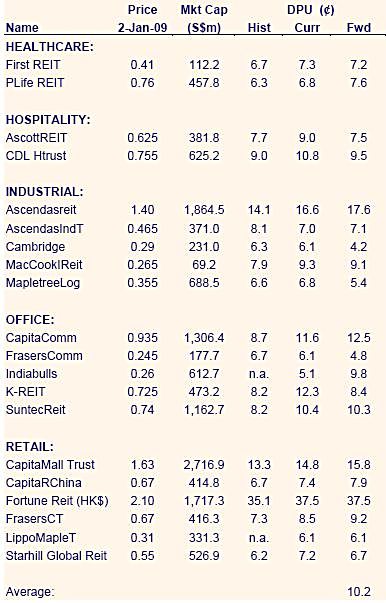

Part 1 of a wide table from UOB Kayhian report.

UOB Kayhian this morning issued an ‘overweight’ rating on Singapore REITS, saying that it believed that REITS’ share prices had bottomed.

Last year, Singapore REITs plunged 56.3%.

The upside potential was emphasized by UOB Kayhian. ”Besides providing visible and recurrent income, there is further upside potential if credit market normalises in 2H09,” said analyst Jonathan Koh.

Its preferred BUYs are:

* Frasers Centrepoint Trust (FCT SP/BUY/Target: S$1.30) and CapitaMall

Trust (CT SP/BUY/Target: S$2.65) for retail;

* Ascendas REIT (AREIT SP/BUY/Target: S$2.72) for industrial;

* Ascott Residence (ART SP/BUY/Target: S$1.06) for hospitality;

* Suntec REIT (SUN SP/BUY/Target: S$1.33) for office Reits.

The yield spread between Singapore REITs and 10-year government bond has receded from 11.7% in early Dec 08 to 9.8% currently.

“Nevertheless, a flattening yield curve will provide a boost as it eases pressure from the risk of refinancing. It also makes REITs more attractive to investors focusing on income and yield,” wrote Jonathan.

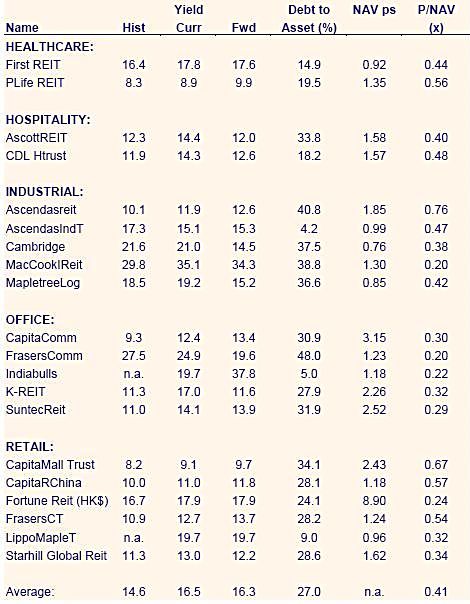

Part 2.

Recent story: CAMBRIDGE REIT: Ratings by JP Morgan, Nomura, UOB Kayhian

Forum thread: REITS: Please weigh the risks