Excerpts from analysts' reports ....

Deutsche Bank lowers GENTING’S target price to 90.5 cents

Analyst: Aun-Ling Chia, CFA

Lower target price to S$0.905 (-23%); maintain Hold

We have lowered TP to S$0.905, valuing RWS on 13x discounted 2011 EV/EBITDA (vs 14x 2012 previously). The shift in valuation methodology reflects the near-term earnings risks given more punitive junket framework and lack of positive surprises from initial gaming data points.

Key risks: lower-than-projected gaming market size; another downturn in the regional economy. Upside risk is prolonged delay of MBS’s opening.

Our initial thoughts and observation

We visited RWS casino (on Friday) after it soft-opened at 12.18pm on 14 February, the first day of the Chinese Year of the Tiger. At the same time, the Universal Studios Singapore (USS) started one week of sneak peek, where the theme park opens from 5pm to 9pm every night from 14 February to 21 February, showcasing restaurants and shopping venues only, as rides and shows are still being fine-tuned and are scheduled for opening mid- to end-March.

Only half the gaming floor is opened; minimum bets are higher than expected

Despite anticipating large turnout during the Chinese New Year holidays, we were slightly disappointed that only half of the gaming areas were opened. Management defended that strategy and believed that a phased opening would work better given that this is a new property and most of their croupiers (especially those on the main gaming floor) are new,with no real-life experience.

Management prefers a gradual ramp-up to full capacity over the next 4-6 weeks, the speed of which depends on how fast their croupiers can be trained up. According to management, the casino opens with 270 tables including 50 tables at the premium Crockfords Tower.

|

At 10am Friday morning, the casino was not as busy. Entering the casino was brisk, a stark contrast from the 40 minutes to 2 hours wait that some had to endure during the first two days of opening. In the casino, tables are 60-70% full, with most empty tables located in the smoking area. Casino patronage, however, built up quickly after 12pm with most tables operating at close to full capacity. Slots appear to be highly popular with >90% of them occupied.

Though we did not stay for the full day, we would expect the crowd to grow further as casinos normally reach peak capacity in the evening. Management did not share any casino patronage data during the first few days of opening, but commented that newspaper report of 60,000 for the first three days (i.e., an average of 20,000 per day) was not far off. Deutsche Bank previously forecasted 11.1m RWS visitation in 2010, of which 55% or 6.1m will enter the casino. This implies slightly less than 19,000 average casino visitation per day.

Based on our observations, there are roughly 400 tables on the main gaming floor, of which 220 tables (or 55% of capacity) are opened. In terms of games, there are 13 types with baccarat dominating at c. 42% of table capacity, followed by roulette (25%), blackjack (18%) and pontoon (11%). Minimum bets for baccarat/blackjack/pontoon are S$50-100 while roulette ranges from S$2 to S$4 and S$10. Other games have minimum bets that start at S$10.

There are also three multiple-terminal electronic baccarat tables with 32, 40 and 100 terminals each. On the second floor is Maxims Club (Resorts World silver and gold card holders) and Crockfords Club (VIP or Resorts World platinum cardholders). Maxims Club started operations on Friday (19 February, 8pm) while Crockfords has been operational from day one. We understand from our visit that Crockfords has roughly 60 tables, of which 16 tables are in the common area and the rest are spread out in 14 private rooms. All the rooms are booked up over the next few weeks. In total, we understand that there are roughly 600 tables in the casino. This is higher than the 540 tables Deutsche Bank assumed in our projection.

Malaysians are highly visible in the casino

We gather that Malaysians made up a fairly significant portion of the casino visitations. This observation was confirmed later by management: many existing Genting loyalty card members visited the casino over the last few days.

JP Morgan maintains 'overweight' rating on GENTING and $1.20 target price

Analysts: Nicole Goh, Billy Ng CFA, Christopher Gee CFA

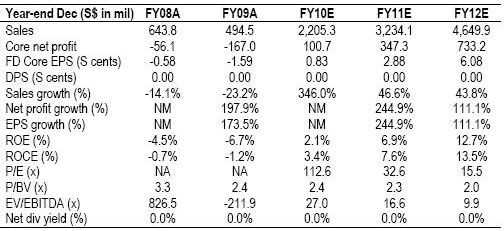

Result slightly below expectations; we maintain OW: Genting Singapore reported an FY09 core net loss of S$167MM vs. our estimate of S$149MM. We are not changing our rating.

Weaker UK operations in 4Q09: UK operations contributed S$23MM in FY09 and S$33MM in 9m09. The weaker 4Q09 numbers are due to a poorer luck factor and weaker attendance.

RWS casino operations within expectations, so far: Visitor arrivals to the casino were 20,000-25,000 per day in the first five days of operation, which could equate to 7.3MM visitors per annum (by simply extrapolating 20,000 visitors per day); this is above our estimate of 5MM visitors to the casino in FY10. This is in spite of the milder marketing efforts given the initial uncertainty of the opening date. Note that the company is maintaining its visitor arrival forecast of 13MM visitors within the first year of opening.

Share price has been weak lately and may remain weak in the short term: This, we believe, is due to (1) recent mandatory conversion of S$322MM of CBs into 338MM new shares, and (2)some initial issues such as the long lines outside the casino and less experienced dealers.

Price target, valuation, key risks: We remain OW on the stock with a fundamental PT of S$1.20 as we believe in the long-term prospects of the two Singapore IRs, while we believe that there is upside potential to our FY10E numbers (judging by the very preliminary numbers above). We reiterate the benefit Genting should reap from having100% market share in the casino segment for at least the next three to five months before the opening of the Sands casino.