CHINA PHARMACEUTICAL GROUP (1093 HK) sees the finished drugs business as the best way to support the company’s long-term growth.

Listed in Hong Kong for over 15 years, the drugmaking giant currently has four major product categories: penicillin series; cephalosporin series; vitamin C series, and finished drugs.

To enhance profitability, China Pharma is progressively adjusting its output to put more weight on its vitamin C series and finished drugs, and less on its penicillin and cephalosporin series, Executive Director Eddie Chak told NextInsight, Aries Consulting and a group of Greater China fund managers in Hong Kong last week.

“Vitamin C became a bigger profit earner last year and this year, and we currently have an over 20% global market share for the product,” Mr. Chak said.

He was being tactfully modest with us, because the fact is that last year vitamin C revenue rose 96% to 2.2 bln hkd, and gross profit for the popular common cold-fighting vitamin was up 195% at 1.2 bln hkd during the same period.

Mr. Chak added that the major export markets for its vitamin C series products were the US and the EU, which differed from that for its penicillin exports, which were primarily destined for India.

“As for vitamin C and our global market share, we don’t plan on relinquishing that position anytime soon.”

He added that another advantage to producing vitamin C was the relatively less onerous regulatory restrictions on its production.

“Penicillin production often faces much greater environmental constraints with more serious problems. For producers, factory stoppages are a frequent possibility.”

China Pharma’s factories are all in northern China, namely Shijiazhuang in Hebei province, and Hohhot in Inner Mongolia.

As proof of the growing awareness and popularity of vitamin C as well as the company’s antibiotic products, both as a bulwark and cure to communicable respiratory ailments, China Pharma saw much brisker orders for its finished antibiotics when the mercury began to plummet.

“We always see a fourth quarter sales spike as flu season approaches,” Mr. Chak said.

And he should know, having seen his share of autumns come and go in the industry.

Mr. Chak was appointed executive director of China Pharma in 2005, and holds a CPA and an ACCA. A graduate of Hong Kong University, he has over 19 years of experience in auditing and financial director management.

He said the company expects its revenue next year to be underpinned by a healthy proportion of long-term orders.

Over half of its vitamin C contracts are for export through long-term (1-2 years) fixed price contracts with well-known clients including GSK, Wyeth and Coca Cola. Usually, more long-term contracts are signed in the fourth quarter than the first three quarters, further making the October-December period a heyday for sales of the vitamin.

But China Pharma expected domestic sales of vitamin C to gradually chip away at the heavy reliance on exports due to tremendous untapped potential in China.

Chinese per capita consumption of the vitamin is merely four grams per year, shockingly low when compared to 6,090 g/yr for developed countries.

Analysts have recently said that they expect Chinese demand for vitamin C to increase around 20% annually over the next few years.

For example, Merrill Lynch said such growth forecasts for the vitamin are based on: 1) strong growth in the nutritional supplement segment driven by improving income, higher standards of living and higher health awareness; 2) new food safety policy in China promoting the replacement of an older generation of food preservatives with vitamin C, a commonly used preservative in developed countries, and 3) mid-teen growth in the overall drug segment.

It added that China would likely carry global sales of the vitamin going forward given its low base level.

Production tweaks: Just what the doctor ordered

A quick glance at the company’s turnover breakdown pie chart makes it clearly evident why vitamin C and finished drugs were the new darlings of the drugmaker.

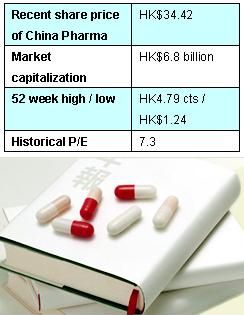

Last year, total revenue rose 37% to 6.8 bln hkd. Among this, vitamin C series and finished drugs comprised 32% and 29%, respectively, of the top line.

This represents a substantial jump for vitamin C, which in 2007 contributed 22% to total turnover.

“We’re aiming for double digit revenue growth,” Mr. Chak offered, suggesting that pharmaceuticals – even with heavy export reliance – were less prone to the vagaries of global recession.

"We’re also aiming for 20% annual growth for finished drugs,” he added.

In fact, some of the more bullish market forecasts say that within three years, finished drugs might contribute over three-fifths of China Pharma’s profitability!

The company expects to see further sales upside from the ongoing 4.5 trln yuan economic stimulus package, and continuous efforts by Beijing to make health care more accessible and affordable to all 1.3 bln citizens, especially in the less developed rural areas which still account for around two-thirds of the country’s total population.

But China Pharma realized that while rural demand for its pharmaceuticals was just what the doctor ordered, the company had a lot of work to do before its extensive distribution network and marketing campaigns reached the farmers and rural denizens in the vast hinterlands.

“The rural market less developed for us,” he added.

In a recent report, Merrill Lynch added that with its established portfolio of generic/non-prescription drugs and a sales force of 2,400 concentrating on the lower end of the market, China Pharma is well positioned to benefit from the ongoing healthcare reforms, which specifically emphasize lower end healthcare spending.

“We expect finished drugs to become China Pharma’s major profit earner (contribute >60%) by 2012,” the report concluded.

Mr. Chak said that the company did not sell directly to hospitals, using the far more efficient and corruption-resistant channel of selling to wholesalers instead.

“Wholesalers are our main customers and it’s more cost effective. We have some 1,500 wholesale partners.”

China Pharma was well aware of the importance of brand building in the industry – one in which reputation and quality directly influenced sales and literally had the potential to better the health and livelihoods of consumers.

"We advertise extensively in China. Our ads for corporate brand building and health supplement products are up,” he said.

As for the often unstated rivalry between Western medicine (China Pharma’s bread and butter) and traditional Chinese medicine (TCM), he said that the former would most likely be the bigger beneficiary of government stimulus measures and healthcare reform initiatives, despite this country being the birthplace of TCM.

“To be honest, I don’t know much about TCM. But the ongoing healthcare overhaul will benefit Western medicines like ours more, partly due to their clinical verifiability and proven track record, as well as safety issues. There is much more upside growth potential for Western medicines and a growing demand in China,” he said.

NextInsight asked him if players in China’s pharmaceutical sector were victims of their own success, given the notorious and thriving counterfeit industry that churns out virtual copycats of any product that so much as flirted with legitimate market success.

“It’s inevitable here in China that jealous upstart rivals will bootleg our brand. But we will continue to cooperate with authorities to crack down on this wherever and whenever it appears.”

But Mr. Chak was confident that China Pharma had the right prescription for success in the pharmaceutical industry.

“Our major domestic rival only produces penicillin and finished drugs....but they don’t have vitamin C operations.”