CIMB-GK MAINTAINED its “Buy” call with a target price of 96 cents on Ausgroup last week, citing its relatively cheap valuation in the offshore & marine universe.

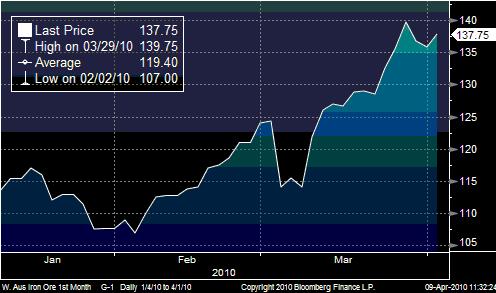

The report was triggered by a structural shift in iron-ore markets in the past couple of weeks as the world’s largest 3 mining companies, Vale, BHP Billiton and Rio Tinto, announced a switch to setting the price of iron ore contracts every 3 months, ending a 40-year system of annual pricing.

The new price system will lift the cost of iron ore to Asian steelmakers to about US$110-$120 a ton for April-June contracts, up 80% to 100% from the US$60 level at which the 2009-10 annual contracts were settled.

CIMB-GK analyst Yeo Zhibin believes that higher iron-ore prices could accelerate capex spending in the mineral resource sector in Western Australia, benefiting specialist construction service companies like Ausgroup.

However for the high profile Gorgon oil & gas project, Australian fabricators such as Ausgroup have been priced out by Asian competitors due to a rising A$.

CIMB-GK expects Ausgroup’s earnings for the financial year ending Jun 2010 to grow 90% year-on-year, given its strong order book of A$470 million.

It has a target price of 96 cents based on 13x CY11 P/E, Ausgroup’s trading average since listing.

”We see stock catalysts from an acceleration in orders wins from LNG and mineral projects, improved margins and further sets of strong results.

”Key risks to our call are execution slippages and lower than-expected order wins,” according to the CIMB-GK report.

CIMB-GK’s bullish report contrasted with OCBC Investment Research's (OIR) update on the Aussie mining resources infrastructure specialist issued 2 weeks ago.

While OIR analyst Meenal Kumar believes that Ausgroup’s 4Q10 (Apr-Jun 2010) revenue will grow sequentially because of completion of works at several LNG projects, she is bearish because of Western Australia’s subdued project tendering activity.

”There is a large potential pool of projects but many players are still taking their time to resume or launch projects due to continuing economic uncertainty.

”Rising costs (especially labour) may be another concern,” according to the her report.

LNG projects that contribute to 2H10 revenues (Jan-Jun 2010) include Woodside's Pluto and BHP Billiton's Rapid Growth Project 5.

OIR has a ‘Hold’ rating and a relatively conservative target price of 60 cents.

Related story: AUSGROUP: Will it rebound with iron ore price recovery?