Please read this together with the company's press release and full financial statement at www.sgx.com

GOODPACK LOOKS set for a new phase of growth as it seeks out business in new industries after having concentrated on the rubber and fruit juice industries all these years, transporting their goods in special Intermediate Bulk Containers (IBCs).

Listed on the SGX since 2000, Goodpack is the No.1 player in its business in the world, and owns 1.9 million of the containers which it leases out for transportation.

As an illustration of Goodpack’s value proposition, 16 of its fully-laden IBCs can fit into a container.

After the contents are unloaded, 144 IBCs can be nested into each other inside a container for the return journey. In the case of conventional containers, 16 can fit into a container, laden or otherwise, which spells higher transport costs.

Printing ink may seem like an unusual cargo for Goodpack but it has clinched a major contract with an Indian company to export the ink to Europe and the US, said Mr Michael Liew, executive director of Goodpack at a briefing for analysts yesterday evening after the company’s FY09 (ended June) results were released.

Auto parts is another new industry being targeted: Small contracts in India, China and the Philippines have already been clinched and major Japanese automakers are currently trying out the IBCs.

Goodpack will set up an office in South Africa because the country produces a large volume of BMW parts which are exported.

”Auto could be the star player in our next financial year,” said Goodpack chairman David Lam.

Asked what the conventional packing is for auto parts, David said: “It’s wood. They pack less, we pack more.”

Chemicals is also on the list, as Goodpack seals up the sides of its older IBCs (more than 15 years old) to make it leak-proof for transporting these liquids. Chemicals have traditionally been packed in drums or steel-reinforced cages.

“I’m pretty excited about this industry. The volume is huge,” as David said.

Goodpack could lease its IBCs at half the rate that its competitors sell their containers for one-time use.

Goodpack has recently employed a chemicals industry veteran in Singapore to pursue clients in this business segment. In all, the company will hire 50 sales and marketing staff in selected countries who are experienced in their own industries to develop Goodpack’s new business segments.

Asked about the supply of additional IBCs for the new business to come, David said Goodpack would not be coming up with the money for capex. Its Chinese supplier, who is also a shareholder of Goodpack, has agreed to build the IBCs for lease exclusively to Goodpack.

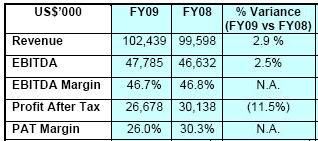

To better illustrate the business performance for FY09, Goodpack’s CFO-designate Lok Pei San used a fixed exchange rate for the year and the previous year, which cancelled out the effect of the USD rise against the euro and won in FY09.

Goodpack has subsidiaries in Europe and South Korea, whose financials are consolidated into Goodpack’s in USD.

Under the fixed exchange rate, Goodpack’s revenue and net profit rose 9.2% and 1.3% to US$108.8 million and US$30.5 million, respectively.

But taking into account the forex fluctuation, the corresponding figures were US$102.4 million (+2.9%) and US$26.7 million (-11.5%).

Goodpack proposed a 2-Singapore cent final dividend and a 1-Singapore cent special dividend, unchanged from the previous year.

Recent stories:

GOODPACK: Buying by 2 foreign funds

GOODPACK: The man behind its sterling results