Major customers of Goodpack include major tyre manufacturers and chemical companies. Goodpack’s fleet of 1.9 million Intermediate Bulk Containers (IBCs) are used in over 60 countries worldwide and its operations span the globe in areas such as Africa, Asia, Europe, Middle East, North America, Oceania and South America.

THE CASH tap turned on happily for Goodpack in Q2 (Oct-Dec ’08) when US$1.85 million from operations flowed in compared to an outflow of US$8.7 million in Q2 of 2007.

Two reasons were given by the Singapore company, which is the world’s largest lessor of boxes called Intermediate Bulk Containers, or IBCs, for transporting cargo such as rubber:

a) Double-digit revenue growth.

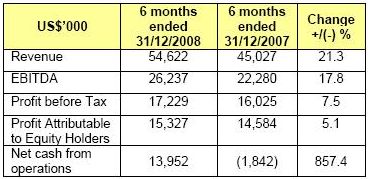

Despite the overall decline in global trade volume, Goodpack posted a 21.3% increase in its 1H2009 (July-Dec ’08) turnover to US$54.6 million.

b) Faster collection of its accounts receivables.

Receivable turnover days improved from 146 days as of 30 June 2008 to 117 days as of 31 December 2008.

There is less positive glow when it comes to the net profit. For Q2 of FY’09, Goodpack reported a 1.3% dip in net profit despite a 13.4% rise in revenue. Similarly, for first half of FY ’09, the figures are 5.1% and 21.3%, respectively.

Stock has declined 60% in the past 12 months.

Goodpack’s explanation for profit growth lagging revenue growth:

a) Higher depreciation (US$6.79 m for first half, up 32.5%) arising from new IBCs added to the fleet, which now stands at 1.9 million boxes;

b) Increased interest expenses (US$2.22 m for first half, up 96.5%) on higher loans taken to finance expansion of IBC fleet;

c) Increased forex losses; and

d) Absence of a gain on disposal of fixed assets.

It said that excluding these additional expenses which amounted to US$4.2 million, the Group would have registered a 33.8% growth in its net profit for the six months ended 31 Dec.

David Lam, chairman of Goodpack.

Photo by Sim Kih

Photo by Sim Kih

In a strong signal of the stability of its business, Goodpack said that over the last 6 months it had renewed contracts with most of its key customers for the next three to five years.

Challenges it has identified and which it is tackling are demand uncertainty, logistics & handling expenses as well as interest rate and foreign exchange volatility.

Goodpack stock has fallen 60% in the past 12 months.

At 66 cents, it recently traded at a current-year PE ratio of about 7 based on an annualized earnings per share of 6.58 US cents.

Kim Eng Securities has upgraded the stock from a 'hold' to a 'buy' as its valuation is the low end of its eight-year PE band of 8-28X.

The analyst also expected Goodpack to report improved margins in the coming quarters as a result of cost-cutting initiatives. Kim Eng's price target for the stock is $1.04.

Recent story: GOODPACK: The man behind its sterling results