These ‘new projects’ will continue to contribute in the current 1Q but lower volumes, lower revenue and lower profit vis-à-vis 4Q are expected because of seasonality factors, said Mr Yao Hsiao Tung, the executive chairman and CEO, yesterday.

Overall, for the year, Hi-P expects to grow its topline and bottomline compared to last year, said Mr Yao at an analysts' briefing in Carlton Hotel.

For that, Hi-P will spend $100 million in capex, in part to drive up its production capacity by about 30%, said company officials during a Q&A session with analysts.

Signalling its optimistic outlook, Hi-P yesterday resumed its share buyback with a purchase of 6 million shares between $1.11 and $1.16 per share.

On the flip side, the company, which is proposing a final dividend of 3.6 cents a share (FY09: 3.0 cents), acknowledges that it faces keen competition, rising labour costs and a weakening US dollar.

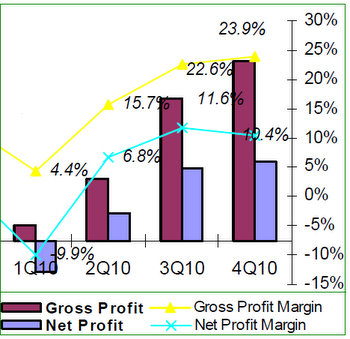

In response to a question, CFO Samuel Yuen said on a long-term basis, investors can expect the company’s gross profit margin to be in the 15-20% range, unlike the 23.9% achieved in 4Q of last year.

Here are some highlights of the Q&A session involving Mr Yao, Mr Yuen, COO Gary Ho and Senior VP (business development) ML Tjoa.

Q: What is the capex for this year?

Samuel: For 2010, our capex was about $40 million, which was sufficient for the doubling of our revenue in the 2H compared to the 1H. For this year, because of the growth of the topline, the capex will be higher at around $100 million.

Besides increasing capacity, the spending will be for improving capabilities for some existing machinery.

Q: Is it easy to hire workers in China?

Mr Yao: Not easy but we should be able to cope. This situation started in 1Q last year. Our 2H revenue doubled but we overcome the situation – not just manpower challenges but also project management.

Q: Last December – what was the headcount compared to June?

Gary: 1Q of last year it was 11,000 and at year-end we crossed 20,000. It’s a common problem for many companies. We plan ahead and have measures – talent development programme and incentives - to retain the operators.

Q: Given the $100 million capex, are you expecting a 40% increase in revenue this year, for example?

Samuel: Capex may not be for immediate impact. For example, if we spend in 2H of this year, it would be for continuous growth next year.

Q: What was the capacity utilization in 4Q last year?

Samuel: 60-70%.

Q: You have an impairment of $20 million for property, plant and equipment last year. How much do you expect for this year?

ML: Minimal.

Q: With your high spending, are you expanding into new areas and getting more customers?

ML: We continue to diversify our customer base and market segments. We are looking especially at tablets - in addition, lifestyle products and household appliances.

Q: For your tablet business, what components do you currently supply and what more can you do?

ML: We currently supply the mechanical parts and plastic and metal – and as you know we are acquiring Motorola design centre so in future we can also do designing. Tablets are going to be a ubiquitous device. It’s a huge opportunity.

The Powerpoint for the presentation is available on the SGX website.

Recent story: HI-P: DBS Vickers raises target price to S$1.30 on 3Q10 earnings surprise