PRICES OF residential properties, now at 8% below the 2007 peak level, will exceed the peak by end of this year, predicted Goldman Sachs in a report today (Jan 13).

It said foreign buying will underpin local demand, which has yet to run its course.

”We expect the high-end to lead for the better part of 2010; there is still positive carry in rental yields, as rents hold steady even as consensus braces for a 10% decline.

”Mass market is more subdued, but affordability and sizable HDB home equity remain supportive of an up-cycle.”

Goldman Sach's views are more bullish than the market, which has turned increasingly divided

over further potential upside.

Goldman recognised the dampening effect on sentiment of slowing new sales (off record highs) and risks of government intervention.

Goldman Sachs has raised its residential price forecasts and now expect high-end properties to rise 10-15%, and mass market, +5-10%.

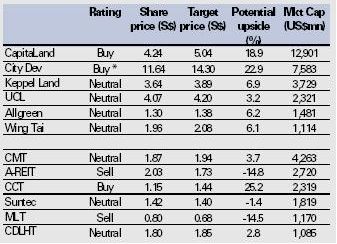

It sees City Development as being the most leveraged to upticks in residential demand drivers as 70% of its land bank is in the high-end sector.

Goldman added the stock to its CL (Conviction List) Buy list with a 12-m target price of $14.30,which means a 23% upside potential.

It upgraded CapitaCommercial Trust to Buy from Neutral, with a target price of S$1.44, which is a 25% upside potential, saying that the REIT is a “quality laggard” with attractive dividend yields (6.5%).

Goldman raised the 12-month target prices for developers by an average of 19%, Net Asset Values (NAVs) +19%, with no change to midcycle NAV discounts.

Its S-REITs target prices have been revised up 28%.

Goldman said its key views for 2010 are:

1. Residential drivers remain strong. Slowing new sales should not be mistaken for renewed weakness; normalization from record high levels to 10,000-11,000 units p.a. is to be expected (2006 the new normal, 10-15% above consensus). Govt land salespoint to rising supply, but we think: 1) sites released in 1H2010 will only be available for launch in 2Q2011; 2) inventory still benign, is expected to rise to 16-18 mths from 12 mths today.

2. Markets are already anticipating mild policy measures. Slowing sub-sales activity, an indication of speculation, allays some concerns. We expect foreign buying will underpin latent local demand. We see high-end transactions leading the market for the better part of 2010, while mass-market takes a breather. Affordability and sizable HDB home equity remain supportive of an up cycle. Residential prices are now 8% below the 2007 peak level. We expect prices to return to peak by end-2010; we see high end prices rising 10-15%, and mass rising 5-10%.

3. Developers’ demand concerns still trump the need to replenish land banks, suggesting a new wave of en-bloc sales is not yet in sight. As a group, developers made S$2.5bn in land purchases in 2009, flat over 2008, and some 75% below 2006 peak levels, despite record take up in 2009. Acquisitions as a percent of sales is the lowest in over 5 years at 15% (peaked at 71% in 2006).

4. Our office stabilization views are playing out, the slowdown in rental decline provided welcome relief. Stocks have re-rated on 'less bad' data, exceeding our expectations. Upside now more limited; we advise staying selective. Investment demand will be slow to return, and may not drive cap rates much lower from here, as:

(1) REITs funding costs still exceed asset yields.

(2) Private Equity dominated 48% of sales in 2006-07, but still sits on sidelines. We see prime grade A rents rising 10% in 2010.