The following was posted by Kevin Scully at his blog yesterday. Visit www.nracapital.com

I dont always give recommendations on what stocks to buy. Sometimes people give me recommendations....for me its usually on the golf course or at the 19th hole.

One such recommendation was TSH Corporation......I was told it would be a four bagger.

Being a typical fundamentalist, I went down to have a look at the published financial information (results releases, annual report and Bloomberg). Bloomberg was really out of date and referred to the company's business as being in aircraft parts, something which the company exited some years back.

There were some suprises in that I found the financials strong with net cash of about S$17mn (its now S$23mn) against market capitalisation of about S$30-33mn..when I was told, its market capitalisation now about S$38mn. It was also trading at about 0.6-0.7 times book which was about half cash.

A quick look at the results and annual report showed that the bulk of profit came from home land security and consumer electronics.

There was a recent sharp price movement up to 18 cents on volume and I received several sms' suggesting all sorts of reasons in particular the entry of a prominent person as a shareholder.....anyway nothing was announced so its pure rumour at this time.

Back to the H1-2010 results, the key points are highlighted below:

a) revenue rose 144% to S$28.3mn

b) net profit rose 135% to S$2.7mn from S$1.1mn

c) net cash is S$23mn up from S$18mn in 2009

d) EPS for H1-2010 is 1.2 cents while NAV is S$0.19

I have found out that TSH's historic core business under home land security comprises - the destruction of used/unused ammunition from our SAF ranges, maintenance of bomb shelters and the management and storage of all public fireworks displays. This seems to be a very stable business generating about S$3-4mn net profit per year and growing modestly.

The new business is in consumer electronics....but as to how this will impact the P&L, its seems a little early to say now. But some of the products from its annual report like photo readers and pc tablets look interesting but its more ODM now.

Can it be a four bagger ??!!

Based on what has been disclosed......in terms of its business fundamentals......I dont think so. But PERs are low similar to under undiscovered small and mid-caps. We have NAV protection and a strong net cash position that is more than half its NAV. So unless earnings rebound strongly, and this has to come from its consumer electronics division, I find it hard to believe that on its business fundamentals alone the stock can be above S$0.40.

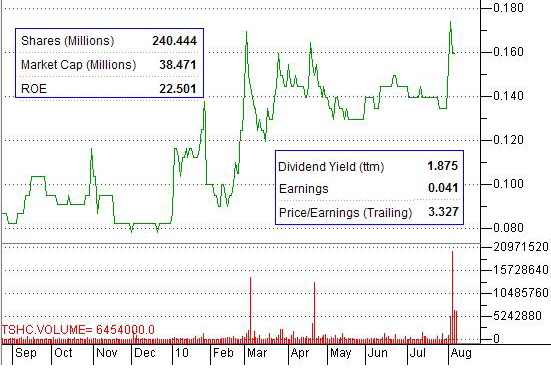

Fundamentals aside, the chart below shows a recent sharp jump in the stock price on good volume ?! What is happening here ? I would welcome any feedback on possible reasons for this interest?