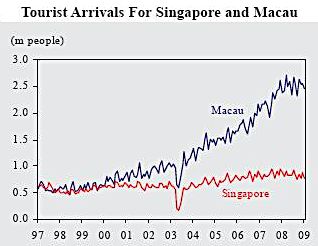

Tourist arrivals surged in Macau after the opening of Sands and Wynn casinos there. Source: CEIC

WHAT SINGAPORE STOCKS could become the market’s focus in the run-up to the end-09 opening of Marina Bay Sands, which will be followed in early 2010 by the opening of Resorts World @ Sentosa?

UOB Kay Hian, in a special report on Tuesday (June 2), noted that Macau is a clear example of the positive impact of mega IRs on the economy.

Macau's gaming industry was liberalised in 2001 with the cessation of the monopoly gaming licence in 2002. Tourist arrivals growth registered sharp spikes in 2004 and 2007 with the opening of Sands Macau and Wynn Macau.

Given this backdrop, UOB Kay Hian forecast tourist arrivals to register an overall 12.0% year-on-year decline in 2009 before rebounding by 20.0% in 2010.

Expecting the market rally to strengthen further, UOB Kay Hian has set an end-09 STI target of 2,800 and highlighted 3 key sectors that will benefit from the IR catalyst:

* Property developers:

UOB Kay Hian noted that in Macau's case, residential property prices shot up before the opening of Sands’ casinos there and rose further by 30% within the first 18 months after the opening of the casinos.

”We expect foreign buyers to return to the Singapore residential property market. Property developers with a high exposure to this segment will benefit.”

Marina Bay Sands on schedule to open Dec 09. Photo: Internet

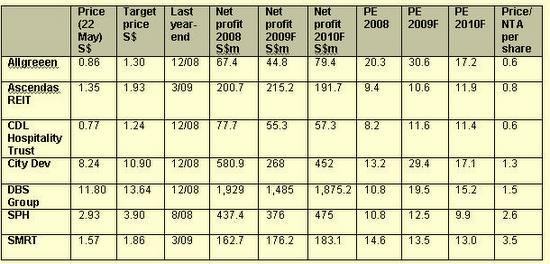

Although property stocks are more than double their March lows, the property sector is still trading at 39% below its long-term P/B mean. “We remain buyers of property stocks. Our top picks are City Developments (target: S$10.90) and Allgreen Properties (target: S$1.30).

* Services plays:

UOB Kay Hian said a recovery in tourist arrivals would benefit service segments such as hospitality, aviation, land transport, retail and healthcare.

The media sector, usually a late-cycle play, will likely stage an early recovery as the IRs spur a recovery in advertising spending.

“We expect renewed investor interest in domestic services plays. Our stock picks are CDL Hospitality Trust (target: S$1.24), SMRT Corporation (target: S$1.86) and Singapore Press Holdings (target: S$3.90).”

UOB Kay Hian also has a ‘buy’ call on Ascott Residence Trust (target: S$0.90).

Top buy calls of UOB Kay Hian.

* Early-cycle recovery plays:

Banks and property stocks are favoured early-cycle economic recovery cyclicals. Real estate investment trusts (REIT) will offer good upside as credit returns, resulting in lower financing risks and fresh capital for acquisitions. If property developers continue their rally, REITs will play catch-up at some point, according to UOB Kay Hian.

“Among the banks we favour DBS Group Holdings (target: S$13.64). Our top pick in the REITs sector is Ascendas REIT (target: S$1.93).”

UOB Kay Hian said Singapore Airlines (fair value: S$9.80) “remains our high-conviction SELL.”

It explained: “The market has priced in an earnings recovery. We believe yields are unlikely to improve any time soon due to excess capacity in the airline industry, competition from low-cost carriers for back-end traffic and continued pressure for premium traffic.”

Recent story: REITs and Shipping Trusts: Positive developments