Photo by Sim Kih

TWO TRENDS are positive for homegrown equipment relocation specialist, Chasen Holdings: First, the robust outlook for semiconductor demand.

Second, escalating labor cost in coastal Chinese cities, which is encouraging factories to move inland.

Chasen is a niche logistics player for relocating sophisticated equipment, such as those used in wafer fabrication, TFT LCD panel production, chip testing and assembly, solar panel and pharmaceutical manufacturing.

”We command about 80% of the Singapore market for relocation of sophisticated equipment,” said Mr Eric Ng, Chasen’s independent director who spoke at CIMB’s investor meeting on Tuesday.

Given its position, the boom in global demand for semiconductor sales this year is auguring a strong set of results for Chasen’s financial year ending Mar 2011.

iSuppli has just upped its forecast for this year’s global semiconductor sales growth to 35.1%, up from the 30.9% issued in May.

Rising prices, inventory buildups by manufacturers in response to strong consumer demand for electronic products and richer chip content in key electronic products like smart phones and advanced LCD-TVs were cited by the market research agency as factors contributing to this year’s semiconductor boom.

What’s more, Singapore’s semiconductor sector posted a whopping 89.3% growth during the first half of this year.

Chasen’s business is project based, with lumpy revenue trend, but it is looking for M&A opportunities to secure recurring revenues.

“Projects give better margins but we also need business segments with recurring revenues,” said Mr Ng.

Currently, Chasen’s relocation business in China has only got MNCs as customers but its strategy is to enter joint ventures to tap on partners’ local customer network.

For example, in May, it formed a JV with Sinotrans Air Transportation Development, a PRC-listed airfreight and delivery agency with a network of 85 branches and 300 logistics outlets in China.

In Feb, it entered into a JV with its Shanghai engineering and fabrication subcontractor to break into the PRC construction market.

CIMB has a ‘Buy’ call on Chasen with target price at 56 cents.

Below is a summary of questions raised by investors at the CIMB meeting, and Mr Ng’s replies.

Q: Why is there a need for specialist relocation services?

Manufacturers cannot afford accidental damage to their equipment. Firstly, it is difficult to retune damaged sophisticated equipment. Secondly, replacement takes 6 months. Equipment cost can be covered by insurance but they cannot afford 6 months of production downtime.

Q: Who are your competitors and what is your competitive advantage?

In Singapore’s relocation market, we have a share of 80%. MNCs always require at least 2 suppliers and the second supplier makes up the remaining 20% of the market. The second supplier can be anybody in the transport industry with trucks and manpower.

In China, we have Japanese, Korean and Taiwanese competitors in the relocation business.

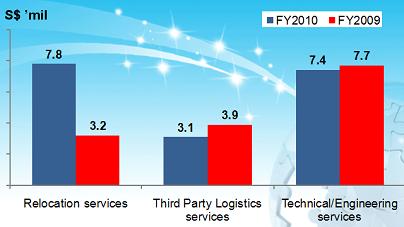

For third-party logistics (3PL), we are one of many suppliers in Singapore, Malaysia and China. For this segment, we ride on our clientele network for relocation services.

For our technical & engineering services, we specialize in steel fabrication for steel structures and industrial buildings as well as machining and contract manufacturing for the telecommunications sector. We tied up with a Swedish customer that is targeting India’s nascent 3G market.

Q: What is your manpower strength?

Our team for relocation services consists of highly skilled (to operate state-of-the-art material handling equipment) and disciplined (to operate in ultra clean room environment) manpower; about 100 in Singapore and 300-400 in China.

Q: What does your transportation fleet comprise of?

We hire the common vehicles like lorries and trucks, but we do own special logistics equipment like air-ride trucks, air cushions and humidity control, that only specialist relocation businesses have.

Q: How will margins be affected by your strategy of diversifying mix of revenue base?

Margins are dependent on the type of industry and their economic cycle.

The relocation business gave us a gross profit margin of 57% when we started. Even though this has eroded with competition, it is still much more lucrative (43% in FY10) than normal logistics services offered by large trucking companies such as Poh Tiong Choon.

For the solar panel relocation business, margins are higher as it is a nascent industry, but this will erode as the industry matures.

For the construction industry, we had better margins during boom times.

Related story: CHASEN: Relocation specialist with strong earnings surge