FUJIAN ZHENYUN Plastics Industry (振云塑业), whose Chinese name means “shake the clouds,” hopes to see more terrestrial shakeups with more laying of pipes under China’s grand infrastructural development plans.

The Singapore-listed firm had a strong 2008, despite the second half of the year being marred by a global financial crisis.

Revenue in 2008 rose 18.1% to 568 mln yuan, while profit attributable to shareholders was up 15.5% at 79 mln.

And the company’s heavy sales reliance on China’s domestic market has helped Zhenyun avoid the pitfalls of hitching one’s wagon too closely to slumping external demand.

Betting on China’s 4.5 trln yuan Big Dig

Fujian Zhenyun Plastics is looking to China’s 4.5 trln yuan stimulus package – the bulk of which is earmarked for public works and infrastructure projects – as a godsend for pipe orders.

Any government drive to boost public works projects is music to the ears of the Fujian Province-based firm as its polyvinyl chloride (PVC) and polyethylene (PE) water distribution piping systems and fittings are used in sectors including building and construction, agricultural, municipal infrastructure, and industrial chemical industries.

Its communications piping systems and fittings are for expressways, municipal roads, bridges, broadcasting, and under ground telecommunications.

Zhenyun’s plastic pipes also provides gas piping systems and fittings.

“We have benefited from the stimulus package. China’s government has pledged to invest four trln yuan in engineering projects by 2010,” said Mr Lin Fei, Zhenyun’s Deputy General Manager.

In an exclusive interview with NextInsight, Mr. Lin said: “Among these are major projects to pump public funds into improving potable water and irrigation systems to rural areas.”

The global financial crisis has certainly brought many challenges to Chinese companies.

“To confront this head-on, the Chinese government has pledged a major increase in infrastructural investment, in order to stimulate demand for both upstream materials and downstream services to make everything happen. So at this point in time, negative impacts from the financial crisis are not unmanageable."

Mr. Lin said Zhenyun “closely follows” market trends, and the progress of various infrastructure tenders and projects.

“We are also constantly promoting our brand image, organizational structure and quality control to boost our market share and protect ourselves amid the global downturn.”

Pipes for Sichuan reconstruction

The company is also seeing orders emanating from the ongoing rebuilding work in mountainous areas of Sichuan Province, which was devastated by a massive earthquake in May 2008.

“We are contributing to ongoing reconstruction efforts. We are aiming to be an integral part of the rebuilding work there, having last year won an over 43 mln yuan of orders.”

Zhenyun is not only a Chinese firm, but is also still very much bound to its home market for revenue generation.

“We are still very much dependent on the domestic market for sales, with relatively few exports, so the drying up in external demand on the back of the global financial crisis has not hit us that hard. Over the past four years, our sales composition by region has not had a major shift in direction.”

And although the company is predominantly focused on the domestic market, this doesn’t mean it is not taking steps to hedge itself against slowdowns overseas.

“Our company is working to enhance its brand image in order to stand out from the crowd. We are also strengthening our product mix, boosting quality and taking other steps to enhance our market position and overall competitiveness.”

The financial crisis that began on Wall Street last summer and soon after shook Main Streets worldwide, is also offering a silver lining of sorts, providing Zhenyun with a growth opportunity through non-organic means.

“The global credit crunch has depressed prices for acquisitions worldwide, so naturally we are looking at attractive M&A options. From the point of operational stability, in order to maintain rapid growth, we believe growth through acquisitions is the best option for us right now,” he said.

“We are keeping a close lookout for desirable acquisitions in this buyers’ market. We have singled out several related enterprises, and may decide to move forward with a bid following further consideration.”

He added that a slower economy also provided relief on wage and raw material inflation, at least until business picked up again.

“Due to the economic recession, raw material prices are softening to pre-downturn levels. Wages currently account for around over 2% of total production costs. Therefore, it can be said that wages and material costs are less of a burden for us now.”

Mr. Lin added that China’s housing market, which has also taken a big hit over the past several months from historic highs prior to the Beijing Games in August of last year, is taking a bite out of the company’s plastic pipe orders from property developers.

“Currently, the property market situation is not exactly robust. Therefore, we are paying very close attention to all government tenders up for grabs to be ready to pounce on any desirable projects. This ‘ear to the ground’ attentiveness will help us weather the current real estate downturn.”

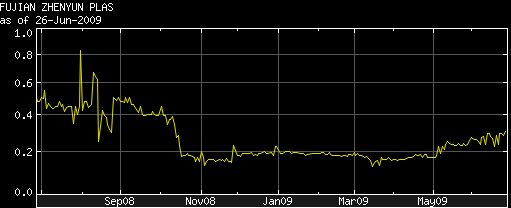

Fujian Zhenyun launched its initial public offering in Singapore of 35 mln shares at 62 Singapore cents each, with the IPO consisting of 33.25 mln placement shares and 1.75 mln retail shares.

“The directors of the group believe that an increase in urban development and redevelopment of old cities, ongoing infrastructural development and large-scale construction projects (in China) will give rise to a general increase in demand for plastic pipes,” the company said at the time, foreshadowing a growth strategy that is still followed today.

Zhenyun has yet to recover to its IPO valuation, suggesting it may be a bargain at the curent price of 0.295 sgd and with pipe orders expected to hitch a ride on stimulus spending.