LEEDEN HAS A long history of some 45 years, the greater part of which was loss-making or profitable only in a small way. Then it had a change of CEO in 2000, a major business restructuring, and the company’s fortunes have since looked up year in, year out.

That CEO is Mr Steven Tham, 58, who was among the 13 recipients of the Outstanding Entrepreneur award out of over 280 nominations at the recent Asia Pacific Entrepreneurship Awards.

Organized by Enterprise Asia, a non-governmental organization in pursuit of entrepreneurship development across the region, the event also honoured, among others, Mr Allan Yeo, CEO of Thomson Medical.

To begin to understand how Mr Tham has moulded Leeden, one has to trace back to the defining experiences in his early career and the towering leaders he said he was fortunate to have worked under.

For five years he worked at Bank of America after he graduated with an honours degree in business administration from the National University of Singapore (NUS). At the bank, his team leader was Ms Theresa Foo, who later rose to become CEO of the Singapore branch of Standard Chartered Bank.

Mr Tham started out as a credit officer and was promoted later to assistant manager, learning frm Ms Foo “how to do things, how to assess applications, how to decide whether a business was good to finance or not”.

In a later period of his life, Mr Tham worked 10 years at Hong Leong Finance, where he regularly had to present his clients’ applications for sizeable loans to a committee, which would discuss the clients’ risk profile and the industry risks.

Being part of the discussion, Mr Tham imbibed business insights from everyone, especially Mr Kwek Leng Beng, the billionaire boss who chaired the committee.

After such close encounters with a fast-rising star and a property guru, Mr Tham was ready to blaze his own trail when he was approached in 2000 to join Leeden as CEO. For that he left his cushy marketing manager’s office in the city for Shipyard Road, an industrial corner of Jurong.

The business that he had to be master of was no new kid on the block: Originally known as Ace Dynamics, it was incorporated in 1964 and listed on the mainboard of the Singapore Exchange in 1975.

When Mr Tham took over the helm of the company, he found it was into a number of unrelated businesses such as the distribution of health food and property development.

He considered it vital for Leeden to develop its core business and be a market leader within each sector it wanted to be in. Over time, the core business became defined as being ‘a value-added integration specialist’ – Leeden provides integrated products, services and solutions for welding, gas and safety to its clients.

Its customers include major oil and gas companies and contractors, shipbuilding and ship repair yards, and steel and pipeline fabricators across Asia.

As its core business became turbo-charged, Leeden began to venture overseas in a meaningful way. Malaysia was a natural choice given the prevalence of heavy industries there. The country’s revenue contribution to Leeden was insignificant prior to Mr Tham joining Leeden, hovering at around RM10 million annually.

Instead of only growing Leeden’s business organically in Malaysia, which Mr Tham considered too slow, he sought to buy stakes in, and form alliances with, businesses in the gas, welding and safety sectors there.

This merger and acquisition strategy came easy to him because he had learnt it in his days at Bank of America along with the financial acumen needed to execute it. The acquisition spree in Malaysia has borne fruit: Last year, Leeden generated around RM120 million in revenue from Malaysia.

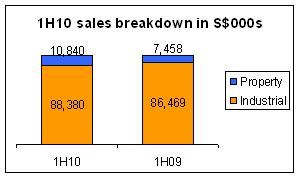

Overall, it was a record year for the company with $13.6 million in profit after tax and record revenue of $157.2 million. Leeden’s cash and cash equivalents as at the end of last year stood at $15.9 million.

This sort of result leads managing director-cum-chief operating officer Kelvin Lee, who has worked in Leeden for 33 years, to conclude: “I would say that for the survival and success of Leeden, Steven takes most of the credit. It was his vision. I have been with the company all this time – I have served under six CEOs - but we didn’t have this kind of achievement. Why were we not able to deliver this new set of numbers, why didn’t we attract bankers’ support? So I say, leadership is very important.”

In another area, the leadership of Mr Tham, who later was also appointed executive chairman of Leeden, became apparent. While Leeden grew its core business, it also quietly made well-timed purchases of land in Malaysia on which it could physically expand its businesses.

Land investment in Malaysia

In the last two years of economic downturn, Leeden bought several parcels of land totaling 44,150 sq m in Malaysia for an undisclosed sum. “I pushed hard for the company to buy land during the recession,” says Mr Tham.

“Our first purchase of land in 2003 was in KL. The freehold land cost RM 30 psf. Now you can’t get it for even RM50.”

Such are the fruits of the tireless traveling to Malaysia that Mr Tham regularly makes for merger and acquisition opportunities and for drawing up operational strategies with his men in Malaysia.

And the acumen for investing in downturns comes from his personal interest in the property market. In his mid-40s, he enrolled in a Master of Science course in real estate in the NUS, where he studied land law and valuation, among other topics. Property cycles happened to be the subject of Mr Tham’s thesis.

In his career with Hong Leong Finance, he had also developed his understanding of the property market through handling numerous property loan applications – and of course working for Mr Kwek, who is a proven sharp investor of properties.

A property purchase in the depths of the recession last year was made in Batam, where Leeden acquired a building at a firesale price to expand its gas and related equipment business. Batam is the staging ground for Leeden’s next move: it is setting its sights to grow its business rapidly in Indonesia, and the rest of the region.

Though it is an agent for many established brands, Leeden cares too about is own brand. That’s why it went through a rebranding exercise two years ago, converting its name from Ace Dynamics to Leeden and starting its own lines of products that do not compete with those of its principals.

The roots of this branding strategy can be traced back to Mr Tham’s early career: he learnt the power of brands when he was a management staff at the various Singapore agents for Citizen and Ebel timepieces, Mont Blanc pens, and at the franchisee for Burger King. In those places he learnt also the art of marketing – a skill that doubtless is at the heart of Leeden’s business, which is distributing a wide range of equipment and solutions to a wide range of customers.

Finally, Mr Tham recognizes the value of people. “He believes in rewarding people. It’s the key way to encourage them to work hard for you,” says Mr Lee. While Leeden’s 1,200 employees are largely skilled but non-tertiary educated, the company has started to attract top university graduates.

One of them who joined a few months ago is Ms Lucia Zhang, who has a Bachelor of Science (first-class honours) from the NUS, majoring in quantitative finance. Another promising talent is Mr Mak Ka Weng who joined a few years ago with a first-class honours degree in business administration.

Even the CEO’s position, in due course, needs a new leader, who should ideally work a couple of years in Leeden first, said Mr Tham, who owns about 21 per cent of the company. (Mr Lee and another executive director, Mr Lim How Boon, own about 13 per cent in total through a jointly-held company.)

Outside of work, Mr Tham likes to play golf (“it’s necessary for business too”) and jog. He is married to Venetia, a vice-president at Bank of America, whom he met in university.

They have a son, Jonathan, 19, who is completing national service, and a daughter, Phoebe, 18, who is studying in Temasek Junior College. A millionaire many times over, Mr Tham lives with his family in a sprawling bungalow in Siglap – which is a good leg up from the rental flat in Queenstown that he and his five siblings grew up in.

This article first appeared in Pulses and is reproduced with permission.