LEEDEN, which specializes in welding, gas & safety solutions posted 1H10 revenue growth of 5.6% y-o-y to S$99.2 million, thanks to TOP received by its Paterson Linc property development project.

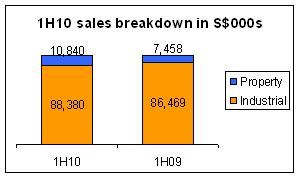

Revenues from its property development grew 44% to reach S$10.8 million.

Revenues from its “industrial” division, comprising of the manufacturing and distribution of industrial welding and safety equipment, welding consumables, industrial gases and related products, increased marginally by 2.2% to S$88.4 million.

Gross profit margins of 29.8%, were the highest in the last five years, thanks to better margins in the industrial division in spite of strong competition.

Profit before tax grew 10.1% to reach S$10.7 million, while profits attributable to shareholders rose 4.3% to reach S$5.3 million.

The company generated S$17.2 million of operating cash in 1H10, compared with S$1.4 million in the previous period, mainly due to better management of working capital.

This allowed the company to reduce bank borrowings and improve gearing ratio to 0.32 times.

Facilities opened during the year include:

1) a new dissolved acetylene plant in Penang, Malaysia,

2) a gas refilling facility in Kuantan, Malaysia; and

3) a fire extinguisher manufacturing plant in Jiangyan, China.

Leeden is also constructing their third welding consumable facility in Malacca, Malaysia.

No final dividend was paid for FY09. Based on its last close price of 37 cents, the company has an annual dividend yield of 2.7%.

Related story: LEEDEN: Turnaround success with award-winning CEO