Source: CIMB-GK

CIMB-GK maintains AusGroup’s target price at 96 cents

Analyst - Lim Siew Khee:

John Sheridan, MD, AusGroup

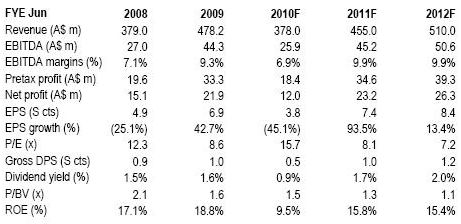

Maintain Outperform. We recently organised a 2-day non-deal road show for Ausgroup in Singapore and Hong Kong. Mr. John Sheridan, CEO, met institutional investors to elaborate on the group’s 1Q10 results, business operations, plans and sector outlook.

Our key takeaways were -

1) progressive pick up in revenue andearnings from 2QFY10;

2) easing margin pressures;

3) positive outlook in mineral resources and LNG sectors. We retain our Outperform rating and target price of S$0.96, still based on 13x CY11 P/E (average since listing).

Key catalysts for the stock include accelerated order wins and margin expansion. Key risks would be further strengthening of AUD$ eroding its competitiveness, clients’ deferral of projects and project execution risks which may swing quarterly earnings.

Order book remains strong at A$350m, A$60m secured YTD. The group has submitted A$600m worth of contracts YTD and will be tendering A$700m-1.1bn.

Notable tenders include a painting and insulation package for Pluto LNG, a A$200-300m fabrication package for Gorgon LNG and two fabrication and construction packages for BHP Billiton’s Rapid Growth Project 5 (RGP 5) in Western Australia.

Contract announcements for Gorgon LNG will be made in 4QFY10. We believe Ausgroup will be able to win some of the tendered packages based on the ability to supply local content. Benefits will flow through FY11 onwards.

Our order-win assumptions for FY10 and FY11 are A$400m and A$500m respectively. About 60% of FY10 revenues are secured back order book.

DBS Vickers prefers S-REITS to property developers

Analyst - Adrian Chua:

Our quarterly strategy has advocated an Overweight for Reits versus Neutral for developers. We continue to prefer the S-Reits to property developers at this juncture, for the former's defensiveness.

The next catalyst for the residential sector is the high-end recovery, though we would only be buyers of high-end developers on dips, as we believe the recovery in this segment is still a while away.

On the other hand, benefitting from this announcement (Government Land Sales for 1H2010) would be developers that lack landbank, like F&N (TP S$4.80) and UOL (TP S$3.93) - they now have plenty of sites to choose from and could potentially be paying much less as developers prioritise the sites that they wish to write a cheque for.

On the REITs front, we continue to like retail and hospitality REITs - Suntec (TP S$1.32), FCT (TP S$1.34), ART (TP S$1.25).

Post your comments in our forum here.