That’s 1.2X price/book value, compared to the ‘unappealing’ 1.5X that the recent rally has stretched valuations to, which is close to the historical average of 1.6x P/BV.

At 1.5X, the market has factored in an economic recovery, but as long as a strong global economic recovery remains opaque, it is unlikely for valuations to stretch beyond the historical average, said the research house.

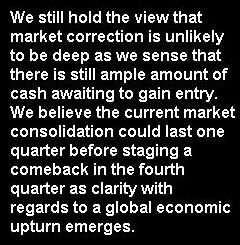

However, ”we still hold the view that market correction is unlikely to be deep as we sense that there is still ample amount of cash awaiting to gain entry. We believe the current market consolidation could last one quarter before staging a comeback in the fourth quarter as clarity with regards to a global economic upturn emerges.”

BNP Paribas report dated June 24

BNP Paribas ventured that given the magnitude of the upswing, a 20% price pullback from its recent peak can be expected. This means the market could decline another 10%, having corrected 10% from its peak in recent weeks. This will bring market P/BV valuation to 1.2x or an index level of 2,000.

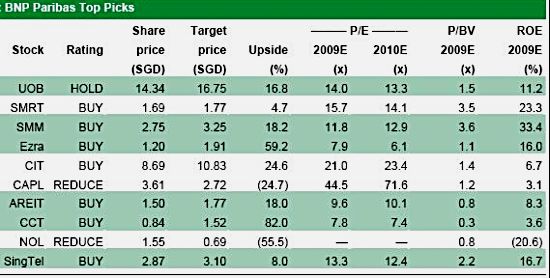

As risk appetite recedes, defensive names like SMRT, SingTel, StarHub, SingPost and SPH will start to outperform the market, according to BNP Paribas which has a ‘buy’ on SMRT and SingTel but a ‘hold’ on StarHub.

Source: BNP Paribas report authored by Ng Wee Siang and his Singapore research team.

Buy cyclical names as market corrects

“We recommend investors accumulate stocks on price weakness. For that, we prefer the larger and higher-beta sectors like banks (UOB is our preferred pick), property (City Developments) and offshore and marine (SembCorp Marine),” said BNP Paribas.

At this juncture, the research house has a ‘neutral’ stance on the banking and property sectors, but a positive stance on the offshore and marine sector. For exposure to small-cap names, BNP Paribas recommends CSE Global and Ezra Holdings.

FSSTI raised to 2,600

BNP Paribas raised its FSSTI target to 2,600 from 2,500 previously as it rolled over its base year to 2010 (from 2009) and after ascribing a 1.6x P/BV multiple (previously 1.5x).

BNP said the higher P/BV multiple is warranted as it believed the recent round of highly-dilutive rights issues is drawing to an end.

“We maintain our OVERWEIGHT stance on Singapore. However, our regional strategist, Clive McDonnell, has an UNDERWEIGHT rating on Singapore from a regional perspective, as high-beta North Asian markets are his preferred choice. Clive is of the view that on a relative basis, the Singapore market will continue to underperform compared to the North Asian markets.”

Goldman Sachs June 09

Recent stories:

UBS: The rally ain't over

UOB KAYHIAN: Overweight S-shares but be careful!

Post or read comments in our forum here.