Last Friday at our "Investment Strategy for a Volatile Market" seminar organised by Lim & Tan I/we were asked what China stock/s investors could look at.

.

I was thinking of adding another - Fuxing China Group. We have already produced an initiation report on China Fuxing Group on July 16, 2010.

I was intending to add Fuxing to my list this Monday but had to make an unexpected trip to Penang that day.

The shares of Fuxing rose more than 10% on Monday on high volume but retraced a little yesterday.

The key reasons for looking at Fuxing are:

a) its strong balance sheet. It has net cash of about RMB595mn or about S$0.15 to S$0.16 per share (higher than the current share price.

b) we expect the company, which has been paying dividends to see the dividend payout rise giving a running yield of about 6%.

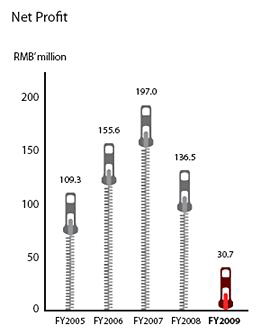

c) the business of the company is set to improve following a collapse of margins in 2009 from the Global financial crisis. We are forecasting profit growth of more than 100% in 2010.

d) the price target in our report is S$0.28 - which offers upside of about 100%.

e) technically the stocks seems to be breaking out of all its moving averages (see chart below) with some resistance expected at the S$0.20 level. The key to this rerating will be its results in 2010 - any confirmation in the earnings recovery that we expect will lead to a rerating.

Read the report for more details.

.