production.

Last year, the Group raised $24.7 million via convertible notes issue and share placement and Mr Song says that proceeds from the funds raised to date and continued harvesting of its timber this year will provide sufficient working capital for the Group in Financial Year 2008. As at end FY2007, the Group remained in a strong cash position with its cash and bank balances increasing nearly six fold from the corresponding period to RMB30.5 million ($6 million).

MARKET ACCEPTANCE

In its research report on the company, DBS Group Research commented that while GIFB’s long-term prospects are supported by its significant technological know-how, a key factor lies in the company securing more contracts for their products as an indication of market acceptance.

To that extent, it made a significant inroad into Southeast Asia’s lucrative agricultural industry last year, with its joint venture company in Malaysia securing a five-year contract worth RMB16 million ($3.1 million) with Malaysia’s Department of Agriculture to supply tissue-cultured tropical fruit plantlets.

Mr Song also revealed that the Group is in talks with the Malaysia forestry department to grow various fruits and herbs by using tissue culture. After a gestation period over the last few years, GIFB seems poised to translate its biotechnological breakthroughs into more commercial success stories.

This article was recently published in Smart Investor magazine and is reproduced here as part of a special collaboration between the magazine and NextInsight.

Recent NextInsight story:

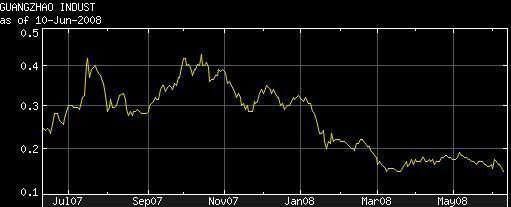

Insider buying: GLOBAL VOICE, GUANGZHAO IFB