� A slowdown looks unavoidable as land bank and pent-up demand dry up.

� High-end segment looks set to rebound in 2010; +10% price rise.

� Favour high-end and large land bank; key picks: City Dev & SC Global.

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Excerpts from report by BNP Paribas analyst Dr Pang Chin Hong

NEUTRAL; risks on the rise, but downside limited

We maintain NEUTRAL on the property sector. Our analysis shows that a further property price increase in the mass-market segment is unlikely in 2010. This is due to unsupportive fundamentals:

1) rental yields are approaching a 10-year low;

2) eroding affordability as interest rate rises;

3) the pent-up demand of 2008 has been met by YTD sales; and

4) the government is determined to control any erratic run-up in property prices. However, we believe price downside is limited, given a resilient HDB market and economic recovery.

Rental yield to hit 10-year low; affordability limits price run-up

A clear divergence arose when property prices spiked up while rentals fell further in 3Q09. This has caused rental yields (i.e. 4.3% for non-landed properties) to compress towards a 10-year low of 3.7%. To reach this low, we estimate price upside would be capped at 17%. A turnaround of rentals is unlikely in the next few quarters, due to the large upcoming supply. We estimate more than 7,500 units will be completed in 2010, vs. the URA’s estimate of 5,737 units, which could surprise the market negatively. Historical evidence shows that the URA estimates could be wrong by as many as 3,800 units.

A slowdown may not be a bad thing; fading regulatory risk

New sales fell for the third consecutive month to 811 units in October after peaking in July at 2,767 units. We believe pent-up demand has been met, given sales of 13,770 units YTD (15-year average annual sales: 8,000 units; 2008:4,384 units). With both sales and speculative activity (i.e. subsales) showing signs of cooling, the risk of further government measures is fading, in our view.

Middle- to high-end segment to outshine the mass market

A slowdown looks unavoidable as land bank is depleting. We estimate only 6,716 units from 32 new developments could be launched by the 30 listed developers in 2010 and would largely consist of middle- to high-end properties (76%). Sales of high-end homes may recover when the two integrated resorts (IRs) open.

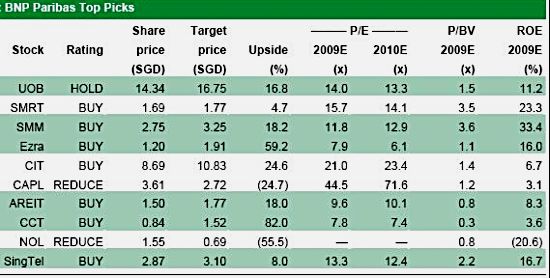

Size and segment do matter; favour City Dev and SC Global

Our analysis shows that share prices of many developers will be range-bound in 2010, as we see little upside to property prices. This is with the exception of the high-end segment, where we forecast a 10% price hike. Thus, we favor developers with large exposure to the high-end segment and sizeable land bank as competition in land bidding is intensive. Key picks: City Dev and SC Global.