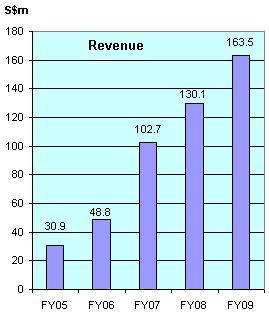

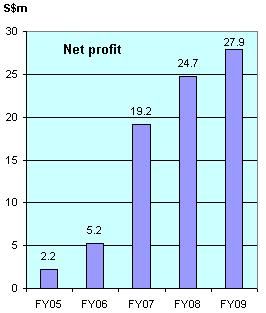

ROXY-PACIFIC Holdings has just reported record revenue and profit for 2009.

The question investors are asking is, can the trend continue for this developer of residential properties?

For the answer, analysts are weighing the following.

#1. Yet-to-be recognized $281-m revenue

This year and next year, Roxy-Pacific (www.roxypacific.com.sg) will recognize a total of $281 million in revenue from the development properties it has pre-sold.

Roxy-Pacific recognises revenue according to the percentage of completion of the projects.

Mr Teo Hong Lim, executive chairman and CEO of Roxy-Pacific, estimated that the revenue split would be 50-50 for each of the two years.

He said so in a reply to a question at a briefing for guests from the investment community last Friday (Feb 19).

At around $140 million, the annual revenue for property development will exceed 2009’s figure of $124.1 million.

(Roxy-Pacific's other core business is hotel ownership and property investment, which contributed $39.4 million in 2009. More on that later.)

So, even if Roxy-Pacific has no new property to sell, it will still enjoy revenue which exceeds 2009’s figure for the next two years.

#2. Six property projects to launch, $300-400 m revenue to reap

Roxy-Pacific, however, is busy. Mr Teo told the briefing last Friday that it would launch at least four property projects this year.

Revenue from the sales will be recognized from 2011 onwards.

The bulk, if not all, of the revenue is expected to be recognized in 2011 and 2012.

Roxy has another two development sites, which were acquired last year along with the other four.

In all, the six property projects (which were acquired for $206 million) have a gross floor area of 33,014 sq m.

The sales revenue from these six projects potentially could amount to $300-400 million, based on a conservative selling price of $1,200 psf, said Mr Teo.

In brief, Roxy-Pacific has $281 million of revenue to book from projects already sold, and another $300-400 million for six projects yet to be launched.

These figures suggest that the record-breaking has a good chance of continuing. In the meantime, Roxy-Pacific continues to scout around for new landbank at good prices.

Mr Teo Hong Lim (right), chairman & CEO of Roxy-Pacific, chatting with investment professionals after the results' briefing. Photo by Leong Chan TeikIN ITS other core business, Roxy-Pacific

Mr Teo Hong Lim (right), chairman & CEO of Roxy-Pacific, chatting with investment professionals after the results' briefing. Photo by Leong Chan TeikIN ITS other core business, Roxy-Pacificowns a four-star hotel, Grand Mercure Roxy (located opposite Parkway Parade), and 88 retail shops at Roxy Square Shopping Centre and Kovan Centre.

Along with the rest of the hotel industry in Singapore, the Grand Mercure Roxy hotel experienced a decline in revenue last year.

The hotel reaped $37.5 million in revenue, down by 23%.

The revenue decline contributed to a lower valuation for the Grand Mercure Roxy Hotel, explained Mr Koh Seng Geok, an executive director of Roxy-Pacific, during the analysts' briefing.

Taken together, the hotel and Roxy-Pacific's office premises were revalued at $232.4 million, down from $278.4 million previously.

As a result, the RNAV of Roxy-Pacific stood at 47.33 cents a share as at end-2009, compared to 50.70 cents a year earlier.

On this year's outlook, Roxy-Pacific noted that Singapore Tourism Board statistics show visitor arrivals in Singapore hit a record 971,000 in Dec 09 - and that's before the opening of the two Integrated Resorts.

Grand Mercure Roxy has seen its average occupancy rate and average room rate rise in Q4 over previous quarters.

More details can be found from Roxy-Pacific's announcements to the Singapore Exchange (www.sgx.com).

Recent NextInsight stories:

ROXY-PACIFIC: Replenished landbank, now gearing up for sale, sale

ROXY-PACIFIC: Stock price 28 cents, RNAV 60 cents