Excerpts from latest analyst reports.....

DBS Vickers raises target price of Hyflux to $3.50

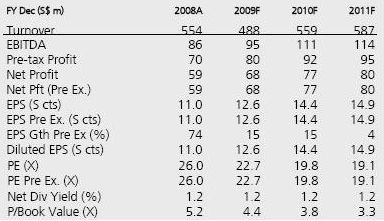

Forecast of Hyflux performance by DBS Vickers.DBS Vickers (analysts – Tan Ai Teng & Sarkar Suvro):

Forecast of Hyflux performance by DBS Vickers.DBS Vickers (analysts – Tan Ai Teng & Sarkar Suvro):

· Visibility clearer than ever, thanks to a firm and growing orderbook.

• Potential for asset divestment strengthened by JBIC collaboration and lower cost of funding at HWT (Hyflux Water Trust).

• Divestment will provide earnings boost; recycle capital to drive further growth in MENA, India.

• Reassessment of Hyflux’s BOT valuation raises SOTP (sum of the parts) value to S$3.50. Maintain Buy, with 22% upside.

We have upgraded our price target to S$3.50, as we raised FY09/10 earnings forecast to account for higher margin. The recent hike in water tariffs in China’s main cities, and an improving investment climate, has also resulted in a higher valuation for Hyflux’s BOT portfolio.

We maintain our BUY call on Hyflux with 22% upside to target price. We believe recent developments have raised the company to a whole new level.

SIAS Research maintains ‘buy’ rating on Roxy Pacific

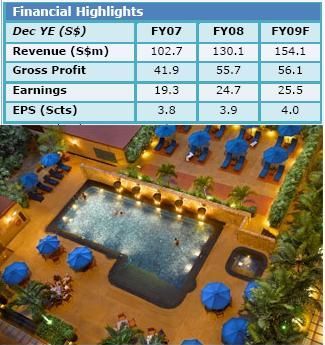

Forecast of Roxy's performance by SIAS Research. Internet photo of Roxy's hotel in East Coast Road.We like Roxy Pacific for its healthy revenue stream, robust balance sheet as well as position in the market as a suburban-fringe developer as opposed to a high-end developer.

Forecast of Roxy's performance by SIAS Research. Internet photo of Roxy's hotel in East Coast Road.We like Roxy Pacific for its healthy revenue stream, robust balance sheet as well as position in the market as a suburban-fringe developer as opposed to a high-end developer. Aside from that, property plays are intrinsically linked to the performance of Singapore’s GDP. We previously stated our view that as the local economy improves, we foresee further upside to current industry valuations beyond 2009.

That said, during our recent management meeting with the Company, we were unable to get a clear indication of Roxy Pacific’s direction and projects going forward. As such, we reserve some doubt on the Company’s upside potential until management is able to provide a more structured plan.

As at 2Q09, NAV and RNAV stood at S$0.19 and S$0.53 per share respectively. Our current forecasts remain consistent with prior estimates. Taking into account the factors above as well as the valuation of other property counters, we continue to apply a discount of 30% to Roxy’s RNAV. Recommendation: Buy. Target price: 37 cents.

____________________________________________________________________________

UOB Kayhian maintains fair value of FSLT at 64 cents

UOB Kayhian (analyst – Esther Sim): We reiterate our HOLD recommendation on First Ship Lease Trust (FSLT) and maintain our fair price of S$0.64 based on 0.8x 2010 P/B of the container shipping sector. We suggest an entry price of S$0.52.

We forecast 19% and 16% yields for 2009 and 2010 respectively. The management determines the application of DRS (distribution reinvestment scheme) for every quarter and as such, there is uncertainty over potential dilution.

While FSLT has begun to repay part of its loans quarterly, it still has a total outstanding loan balance of about US$400m due for balloon payment in 2012 and 2014. FSLT will either have to refinance and/or call for rights issue. The latter may lead to potential dilution of its DPU.