Gross profit improved 2.4 percentage points to reach 37.3%, thanks to more efficient management of production resources and higher margin products such as Organic Soy Milk and Charcoal Roasted White Coffee.

Sales of consumer retail F&B products grew 10.8% to reach S$293.6 million. This division contributed 83.4% to Group revenues.

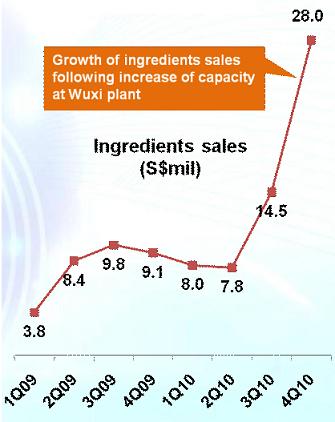

Ingredient sales surged 87% to reach S$58.2 million, thanks to several important new customers from China for non-dairy creamer and strong sales of soluble coffee powder in Malaysia. This division contributed 16.6% to top line (up from 10.5% in FY2009).

Gross profits surged 27.1% year-on-year to reach S$131.4 million.

It also reaped a gain of S$10.0 million for disposing of its entire 37.5% stake in Care Property Holdings for S$20.3 million.

Net profit attributable to shareholders was S$58.4 million, up 45%. Net margins were 16.9%, an improvement of 3.2 percentage points.

A tax-exempt final cash dividend of 3.6 cents per share was proposed, payable on 25 May. Including the interim dividend of 1.8 cents per share, total dividends amount to 5.4 cents per share, translating to a payout ratio of 50%.

Super’s business development manager, Mr Darren Teo, and its CFO, Mr Koh Chun Yuan, met about 15 analysts and fund managers today at its results briefing. Below is a summary of questions raised and the management's replies.

The first quarter of the year is cold, and that is when there is higher demand for hot beverages. We expect strong demand for ingredient sales.

Q: Is there a cost-plus mechanism?

Yes, definitely. The rising cost of raw materials also affects other suppliers. We are very confident of passing on cost increases.

Q: Will there be any pressure on your gross margins this year?

We are planning to revise our retail prices this Mar. We intend to focus on rolling out higher margin retail products and growing the sales contribution of ingredients. Ingredient sales gross margins are 20% to 25% and while that for consumer product margins are about 30% to 35%. Group gross margins are expected to decline as a result.

Q: How frequently have you increased prices?

We last had two rounds of price increase in 2008-2009. Each time was about 6% to 7%.

Q: What is the composition of your cost of sales?

30% is coffee powder, 30% non-dairy creamer, 15% sugar and miscellaneous, 15% in-house packaging, 10% factory overheads. We buy the packaging materials and pack the instant food & beverage ourselves. In fact, we have a packaging plant in each of our major markets like Thailand, Myanmar, Malaysia and Singapore.

Q: What are your suppliers telling you about the price trends of your raw materials?

Robusta coffee bean prices peaked at about US$2,600 a ton in 2008. Right now it is already about US$2,300 to US$2,400. We believe prices will soften.

Q: Who are your ingredient sales customers?

For ingredient sales, most of our customers are the larger milk-tea players.

We plan to launch 3 to 4 coffee-related products.

Q: How much are you allocating for your A&P expense?

We are maintaining it at about 11% to 13%. In Thailand we used Waan Thanakit as brand ambassador. In Singapore, we used JJ Lin. These two entertainment celebrities are popular with the younger crowd, which we are targeting. Our brands are already well entrenched with the older generation.

Q: Are there any new players for non-dairy creamer in China?

It is difficult for new players to enter this space. The large food manufacturers like Nestle however, have the manufacturing expertise compete with us. However, food manufacturers don’t normally replace food ingredient suppliers without hiving off the relevant product variant because the food ingredient affects a product’s taste profile.

Q: Why were you able to secure such large food ingredient contracts?

We have the quality and food safety. China players currently do not have the technology (they are not even able to export Taiwan) while large food ingredient manufacturers like Nestle charge a premium. So there is a gap where we can fill. The manufacturers of consumer F&B products in China are very large players with large volumes given its huge population.

Related story: Yuanta Reiterates ‘Buy’ Call On SUPER TDR With Target Price At NT$19.80