This is Part 2 of our report on our visit to Hu An Cable, the first being Hu An Cable: Powering up for Greater Investor Interest

ABOUT A year from now, on the plot of empty land behind the billboard (above) will rise a factory-cum-office complex funded by the Singapore IPO proceeds obtained by Hu An Cable.

The new plant – whose site I visited on an analyst’ trip last week - will be a key revenue and earnings driver in the next few years for the company, which is one of the 10 largest manufacturers of cable and wire in China.

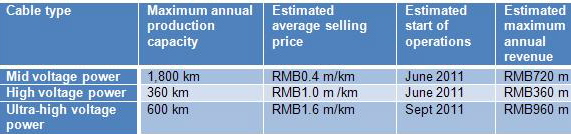

In a nutshell, the 5 new production lines will have the capacity to produce cable worth up to RMB 2 billion a year (assuming 100% capacity utilisaton throughout the year, which is not likely; nothing even close to that). For perspective, the company had revenue of RMB1.4 b last year and net profit of RMB134 million.

Of the 5 production lines, the plant in Yixing about three hours drive from Shanghai will house 2 production lines from Finland and Germany for producing the most technologically complex type of cables – the 500 Kv cables for high volume and high voltage power transmission.

No, this is not what you find inside households.

Instead, the ultra-high power cables are used in power stations, and across the countryside transmitting high voltage power across thousands of kilometers, even from the west to the east of China.

Fewer than 10 manufacturers in China at present have the capability to supply these cables, so China is largely dependent on imports for them.

The demand for these cables will intensify in the coming years because the State Grid Corporation of China has recently announced that it would build three ultra-high voltage power transmission networks in northern, eastern and central China by 2015.

The scale of the project is reflected by the RMB270 billion to be spent on the networks over the next five years, compared to the RMB20 billion spent on such projects in China in the past five years.

Aside from the 2 production lines for ultra-high power cables, the new plant will have one line for high voltage power cables and two lines for mid-voltage power cables.

Hu An Cable’s investment in the plant is about RMB338 million, of which RMB140 million will come from the proceeds of its IPO in February this year. The balance will be financed through internal funds and bank borrowings.

The plant will propel Hu An Cable to an elite club, boosting its current status as a qualified supplier to bellwether companies in the power generation and transmission sectors such as the State Grid Corporation of China, China Southern Power Grid, China National Petroleum Corporation, China Huadian Corporation, Sino Petrochemical Corporation and China Petroleum & Chemical Corporation, etc.

Approximately 46.7% of the Group’s revenue for 2009 was derived from its supplies to these companies.

Investors could be well-rewarded by buying Hu An Cable as a proxy to the fast-growing power infrastructure sector in China.

We estimate that the added production capacities could contribute additional revenues of Rmb300-400m in FY11, and up to Rmb1bn by FY12.

• Valuation and Recommendation. Incorporating the anticipated additional contribution from mid to ultra high voltage cables and dilution effect from the issue of new shares to underlie its TDRs, we have raised our EPS estimates for FY11 and FY12 by 2 and 17% respectively.

Given the company’s impending TDR listing and move into higher value-added products, we have also re-pegged the stock to 8x CY 11 P/E (previously 6.5x), a 50% discount to its China-listed peers and a 15% discount to S-chips under our coverage.

We reiterate our BUY call on Hu An Cable, with our new target price of S$0.64 (previously S$0.51) representing a 54% upside from current valuation.

Stock catalysts from (i) the successful listing of its TDRs at a premium price; and (ii) better-than-expected 2H10 results.

CIMB full report here.