RARE IS the academic, or someone with an academic background, who heads a Singapore-listed company.

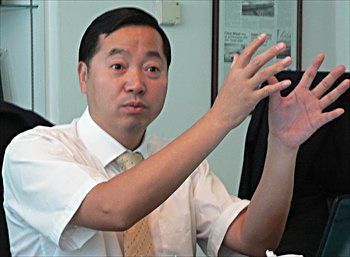

Guo Hongxin, 45, is that rare executive chairman. He heads Sunpower, which is a China-based heat transfer technology specialist.

He wants to build an enterprise that will thrive through ups and downs.

The recent economic fallout signified a coming of age for Chinese enterprises that thrived through the odds, he said over lunch with NextInsight recently at Zhou's Kitchen restaurant in the city.

His philosophy is to appoint the best professional talent available rather than handing management control to a family member.

This November, he will receive a doctorate degree for his research findings on heat pipe technology used under permafrost conditions.

Outside of work, he finds reading a joy. He considers holidays an excessive luxury and keeps business trips short. What he loves a lot is devouring books on social sciences as well as astronomy, geology and Buddhist philosophy.

To keep fit, he runs and plays golf in the evenings. He is married with a teenage son, who is about to read economics at Boston University.

Apart from running Sunpower, he spends about 2 days a month giving lectures to postgraduate research students. He has also been appointed by the Jiangsu government to give lectures to local entrepreneurs, which helps in promoting Sunpower’s products and services.

As an expert in heat transfer technology, his lectures do not come cheap – a handsome Rmb 3,000 an hour.

|

Stock price |

19.5 c |

|

52-week range |

6 - 21.5 c |

|

PE |

7.6 |

|

Market cap |

S$64 m |

|

Dividend |

-- |

|

Source: Bloomberg |

|

When he was vice dean at Nanjing University of Technology’s Heat Pipe Technology Development Institute, Mr Guo had approached a Sinopec subsidiary, Yangzi Petrochemical, with a solution to prevent energy loss when transporting liquefied gases, which need to be at very low temperatures.

Won over by Mr Guo’s cost cutting innovation, the petrochemical giant commissioned the production of its first batch of pipe supports that insulates liquefied gases from gaining heat. So with a start-up capital of Rmb 50,000 put together with a few friends, Sunpower was born in 1997.

One of the co-founders is a college friend, Mr Li Lai Suo, 47. He is currently an executive director at Sunpower and holds a 21% stake.

Mr Guo holds 23% while another executive director, Frank Ma, holds 17%.

Free float is about 28%, or about S$18 million in market value.

Sunday's story: SUNPOWER's PE is 7.6 but China-listed peers' are 33-59X!