AMAZINGLY, Yangzijiang Shipbuilding has not suffered any cancellation of ship orders – a fact that the company has given several reasons for in the past.

Last week, its CFO, Liu Hua, beefed up the reasons at a conference (organized by Financial PR) Yangzijiang still had a strong order book of 139 vessels worth US$6.1 billion as of end-June.

An oft-cited reason is that customers have paid 20% cash upfront and another 20% in banker’s guarantee before work began. That’s just too much money for the customers to walk away from.

In addition, Yangzijiang’s (www.yzjship.com) customers, based in countries such as the UK, Italy, Taiwan and Germany, are largely big companies that have financial muscle – a criteria which the Yangzijiang management had set in years prior to the industry downturn.

What is less well-known is that Yangzijiang - the sixth largest shipbuilder in China - has a high-quality building programme that ship buyers cannot find fault with and thereby cause a delay in the building. A delay on a vessel can have a snowball effect on the building schedule of other vessels.

Yangzijiang has a quality building programme and timely schedule of delivery in part because it builds standardized vessels.

Ms Liu said: “We offer eight types of vessels according to our specifications, instead of the customers’ specifications. This is particularly important during this time. We have an outstanding order book of 139 vessels – if each vessel is different, it’s up to the customer to say if you meet their requirements, which makes our work more difficult and makes it easier for the customer to cause a delay in the building.”

She added that the company’s management, having lived through two industry downturns, identified the benefits of standardized vessel specifications before accepting orders in the boom years of 2006 and 2007.

Standardised vessels mean there is no need to retrofit tools to suit vessels of different specifications, and it also facilitates mass production, which is why Yangzijiang enjoys significantly lower fixed cost per vessel, said Ms Liu.

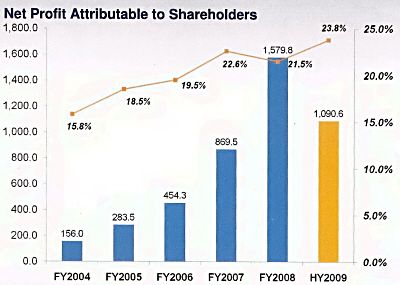

Record net profit margin of 23.8%

In the first half of this year, Yangzijiang reported record net profit margin of 23.8%, up from 20.5% in the same period last year – thanks in part to a fall in steel prices.

And interestingly, as Ms Liu pointed out, Yangzijiang also enjoyed about RMB296 million in “other income” and “other gains” from interest on its cash hoard, foreign exchange gains and investments.

(Yangzijiang had a whopping RMB 9 billion in cash on its balance sheet as at end-June.)

Net profit jumped in 1H this year to S$1.1 billion, up from S$709.4 million previously.

Interestingly, the operating cashflow for 1H09 was the same as the net profit of S$1.1 billion. In FY08, the operating cashflow was S$2.6 billion, much higher than the net profit of S$1.6 billion as the cashflow included 20% downpayment for new orders.

In 1H this year, there were no new orders.

Given the industry downturn, Yangzijiang is working with ship owners to tide through the tough times:

* For orders where the 40% prepayment in cash has been received, Yangzijiang will consider any request to delay the stat of vessel construction. Deliveries of 18 vessles have been rescheduled for 5-24 months.

* Yangzijiang will consider requests to change the vessel type. Four containerships orders have been changed to five dry bulk carriers (which are in better demand).

* Yangzijiang will provide docking facilities for completed vessels of up to six months.

Touching on another attractive aspect of the company, she pointed out that the chairman, Ren Yuanlin, holds a 29.23% stake (worth about S$1.1 billion, which makes him one of the richest men in China) while an executive director, Wan Dong, holds 13.97%.

“With 44% of the shares held by them, you can be rest assured that the management will look after the long-term interest of the company, instead of the short-term share price,” she said. “Since the company was listed (in March 2007), the two of them have not sold a single share.”

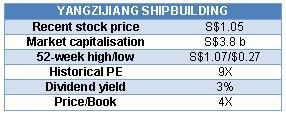

The stock’s recent price of $1.05 is slightly higher than the IPO price of 95 cents. The shares traded as high as $2.74 in October 2007.

Recent stories:

YANGZIJIANG: 2Q09 net earnings up 80% yoy at Rmb 607.4 million

YANGZIJIANG'S chairman eschews the high life