Report authored by Ng Wee Siang and the Singapore research team at BNP Paribas.

BNP PARIBAS said it expects the Straits Times Index (STI) to climb to 2,500 points this year from around 2,100 currently, due to what it calls a “confluence of positive factors” driving up valuations.

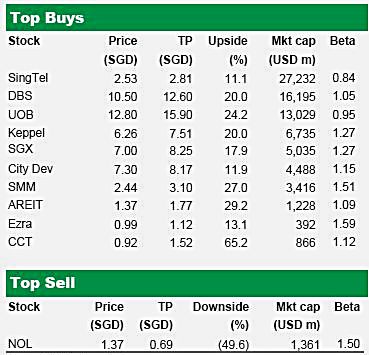

“For exposure, we recommend proven high-beta names like UOB, DBS, KEP and SMM,” the French investment bank said in a note to investors yesterday.

The market value-weighted index charts the movement of 30 representative firms listed on Singapore'’s mainboard, BNP said it is raising its STI target based on a 1.5x 2009 estimated book value (BV).

“We foresee room for the market to re-rate further. Despite the recent rally, the Singapore market remains attractive from a valuation standpoint. Priced at 1.2x 2009E BV, the market still trades at one standard deviation below its historical mean since 1997. Valuation aside, signs of a global economic recovery augur well for the equity market.”

It added that while economic indicators are still mixed “this is to be expected at economic turning points. Unlike the past, the economic implications from the unprecedented measures adopted by global policymakers are likely to be more compressed and intense.”

BNP said it expects more positive data to come through in the months ahead to fuel the market rally.

“Anecdotal evidence suggests that pessimists still outnumber optimists and the notion of a global economic recovery has not become mainstream leaves room for positive surprises.”

It urged investors not to ignore this “sea of liquidity.”

“We expect this rally to continue, in part powered by the sea of liquidity. There is as much as S$296.7 bln liquid cash that could be deployed into equity investments. The cash ratio (measured as a percentage of Singapore’s market capitalization) has recently risen to unprecedented highs as risk appetite shrank. With so much liquidity waiting to be ploughed into the market, any market correction is likely to be shallow.”

The brokerage urged an increased investment exposure to beta counters.

“To profit from this cycle, investors need to be pragmatic with their investment views, abandoning them after a time, in our view. Our preferred sectors are banks (upgraded sector view: POSITIVE) and offshore and marine (no change).

Source: BNP Paribas

"We are NEUTRAL on the property sector. For exposure to high-beta names, we recommend UOB (top sector pick), DBS, SembCorp Marine (top sector pick) and Keppel Corp. NOL remains our top SELL given its weak sector fundamentals.”

It said it now rates OVERWEIGHT the Singapore market from a country perspective.

“However, our regional strategist, Clive McDonnell, has an UNDERWEIGHT on Singapore from a regional perspective, as high-beta North Asian markets are his preferred choice.”

It urged investors to “ride the liquidity wave.”

"In our view, there is still upside to be had despite the recent market rally. Our sense is non-believers still outnumber optimists and most funds are still sitting on the sidelines awaiting a significant market correction."

It said that denizens of the city-state were sitting on a “massive cash hoard” which would best be served by moving from savings accounts to securities.

“Over the past 12 months, the financial meltdown led to Singaporeans stashing money in the safe haven of bank deposits. The result was Singapore’s customer deposits surging from S$266.3 bln in December 2007 to S$296.7 bln as of March 2009."

BNP said the S$296.7 bln kneeling mantis-like in savings accounts represents the level of cash that can be deployed into equity investments instead of being kept in the low-yielding fixed deposit accounts, which currently reward savers with less than a 1% interest rate.

“A massive built up in liquidity within the Singapore banking system shows that our more narrowly-defined cash level (expressed as a proportion of Singapore market capitalization) is at unprecedented highs. With so much liquidity waiting to be ploughed into the market, any market correction is likely to be shallow. If the market rally continues, the bears may capitulate and start coming in droves, driving the equity markets significantly higher.”

BNP said its relatively sanguine view on Singapore’s economy is based on real-time, on-the-ground assessments.

“Green shoots are blossoming. Our belief of an economic recovery following various stimulus packages put together by global policymakers is vindicated, with signs that the global economy has past it worst phase emerging. The economic indicators are arguably mixed but this is to be expected at economic turning points. The impact should continue to filter through for the rest of this year, in our view.

Source: BNP Paribas, CEIC

“Already, we have seen a sharp rebound in BNP Paribas leading Asian export indicators and Singapore’s Purchasing Managers’ Index (PMI) as depicted. We expect the global leading economic indicators to start reversing from their downward trend soon, given the better-than-expected PMI numbers from China and the US released last week.”

It added that the perceived risk to the US economy has diminished.

“The US mortgage market is gradually regaining some ground. Interest rates on the US 30-year fixed-rate mortgages have dropped to an average 4.78% at the end of April, their lowest since the data started. This has sparked an influx of mortgage refinancing. This should help stem an influx of home foreclosures, arresting a further sharp decline in property prices.”

It said the time to take a tactical approach is here.

‘In our strategy report in January 2009, we recommended investors loading up on beta towards the end of 1H09. It appears that the process has to be brought forward as the economic recovery came in earlier than we had expected. We think there is a need to be flexible enough in one’s mindset to switch in and out of cyclicals, as opposed to the usual ‘buy and hold’ strategy. Unlike the past few recessionary periods, the economic implications from the unprecedented measures adopted by global policymakers are likely to be more compressed and intense.

“To profit from this cycle, investors need to be pragmatic with their investment views, abandoning them after a time, in our view. The notion of a global economic recovery has not become mainstream suggests further share-price upside.

Our preferred sectors are banks and offshore and marine sector, which we have POSITIVE views on.” BNP said it remains NEUTRAL on Singapore property. “Despite its high-beta characteristics, NOL remains our top SELL given tough fundamentals – besieged by an influx of new supply – confronting the sector.”

Recent story: High cash pile precedes a bull market