Five Roxy-Pacific directors have been buying its shares this year as the company reported quarter after quarter of rising profit. At 37.5 cents recently, the stock trades at a hefty 56% discount to its revised Net Asset Value of 58.39 cents.

It’s a company Mr Tan, who sits on other boards such as ST Engineering, has watched grow from strength to strength.

Four days ago, on Nov 10, his 50%-held vehicle, Winmark Investments, bought 500,000 shares of Roxy-Pacific.

Winmark now owns 13.3 million shares of Roxy worth about $5 million based on the stock’s last closing price of 37.5 cents.

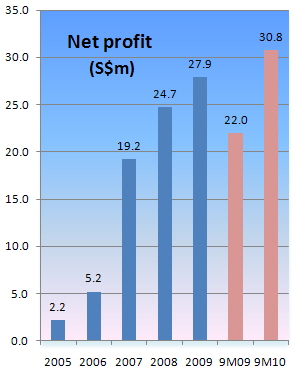

* Net profit for 3Q jumped 42% to $8.9 million;

* Net profit for the first nine months of this year jumped 40% to $30.8 million.

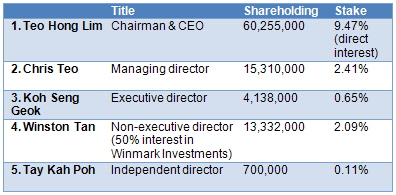

Winston Tan is among a number of Roxy-Pacific board members (see photo above) who have bought shares this year. No director has sold.

Spearheading the buying was Teo Hong Lim, the executive chairman and CEO, who bought 775,000 shares for his own account, which now holds 60.3 million shares.

That is not all. He owns more than 20% of Kian Lam Investment, which bought 2.045 million shares this year.

Kian Lam is the biggest shareholder of Roxy-Pacific with 228.9 million shares, or a 35.97% stake.

Mr Teo has a further deemed interest since Kian Lam, in turn, owns more than 50% of Sen Lee Development which holds 70.93 million shares.

It is said that while there could be any number of reasons an investor sells shares, there is only one reason he buys – he expects the shares to be worth more in the future.

Roxy-Pacific’s directors, who bought the stock, wouldn’t be exceptions, given that the company’s business has done well since its IPO but the stock has yet to catch up in performance.

It is on track for a record year of profit this year as it has progress billings of S$241.9 million to be recognised from 4Q2010 to FY2012.

Its stock price, however, has lagged behind in performance, having managed a 25% rise since its IPO, with most of the gain coming only this year.

At the recent closing price of 37.5 cents, it trades at a hefty 56% discount to its revised Net Asset Value of 58.39 cents a share, as at end-Sept this year.

Following the 3Q result, SIAS Research said it maintained its ‘Increase Exposure’ rating and upgraded the counter’s intrinsic value from 45 cents to 53 cents.

Investment risks

While Roxy-Pacific has lots of revenue waiting to be recognized as the construction of its property projects progresses, the company has to constantly seek to replenish its landbank – at good prices. It is a challenge.

Another challenge: As has happened in past property booms, property developers could face tighter government policies aimed at cooling down the market.

And while a robust economy supports higher selling prices for their properties, developers, like other businesses, have to contend with increases in raw material and labor costs.

For SIAS Research and Standard & Poor's latest reports on Roxy-Pacific, click here.

Recent stories:

ROXY-PACIFIC shares touch record high at 39 c

ROXY-PACIFIC, CHINA PROPERTY: What analysts now say.....